Since the beginning of the year, the housing market in Sparks and Reno has seen an uptick in housing prices. At the same time, the number of new contracts increased, and sellers received more for their homes, which indicates high buyer demand. However, several factors impact the bottom lines of homeowners and borrowers alike.

Many people wonder if there will be another housing bubble, while others believe higher mortgage rates will inevitably pull home sales down and slow home price appreciation.

We don’t have a crystal ball to tell you what the future holds, but here are some insights from Q1 2022 and our predictions for the housing market in the Northern Nevada region.

How Evolving Trends Have Impacted The Housing Market In Sparks And Reno

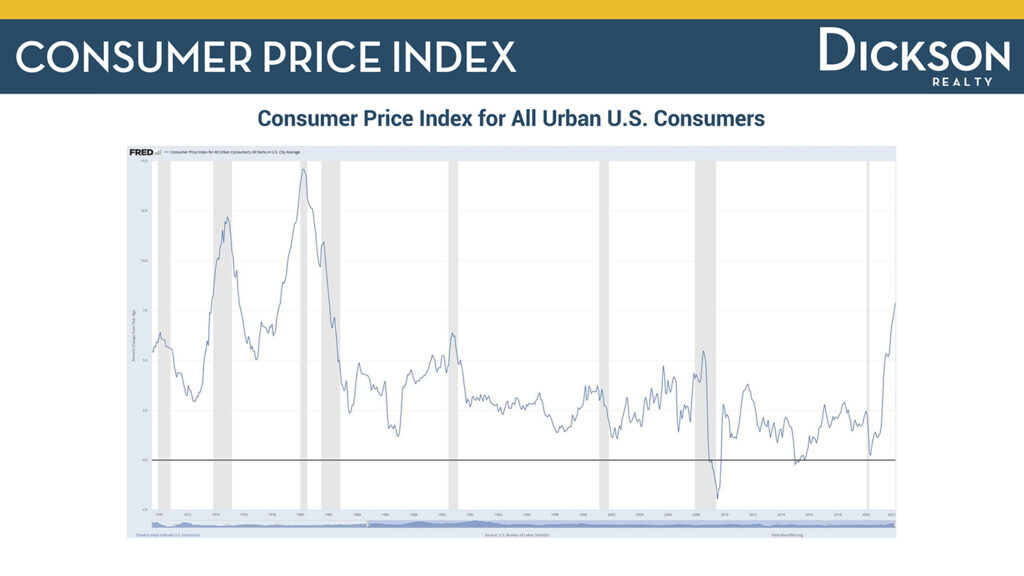

It’s no secret that elevated inflation affects markets nationwide—the housing market in Sparks and Reno is no exception. The Consumer Price Index (CPI), which measures the average change over time in the prices paid by urban consumers in the U.S., shows about a 7% increase in living costs since 2020. This significant change over time is due to several factors, including supply disruptions and pent-up consumer demand for goods after the initial impact of the global pandemic. The Russia-Ukraine War overseas has also contributed to increased higher gasoline prices—in some states, the average gas price is $5.57 a gallon.

While the current cost of goods and services feels like a shock to the system, this isn’t the first time the U.S. has experienced prices like these. This graph shows a CPI increase of nearly 15% in the 1980s, and during those times, the real estate market remained stable.

