The third quarter of 2022 has ended, which means it’s time for another Reno-Sparks real estate update for clients and community members who want the most up-to-date information. In September 2022, the Northern Nevada housing market saw home prices drop slightly while supply and demand shifted to more sustainable levels.

There are also a few national economic factors to keep an eye on in the upcoming months, including rising interest rates, buyer purchasing power, foreclosure filings, and overall inventory levels. Whether you’re in the market to buy or sell, you’ve more than likely felt the indirect pressures of U.S. inflation on the housing market.

Mark Fleming, Chief Economist of First American Title Insurance Co., describes this as a time of economic uncertainty, with many waiting on the sidelines:

“When the economic uncertainty dust settles, those buyers and sellers who were on the sideline will jump back in the housing game. Demographic trends support elevated purchase demand in the years to come, so it’s a question of when, not if, for the housing market.”

Before diving into our update, here’s a brief snapshot of what we discussed:

- The Fed is expected to fight inflation more aggressively through 2022 and into 2023.

- Buyers have lost 35% of their purchasing power.

- Homeowners have more financial strength through inflation-adjusted equity.

- Oversupply is currently not a concern.

- Housing prices have dropped slightly.

- More sellers are going to be reluctant to sell.

- Bottom line: marry the house, divorce the rate.

If you want a closer look at what happened in Q3 2022 and what to expect for the remainder of the year, keep reading.

Sparks-Reno Real Estate Update Amid National Interest Rate Hikes And Affordability Headwinds

From September 20 to 21, the Federal Open Market Committee (FOMC) held a meeting to discuss persistently high U.S. inflation, supply and demand imbalances, higher food and energy prices, and broader price pressures.

The FOMC concluded its meeting by raising the federal funds target rate by 75 basis points (bps), representing the third consecutive 75 bps hike and the fifth rate increase this year. If you’re wondering how this will affect buyer purchasing power, here’s what you need to know.

How it works…

When the Federal Reserve (the Fed) responds to high inflation with a fast-paced, aggressive monetary policy such as this, it invariably results in higher mortgage rates. In other words, the Fed sets the federal funds rate and restricts the amount of money banks, and other depository institutions can access overnight, which means higher borrowing costs.

What happens now…

As a result of these recent interest rate hikes, the national average for a 30-year-fixed mortgage rate reached 6.92% in October 2022, its highest level since April 2002. Though our 2022 predictions expected to see mortgage rates rise for the remainder of the year, it is evident that the Fed has taken a much stronger approach to return U.S. inflation to its 2% objective.

All this considered, the Northern Nevada real estate market has remained fundamentally strong, and depending on where you stand, there could be factors in your favor.

Riding The Wave For Long-Term Investment

If you have been following our monthly and quarterly Sparks and Reno real estate updates, you know that the higher interest rates have made it challenging for buyers, especially first-time home buyers, to afford homes in specific price ranges.

Buyers have lost 35% of their purchasing power since the beginning of the year. To further put this into perspective, those who could afford the monthly payments for a $554,000 loan in January 2022 can now afford payments for a less than $360,000 loan in September 2022.

Still, it is essential to remember that real estate is a long-term investment, even if the U.S. enters a recession. It’s also crucial to know that this isn’t a repeat of the financial crisis we saw from 2007 to 2009, which was caused by the proliferation of high-risk mortgages and lending practices that no longer exist.

Another factor to remember is that the real estate market will often react differently depending on the region’s underlying population growth, income, area size, and construction costs.

Your Home Is One Of Your Biggest Assets

You may or may not be surprised to learn that homeowners today are financially stronger than they have been since 1983. This is primarily because of how they’ve handled equity since the Great Recession and higher home prices over the last two years.

Odeta Kushi, Deputy Chief Economist at First American Title Insurance Co., breaks it down like this:

“U.S. households own $41 trillion in owner-occupied real estate, just over $12 trillion in debt, and the remaining ~$29 trillion in equity. The national “LTV” in Q2 2022 was 29.5%, the lowest since 1983.”

