As we head deeper into the new year, many buyers and sellers have questions about the future of the housing market in Reno and Sparks. They want to know if prices will decline or continue to grow, how the economy will affect purchasing power, and if there will be enough supply to meet demand.

While we can’t predict the future (although we wish we could!), it’s essential to think about where we came from and where we’re headed. We can look to the past to learn what trends and opportunities might come to our region.

In the fourth quarter of 2021, the housing market in Reno and Sparks experienced slightly higher mortgage rates, lower inventory levels, and increased housing prices along with the rest of the country.

Since the pandemic started, mortgage rates and inventory levels have been historically low, which has spurred one of the most competitive housing markets in modern history, and housing prices to skyrocket. But the real estate market isn’t the only industry experiencing a rise in goods and services. With a bevy of pandemic recovery moves made by the Federal Reserve (the Fed), the U.S. economy is currently facing an incredible amount of inflation.

Keep reading for more information about how this could affect the housing market, what happened in Q4 of 2021, and what to expect next.

How National Q4 Numbers Compare to the Housing Market in Reno and Sparks

If you’re a buyer or a seller, national real estate trends can significantly impact the housing market in Reno and Sparks. But depending on where you stand, there could be many factors working in your favor. Here’s what you need to know.

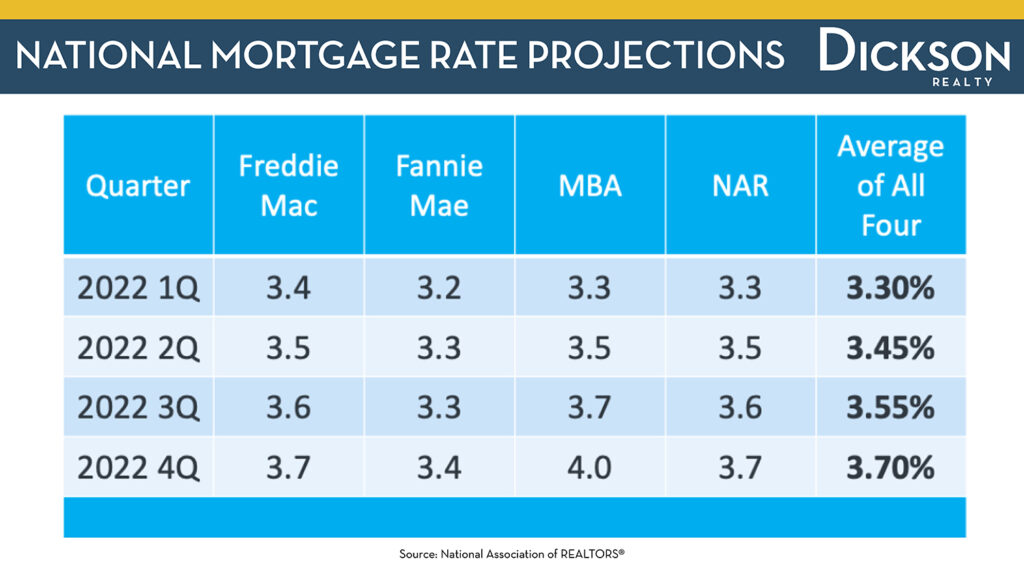

Mortgage Rate Projections

With U.S. inflation hitting a 39-year high, the Fed has suggested upping interest rates three times in 2022 to support the economy better. If this plan goes through, there may be fewer purchases of mortgage-backed securities, which could result in higher mortgage rates. In January 2021, the national average for a 30-year-fixed mortgage rate reached 2.85%, a record low. However, it has been gradually increasing, and it’s now the highest it has nearly been in two years. With this in mind, it’s important to remember that interest rates differ by state and your personal/financial information.

Let’s talk about how rising mortgage rates have affected the housing market in Reno and Sparks. By the end of 2022, we’re expecting to see rates increase to 3.7%. However, mortgage interest rates in Northern Nevada currently remain below the national average. Many real estate investors also believe that the real estate industry is strong enough to absorb an uptick in rates.