U.S. Housing Prices During Times of National Inflation

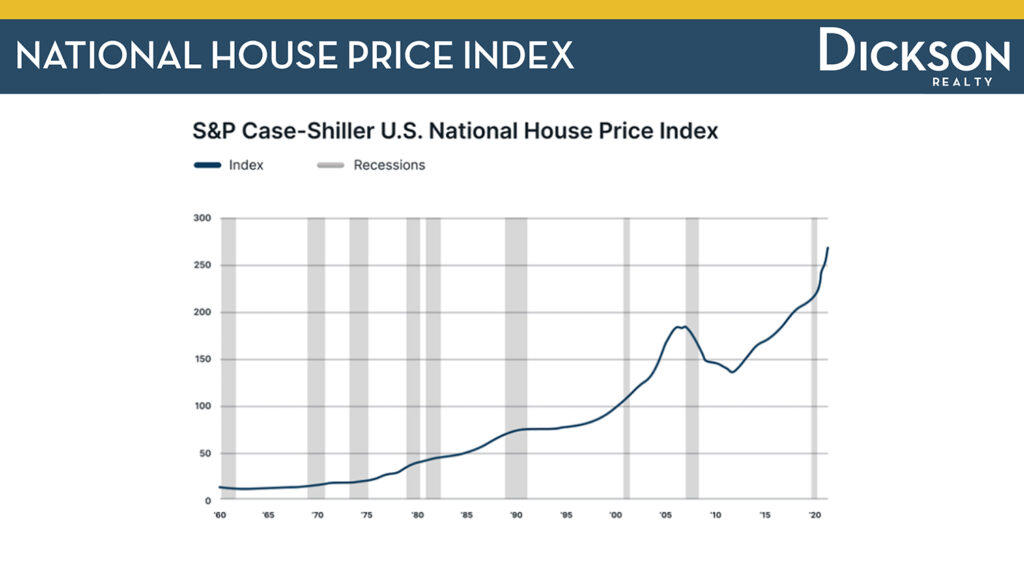

To provide more perspective on how higher living costs impact the housing market, the S&P Case-Shiller U.S. National House Price Index shows how home sale prices have fluctuated since the 1960s. With nine recessions over the last six decades, the Great Recession—from 2007 to 2009– represents the lowest price point drop. This extreme change was due to the collapse of some of the country’s largest financial institutions, which caused extreme turbulence across U.S. markets. In other modern recessions, housing prices hardly skipped a beat.

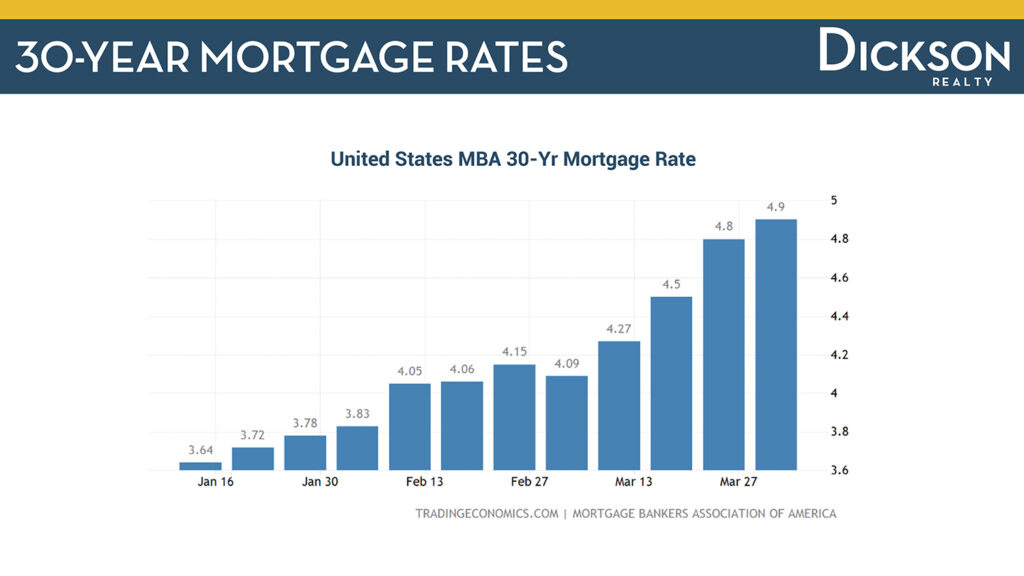

Mortgage Rates Jumped Whole Percentage Points

As U.S. inflation increases, the Federal Reserve reacts by applying a more aggressive monetary policy, which leads to higher mortgage rates. In Q1 2022, mortgage rates rose by 1.5 percentage points, representing the most significant quarterly jump in 28 years. This chart shows the average 30-year fixed-rate mortgage increased 34.6% since the beginning of the year, which has affected buyer affordability and home sales across the country.