To break this statement down further, homeowners had an average of $320,000 in inflation-adjusted equity in Q2 2022, an all-time high number. So, if you find yourself in a spot where you need to leverage the equity in your home, it’s likely that the value has risen in the past year.

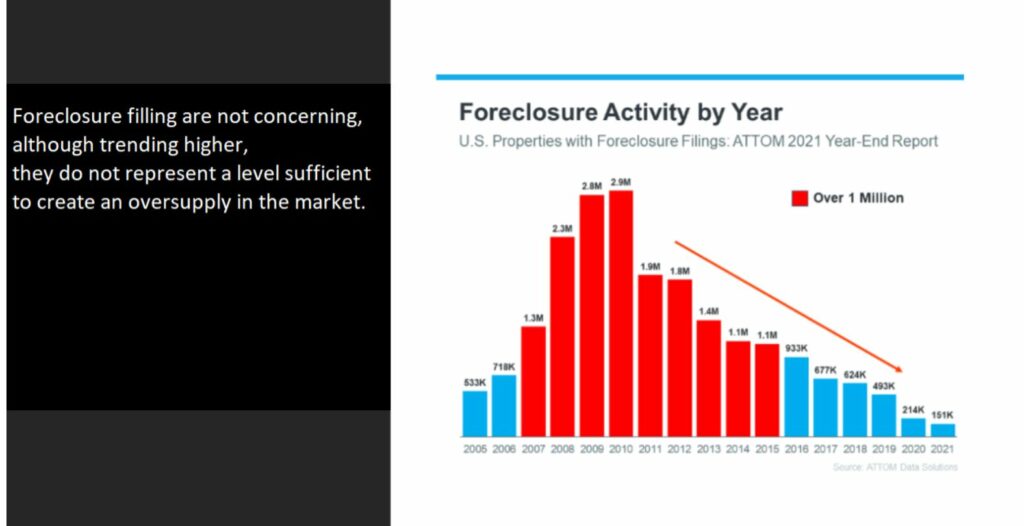

Foreclosures Remain Historically Low

Another excellent indicator that the U.S. housing market has remained fundamentally strong is the number of U.S. properties with foreclosure filings. Though filings have experienced an uptick this year, foreclosures remain significantly lower than in previous years and do not represent a level sufficient to create an oversupply in the market.

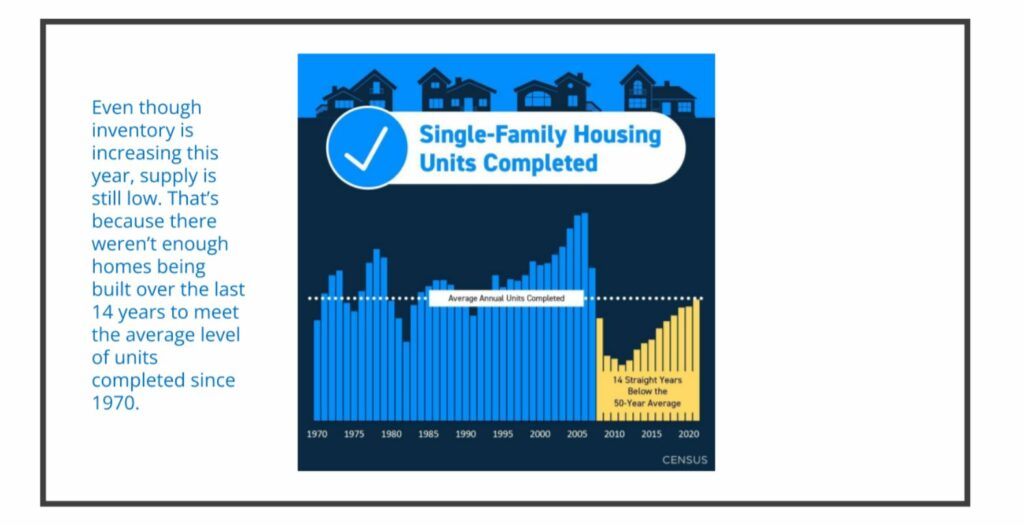

Oversupply Is Unlikely

In 2021, many of our clients and community members asked questions like, “Where have all the houses gone?” The pandemic, coupled with homeowners staying in their homes longer, cash buyers flooding the market, and increasing housing costs, caused housing inventory to plummet and demand to grow exponentially.