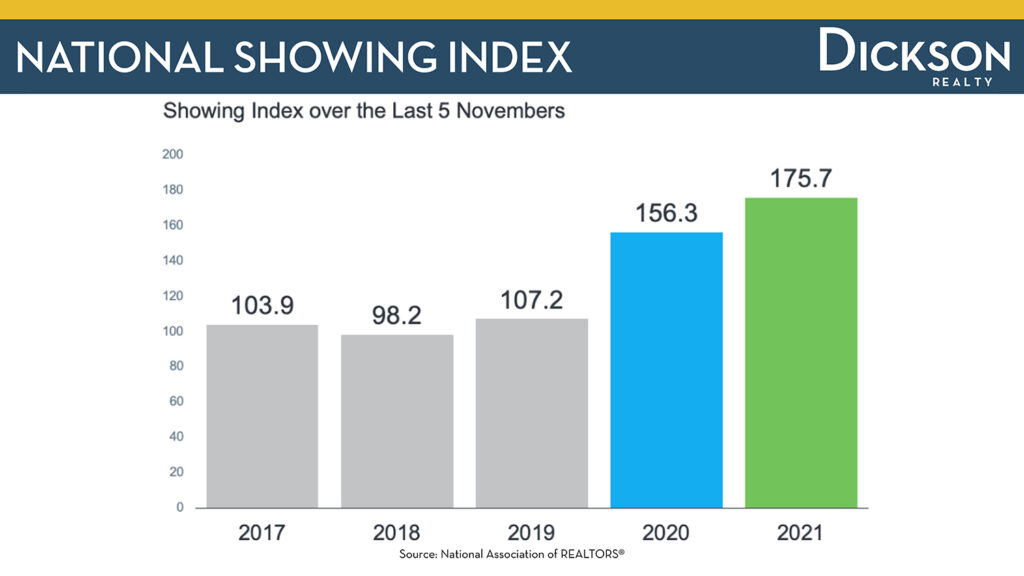

Showings Crushed Pre-Pandemic Numbers

To measure demand, it’s essential to consider how many showings there were in a given month. In November 2021, ShowingTime, one of the most extensive showing companies in the country, had more showings than the last five years. This means that rising interest rates and housing prices are not deterring buyers from entering the market and that demand will likely remain strong in 2022, both locally and nationally.

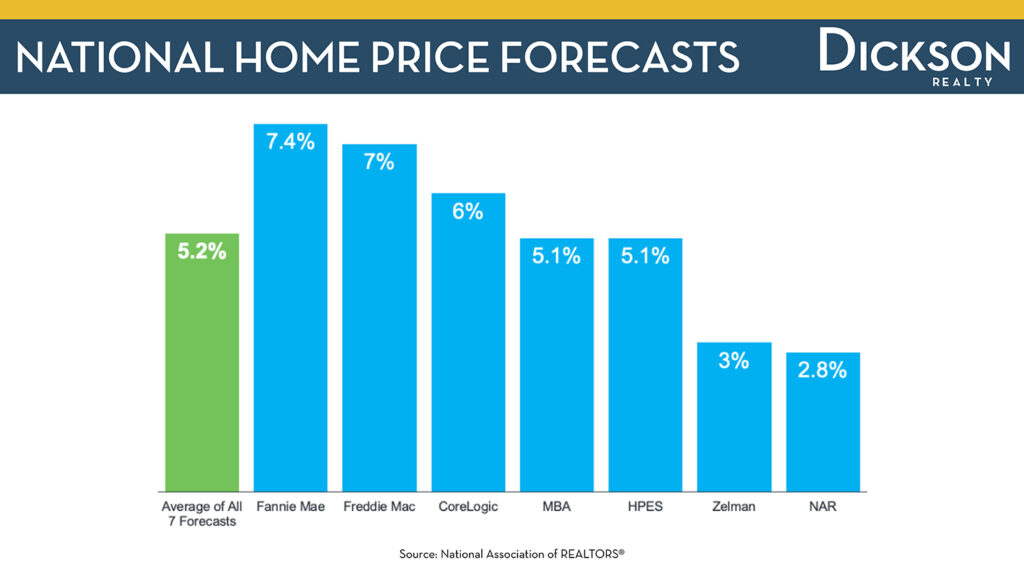

Housing Prices To Increase In 2022

This graph shows a collection of estimates by seven nationally-recognized mortgage loan and real estate companies projecting home prices to grow by 5.2% in 2022. As a national average, this seems on par with the rest of the country. However, due to Northern Nevada’s recent economic growth, the housing market in Reno and Sparks may reflect a slightly higher number of about 8% to 10%.