Still, with these economic factors in mind, we’re not expecting to see a significant change in housing prices due to Northern Nevada’s high demand and lower-than-average inventory levels. Let’s look at what happened in the first quarter of 2022.

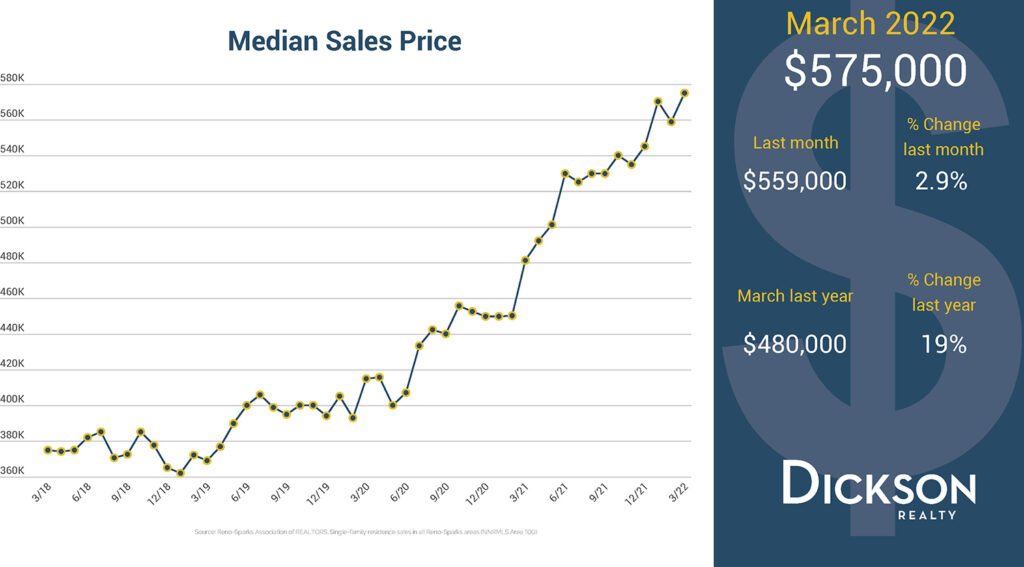

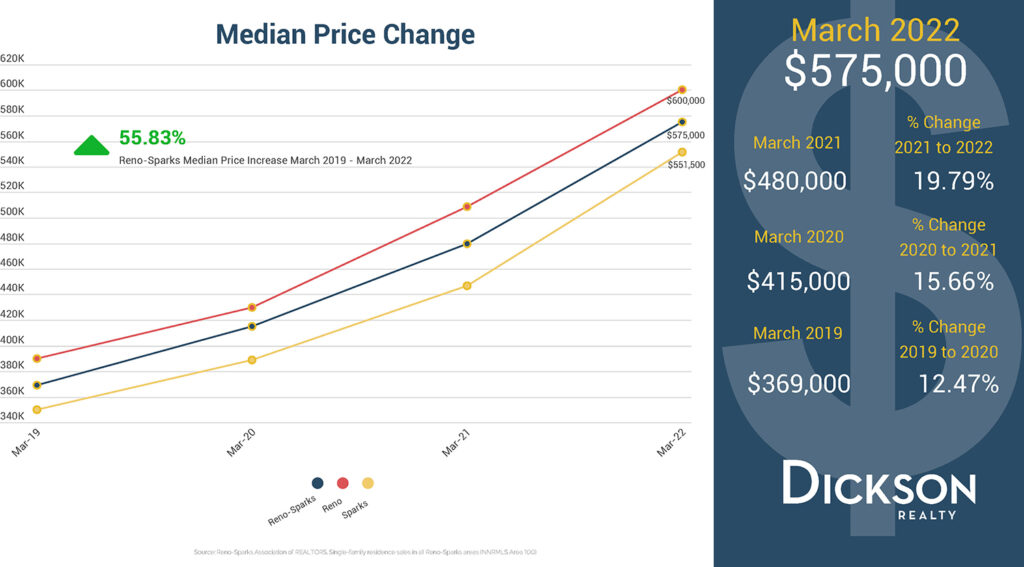

Median Home Prices Broke Previous Record Highs

In March 2022, the median home sale price for the housing market in Sparks and Reno was $575,000, representing a 2.9% rise month-over-month and a 19% change year-over-year. This number also represents an overall price increase of 55.83%, from $369,000 in March 2019.

As a result of this growth, many buyers have started searching for more affordable housing options in Sparks and its surrounding areas—the average price for a home in Sparks has historically been 10% to 15% less than in Reno’s housing market. However, in Q1 2022, this percentage difference moved closer to 8%. If this buyer migration trend continues, we expect this gap between neighboring markets will continue to shrink.