New developments have played an integral role in providing more housing options to Northern Nevada residents. If you haven’t already, check out these new homes in Sparks and these new luxury homes in Reno. And according to a recent Dickson Commercial Group report, there were 10,529 total units planned or under construction in Q2 2022.

However, this graph shows that single-family home development remains below the 50-year average, and developable land, prices, and construction costs continue to be the most influential factors hindering new supply.

As far as available inventory goes, keep reading. Our Sparks-Reno real estate update closely examines how these national factors have impacted our local housing market.

Local Statistics You Need To Know

Median Housing Prices Continued To Drop

Our Sparks-Reno real estate update shows the median price for a home reached $535,000 in September 2022, a 5.3% decrease from the previous month and a slight increase from the previous year. Though home prices have dropped month-over-month, most experts say it’s unlikely that prices will drop in any significant way nationwide anytime soon.

It’s also important to understand that Northern Nevada housing prices reached an all-time high from June 2020 to June 2022. This graph shows that our market is experiencing a typical real estate cycle or housing market correction.

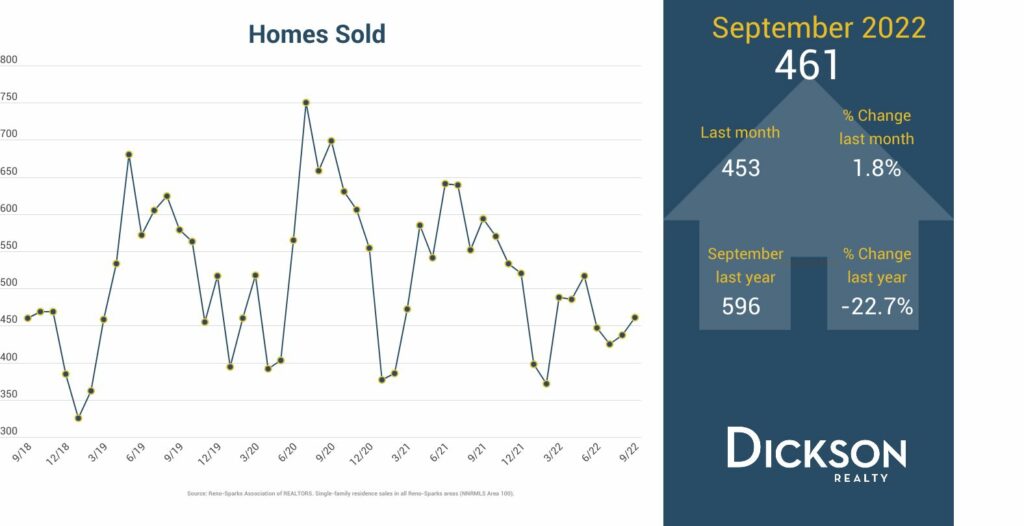

Monthly Homes Sales Were Up

In September 2022, 461 homes sold, representing a 1.8% increase month-over-month and a 22.7% decrease year-over-year. This may seem low if you’re used to the numbers we saw over the last two years. But this graph shows that home sales have essentially returned to levels prior to the pandemic—gradually shifting to more sustainable levels.

Another excellent indicator that home sales have stabilized is the number of days it takes for a home to go into contract. In September 2022, it took 38 days for a home to go into contract, an 18.8% increase month-over-month and a 375% increase year-over-year. This monthly number represents the average number of days it typically takes to sell a home in the Northern Nevada housing market—it took less than 8 days for homes to sell in September 2021.