And although this will affect affordability, we don’t expect less buyer demand as supply constraints continue to affect the market.

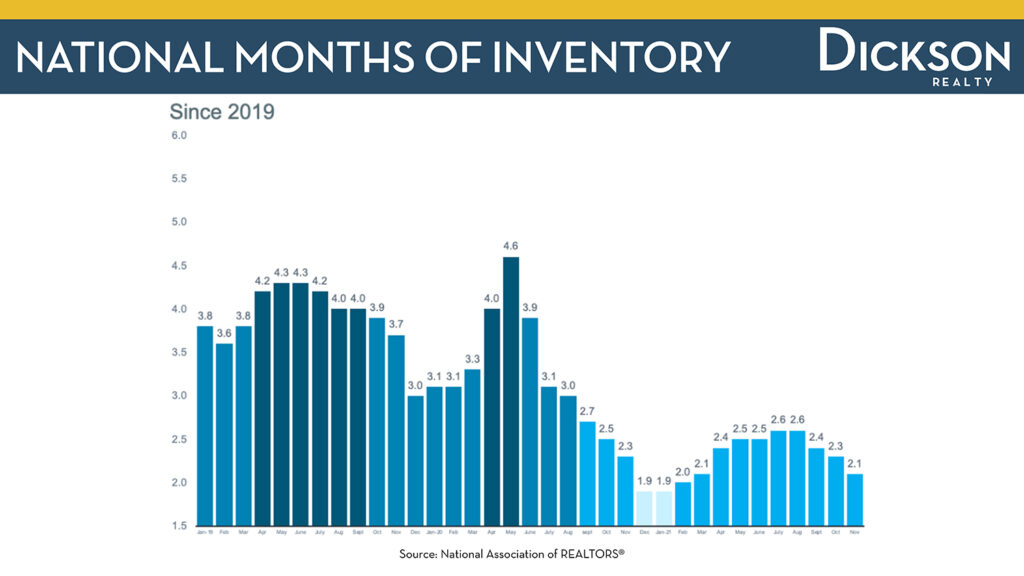

National Inventory Levels Dwindled

Except for peak summer months, home inventory levels across the country have been steadily declining for the last three years. And although it would be easy to blame the current housing supply shortage entirely on the pandemic, the truth is that there is no unified field theory of what’s going on.

Since inventory levels have reached all-time lows, the housing industry desperately needs new construction and development efforts. However, with the current labor shortage, the construction industry needs a ‘staggering’ 2.2 million more workers to keep up with demand, and finding qualified workers is a significant concern.

The good news is that there are some new efforts to bring housing to the Northern Nevada region. Here are four tips on finding a new home in Sparks and Reno.