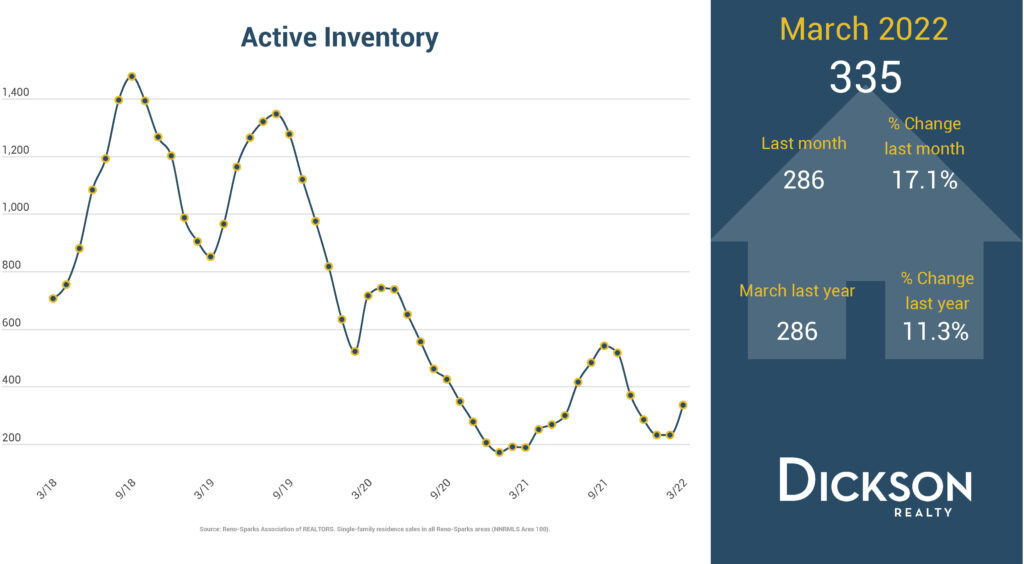

The Overall Number of Available Homes Improved

When a seller lists a home for sale, it’s considered inventory, regardless of its status. As a more dynamic metric to provide buyers with a more accurate picture, we use active inventory to know the number of available homes for sale every month.

In March 2022, the housing market in Sparks and Reno had 335 available homes for sale, representing a 17.1% increase month-over-month and an 11.3% increase year-over-year. Although seasonality has helped with this monthly inventory boost, Northern Nevada’s housing supply remains lower than average.

Homeowners Rolled Into Spring Ready To Sell

While measuring supply, it’s also essential to look at the number of new listings that enter the housing market in Sparks and Reno every month. In March 2022, there were 587 new listings, representing a 24.8% increase month-over-month but a 7.3% decrease year-over-year. Although new listings are down from the previous year, we expect this number to rise as warmer weather embraces the Northern Nevada region.