Inventory Levels Gave Buyers More Room To Negotiate

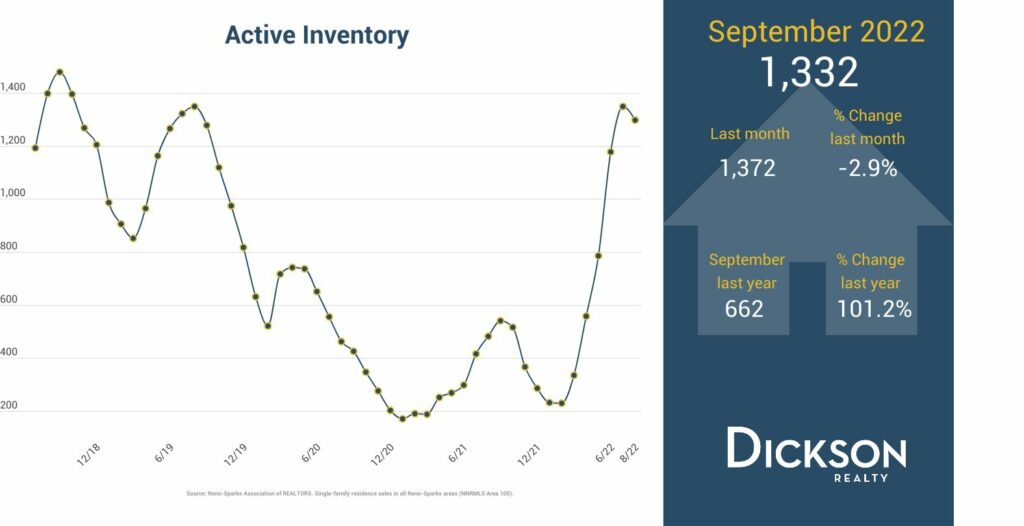

Since our Sparks and Reno real estate updates are constantly changing with an influx of listings, we use active inventory as a more dynamic metric to provide buyers with a better picture of available homes for sale in a given month.

In September 2022, 1,332 homes were available for sale, down 2.9% from August 2022 but up 101.2% from September 2021. As mentioned above, this monthly decrease is an excellent indicator that there’s not an oversupply of inventory—instead, the market is balancing out, providing buyers with more room to negotiate.

Fewer Sellers Listed Homes For Sale

To get an even deeper understanding of supply, we also look at the number of new listings that come into the market every month. Keep in mind that properties can remain in this status for up to 21 days before available for showings. In September 2022, there were 537 new listings, an 11.5% decrease month-over-month and a 23.4% decrease from the previous year.

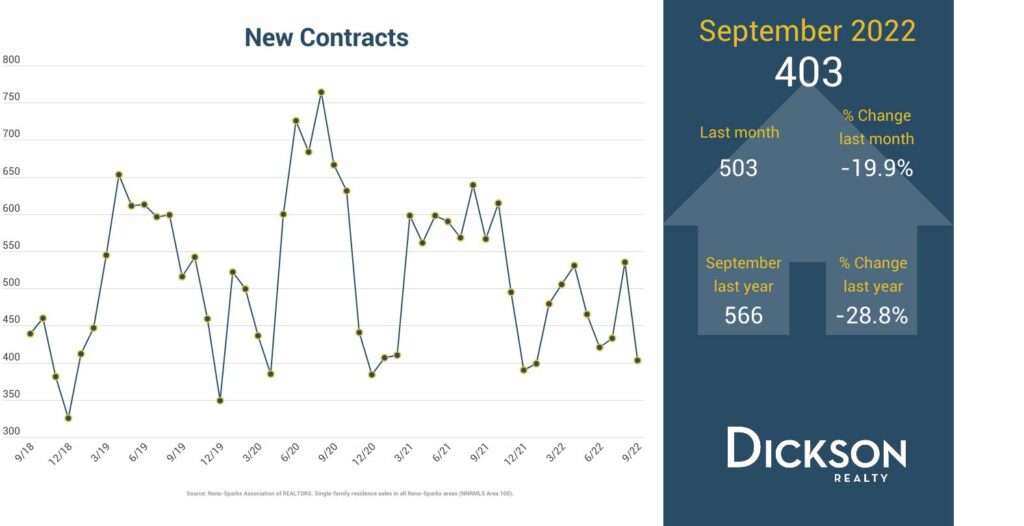

Fewer Contracts Meant Buyer Demand Was Down

If you’re trying to gauge demand in the real estate market, one of the best indicators is the number of homes going into contract every month. In September 2022, 403 homes went into contract in Reno and Sparks, representing a 19.9% decrease from the previous month and a 28.8% decrease year-over-year.