By the Numbers: Q4 Housing Market in Reno and Sparks

Home Prices Reached A New Record High

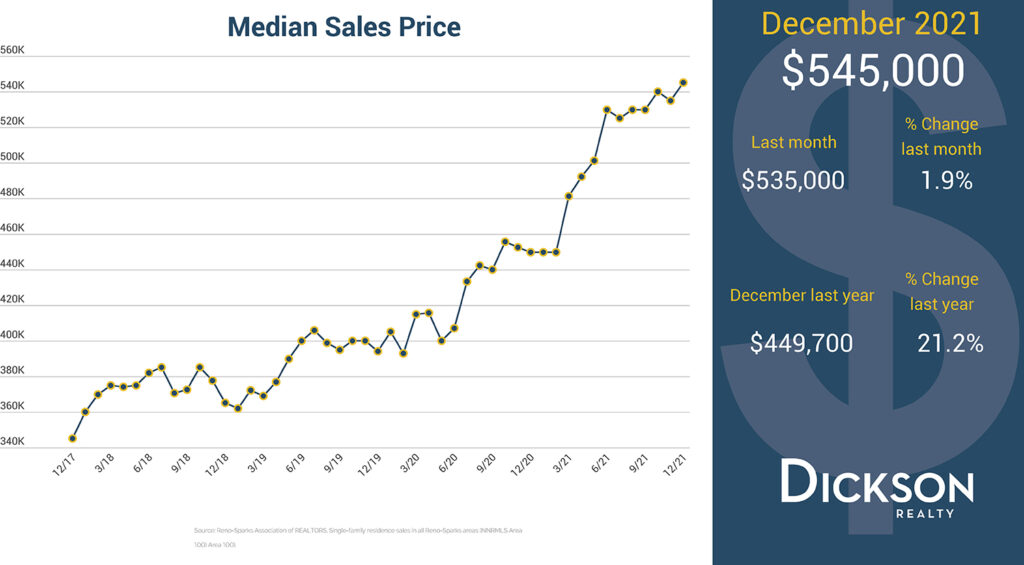

In Q3 2021, home prices for the housing market in Reno and Sparks started showing signs of balancing out, and we were expecting to see this trend continue into the new year. However, in Q4 2021, the median home sale price reached $545,000, representing a 1.9% increase month-over-month and a 21.2% increase year-over-year. Although this rise is a new record-high for the Northern Nevada region, we are hopeful that rising interest rates will help put downward pressure on home price growth.

New Listings Normal For December

In December 2021, there were a total of 295 new listings for the housing market in Reno and Sparks, representing a 22.2% decrease month-over-month and a 9.2% decrease from the previous year. This is often common during the holiday season as Northern Nevada’s winter weather drives many homeowners to spend more time building snow forts and drinking hot cocoa and less time making moves to sell. Seasonality aside, without more inventory, demand is likely to grow in the first quarter of 2022.

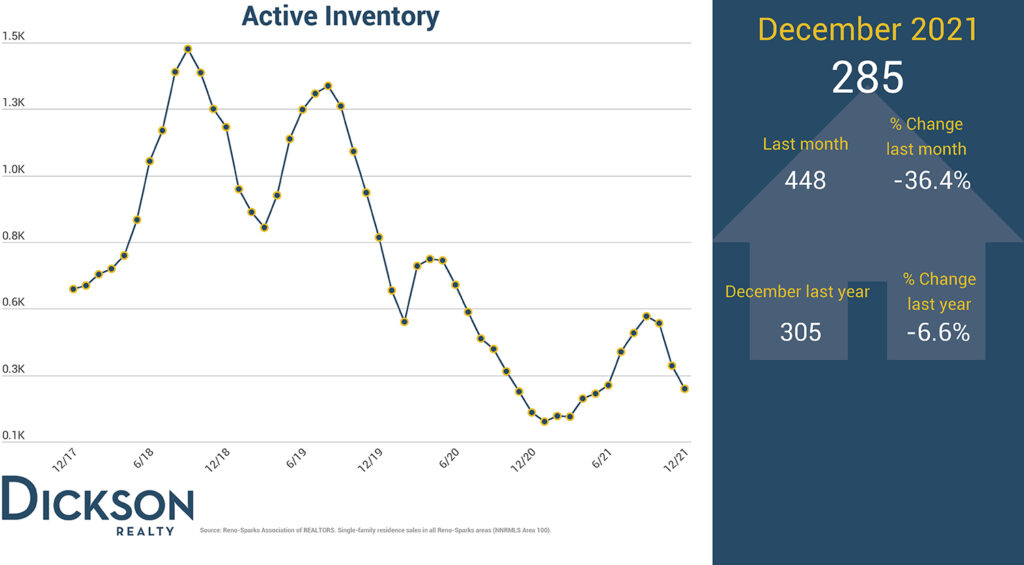

Inventory Levels Dropped Even Lower

To measure supply, we look at the number of available homes for the housing market in Reno and Sparks at the end of each month. In December 2021, there were 285 available homes for sale in the Northern Nevada region, representing a 36.4% decrease month-over-month and a 6.6% decrease from the previous year. Typically, the average number of available homes for sale is 800 to 1000.