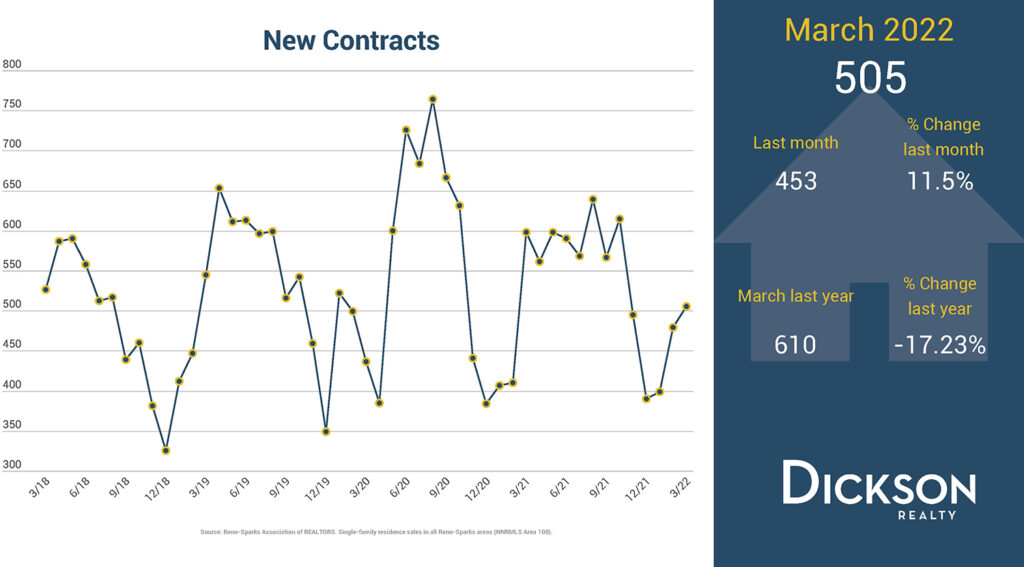

More Contracts Showed Buyer Demand Up

To measure demand, we look at the number of homes that go into contract in a given month. In March 2022, there were 505 new contracts, representing an 11.5% increase from the previous month but a 17.23% decrease year-over-year.

This monthly change shows that the demand for homes in Northern Nevada remained strong. However, if housing prices and mortgage rates continue to climb, more buyers could be forced out of the market.

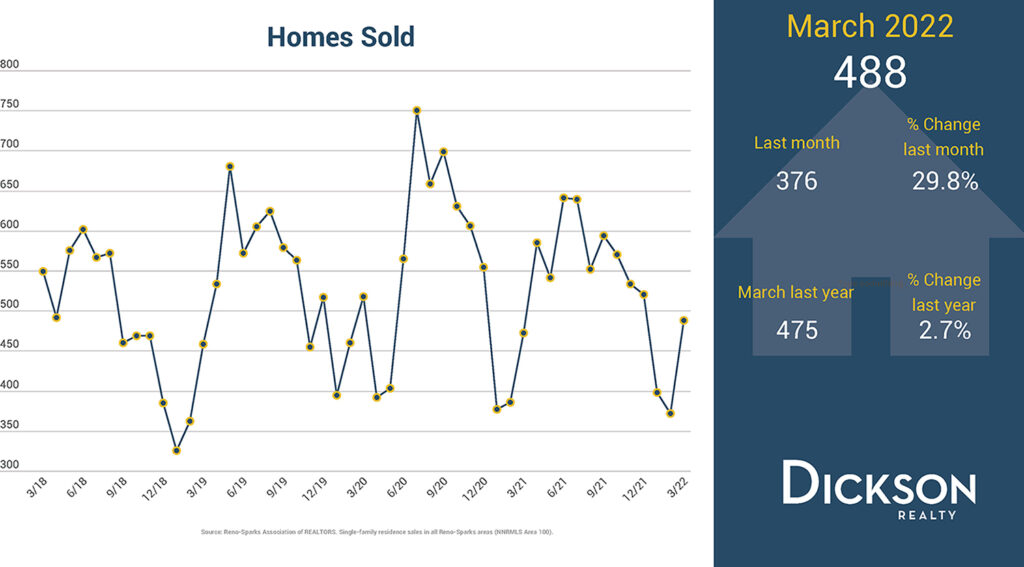

Home Sales Climbed

In March 2022, there were 488 homes sold, which is up 29.8% month-over-month and 2.7% more than the previous year. This number further shows the high demand for homes in Northern Nevada—there were more home sales in Q1 2022 than in Q1 2021, which had a record-breaking pace of homes sold.

