Northern Nevada’s housing market has experienced many highs and lows since the beginning of 2021. While sellers remain in an advantageous position, some homebuyers are struggling to compete with increased home prices, cash offers, and homes selling more quickly.

At Dickson Realty, we want to help our clients and community members understand how national trends affect Northern Nevada’s housing market and why it matters. That’s why we’re looking at the first quarter of 2021 to see what’s happened and what could be in store for the upcoming year.

We’re also looking at state, global, and national trends, and how those can factor into our local real estate market. From record-high unemployment rates to increased cost of living expenses to low inventory levels, the real estate industry has been on a wild ride for the past 14 months. But as job growth continues and more inventory comes online, we’re hopeful that the current extremes won’t last forever.

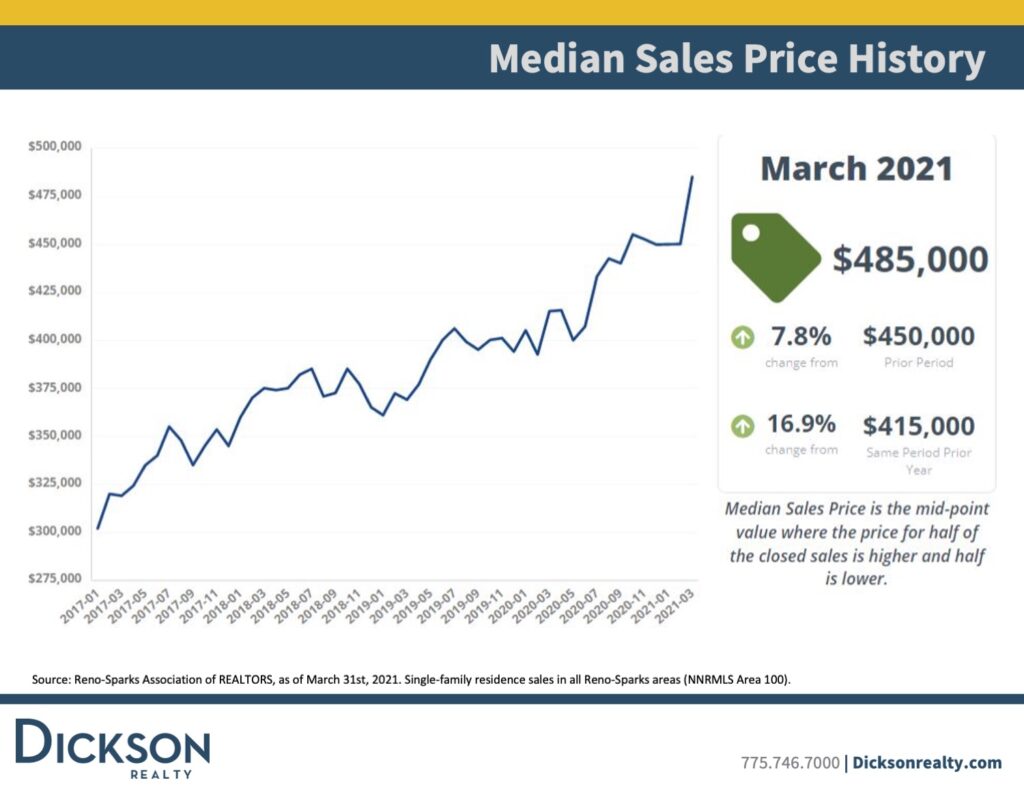

Median Home Sale Prices Trend Up For Northern Nevada’s Housing Market

In March 2021, the median sales price in Northern Nevada stood at about $485,000, representing a 7.8% increase month-over-month and a 17% increase year-over-year. This reflects a new record for the monthly median price, and we’re expecting prices to continue increasing as the economy grows and more people move to the Reno-Sparks area. The median sold price-per-square-foot increased to $272 and is also up 18.7% year-over-year. These increases are consistent with national trends (more on that later) and represent the cause-effect relationship between a low supply and high demand housing market.