Demand Up Year-Over-Year

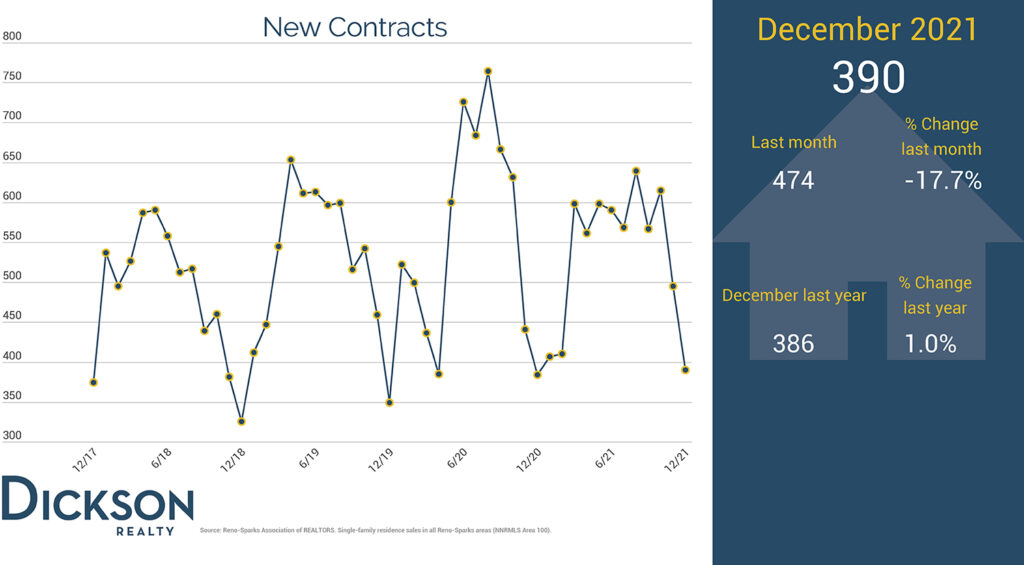

We track the number of new homes that go into contract in a given month to measure demand. In December 2021, there were 390 new contracts in the market, representing a 17.7% decrease month-over-month and a slight increase from the previous year. And although some of the crazy has left the market, this rise year-over-year further indicates that the high demand for housing is still there.

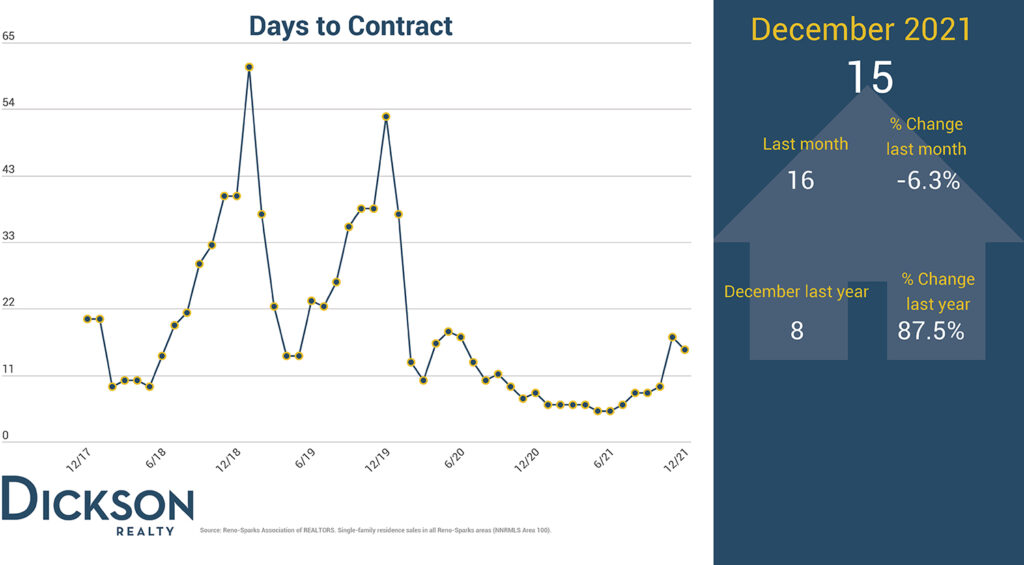

The number of days it takes for a home to go into contract also reflects the demand for homes in Northern Nevada. In December 2021, buyers scooped up homes faster, shrinking the number of days homes spent on the market to 15 days, representing a 6.3% decrease month-over-month and an 87.5% increase year-over-year.