This number represents how rising mortgage rates have affected buyer purchasing power over the last year. In the upcoming months, we will see seasonality coming into play, where demand typically decreases. However, healthy demand for homes in Northern Nevada remains—this graph shows that demand is consistent with years before the pandemic started.

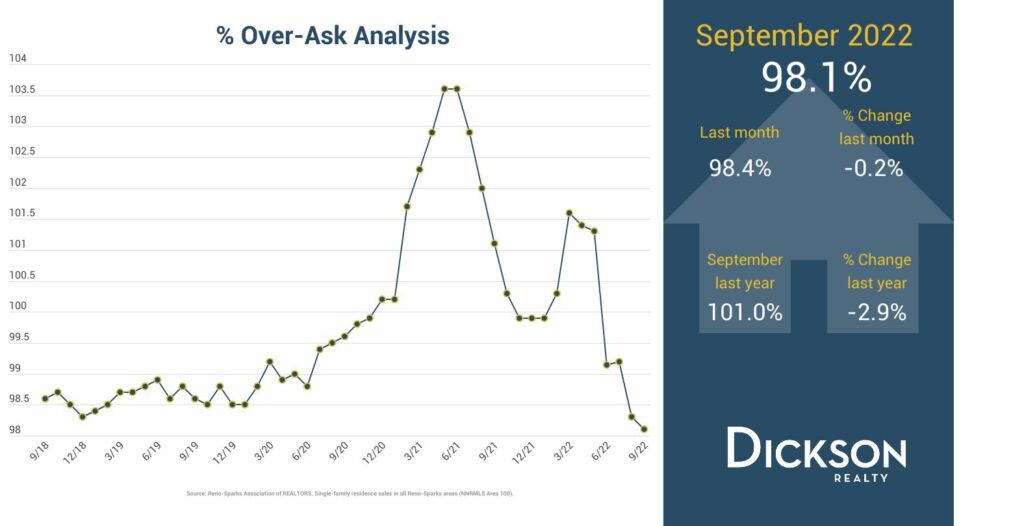

Sellers Received Slightly Below 100% For Their Homes

When demand spiked and available homes dropped in 2021, sellers received a significant amount more than their original asking price. However, if you read our last Sparks-Reno real estate update about stabilization in the market, you know this trend is starting to slow.

In September 2022, the average sale price for a home was 98.1% of the asking price, a slight decrease month-over-month and a 2.9% decrease year-over-year. This is typical for the Northern Nevada market, where homes sell for an average of 98.5% of the asking price.

The Bottom Line: Advice For Buyers And Sellers

Buyers: Our Sparks-Reno real estate update for Q3 2022 showed housing prices and inventory levels stabilizing, which means there are more available and affordable homes for sale. You can use this to your advantage when pursuing homeownership. Don’t let rising mortgage rates scare you from pursuing your dream home. If you find a home you love and can afford the monthly payment, it likely makes sense to buy right now. Are you still on the fence? Contact one of our neighborhood professionals to help explore your options.

Sellers: Though mortgage rates have reduced buyer purchasing power and demand, life events will always create the need, no matter the interest rate. About 90% of borrowers have an interest rate below 5%, and more than two-thirds have a rate below 4%. That said, there are several steps you can take to get your house ready to sell in Reno-Sparks to make your home the most appealing. Contact one of our neighborhood professionals for help understanding the current market conditions and what you can expect when listing your home in today’s market.

At Dickson Realty, we proudly share our quarterly Sparks-Reno real estate update with clients and community members. For more information about buying and selling real estate in Northern Nevada, contact one of our neighborhood professionals today.