More homes were sold than the previous year, and homes also left the market faster. In March 2022, it took just five days for homes to go into contract, representing a 16.7% drop from March 2021.

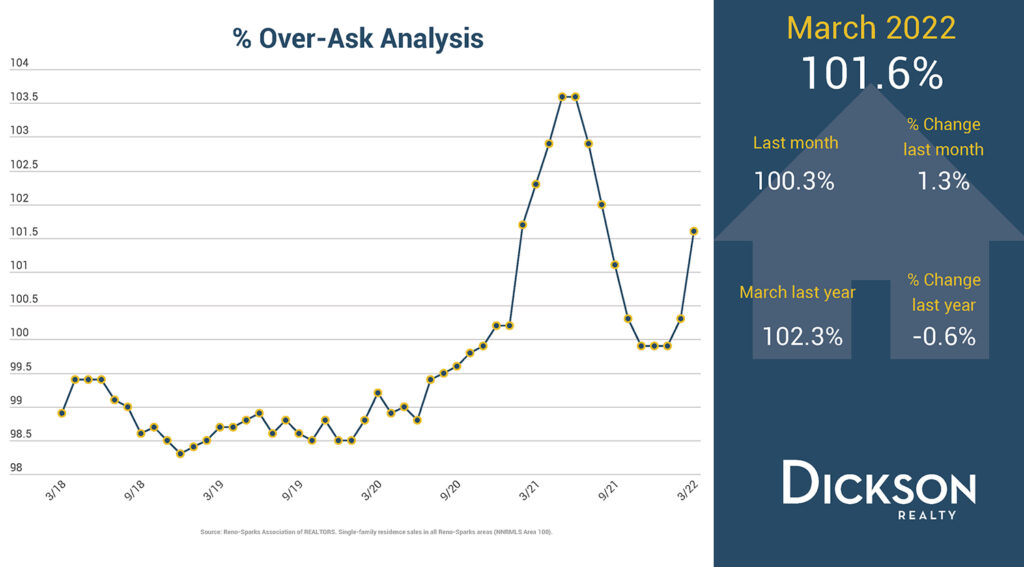

Over-Ask Offers Trended Upward

In March 2022, sellers received 101.6% above the asking price, on average, representing a 1.3% increase from the previous month and a slight decrease year-over-year. This month-over-month change means homeowners received more than their listing price due to the high demand for housing—a trend that trend started shortly after the economic shutdown in Q1 2020. However, as we mentioned above, rising inventory levels and mortgage rates have begun to affect buyer affordability, which could create less competition and fewer over-ask offers in the market.

Advice For Buying Or Selling A Home In Q2 2022

Buyers: Buying a house in a white-hot market can be challenging. But, don’t worry. You can differentiate yourself from other buyers by having a down payment saved, an excellent credit score, and a mortgage preapproval. If you don’t have all of the above, that’s OK. You just need to be prepared to make a competitive offer if you find the home you want. Contact one of our neighborhood experts at Dickson Realty to help you rise to the top of the pack.

Sellers: With higher home sale prices and demand continuing to outpace supply in Northern Nevada, the market remains in your favor. However, as mortgage rates rise, there could be less buyer competition in the market. So, be prepared to have fewer over-ask offers. Then, if you plan on refinancing your home, the time to act is now—each time mortgage rates increase, fewer borrowers can save money on refinancing.

At Dickson Realty, we share monthly updates for the housing market in Sparks and Reno. To learn more about real estate trends in Northern Nevada, contact one of our neighborhood experts today.