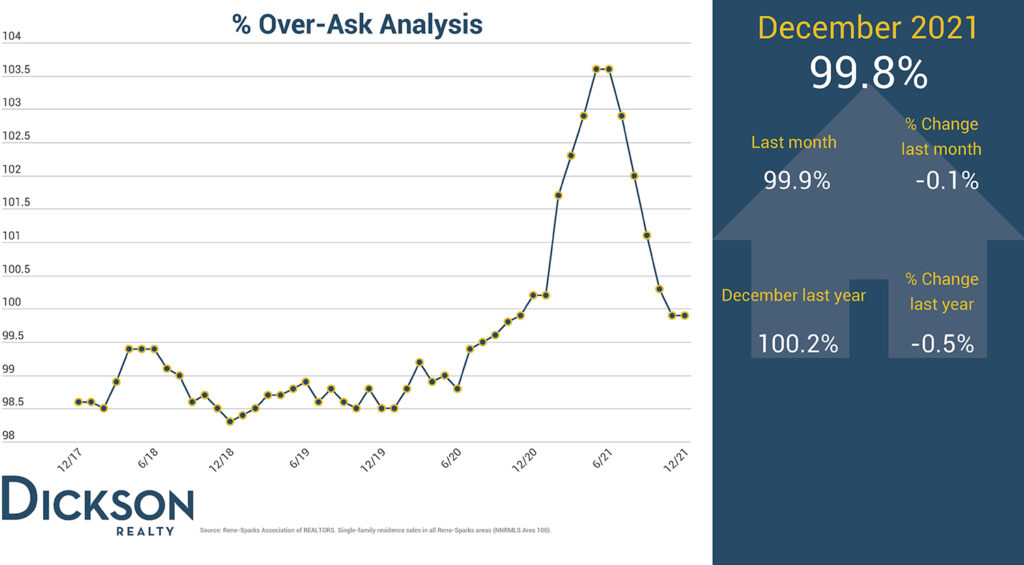

There Were Fewer Over-Ask Sales

Since the pandemic started, sellers have received more than their listing price due to the high demand for housing. However, if you read our last update, then you know these over-asking prices dropped below 100% for the first time in November 2021. We calculate this by dividing the average listing price by the final sales price and measuring how many homes sold for more than the listing price and by what percentage.

In December 2021, the average asking price for a home was 99.8%, a slight decrease from the previous month and year. This is good news for buyers to potentially have the upper hand in the market. However, inventory will tell the tale.

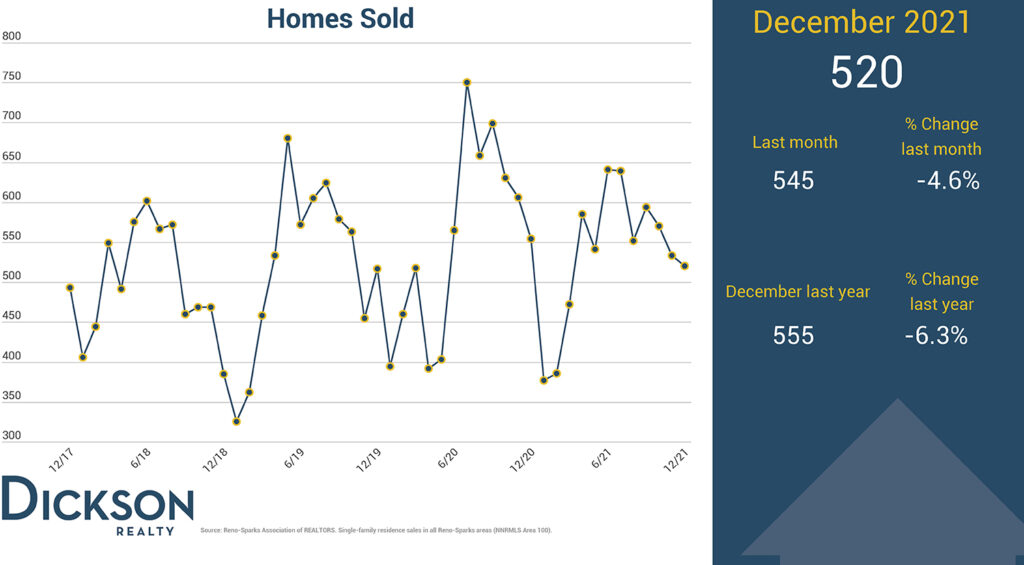

Home Sales Decreased Slightly

In December 2021, 520 homes sold in the Reno/Sparks housing market, representing a 4.6% decrease month-over-month and a 6.3% decrease year-over-year. Although this percentage has dropped slightly, I’d like to point out that this is still a healthy number for the Northern Nevada region. If you look at December 2019, you can see that home sales are starting to return to pre-pandemic numbers.

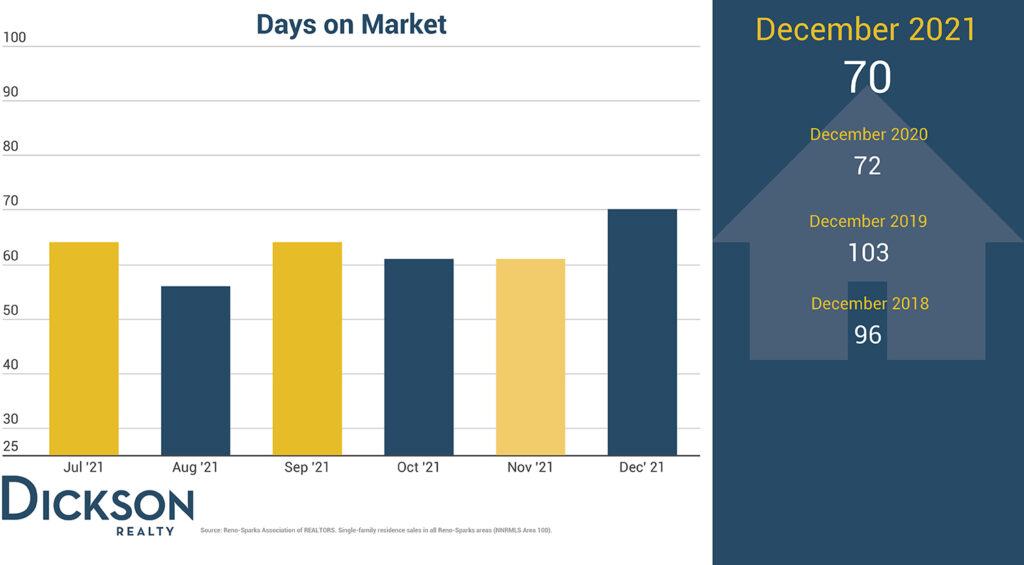

Homes Left The Market Faster

We use days on the market as a tool to show how the housing market in Reno and Sparks has changed, and sellers can also use this information to know how long it will take to sell their homes. In December 2021, homes stayed on the market for 70 days before selling, two days shorter than the previous year and 33 days down from December 2019.

How To Take Advantage Of The Housing Market In Reno and Sparks:

Buyers: We’re starting to see mortgage rates rise, which means now is the time to get your finances and game plan in order. Getting preapproved for a loan now will show sellers that you’re serious about buying as it requires you to send full financial documents to your lender and can provide you with a pre-approval letter. In 2022, housing prices are also projected to rise, so don’t wait too long to decide.

Sellers: Although the market remains in your favor, it’s essential to consider how rising mortgage rates and the recent uptick in COVID-19 cases could affect your want to sell. With this in mind, we’re not expecting housing prices to stop increasing, but higher interest rates may likely slow growth. There is high demand for existing homes in the market. So, if you’re thinking about selling, contact one of our neighborhood experts to help you get the most out of your home.