Buyers Continue To Offer More Than List Price

More homes in the Northern Nevada housing market are selling for above the original listing price. To understand how many homes sold for more than the asking price and by what percentage, we calculate the average sales price divided by the final asking price to measure the increase. In March, the over asking price was 102.3%, a slight increase month-over-month and a 3.2% increase year-over-year. With high demand and low inventory, there’s a significant amount of buyers willing to offer more than 100% above the asking price, especially in more sought-after areas.

Not all homes are selling for more than the asking price, however. In March 2021, 9% of home sales were from under ask offers for homes priced $300,000 and below.

Cash offers are also becoming a larger part of the home buying process, which increases buyer competition. In March 2021, 42% of sales were cash offers for homes priced at $700,000 to $800,000. However, there were zero cash offers for homes priced $300,000 and below. This means many sellers are accepting conventional offers, but some prefer cash over offers backed by FHA interest loans for higher-priced homes.

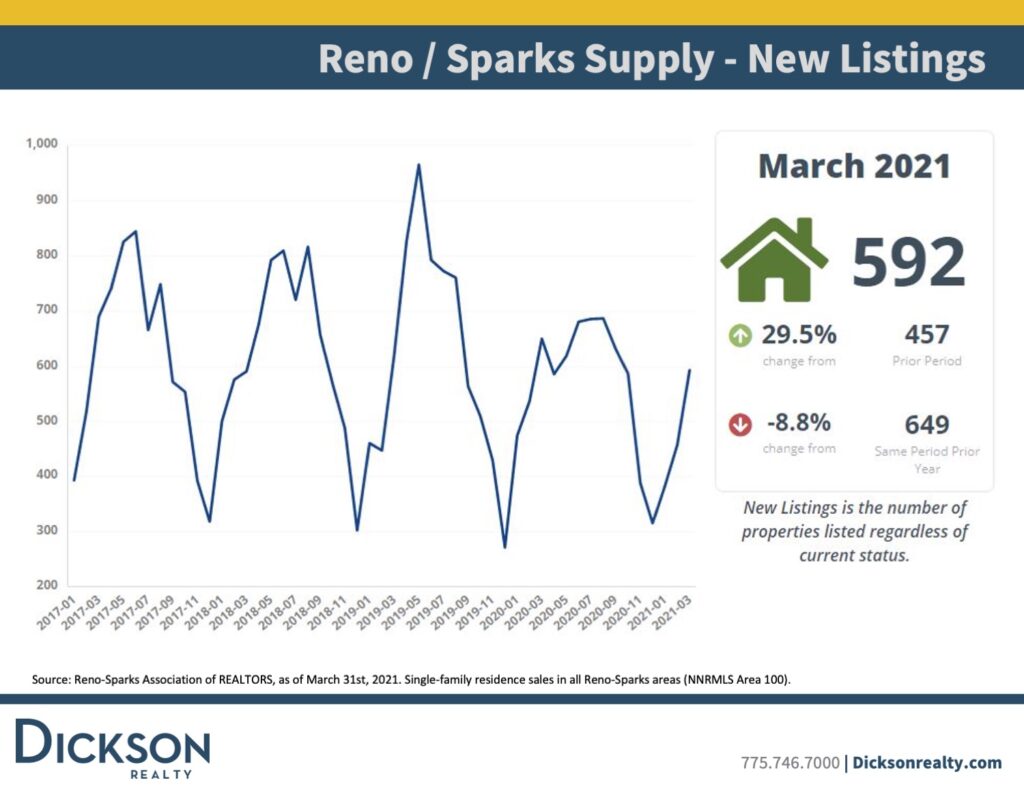

Northern Nevada’s Housing Market Supply Of Homes Increases Month-Over-Month

In March 2021, there were 592 new listings for Northern Nevada’s housing market, representing a 30% increase month-over-month. However, this number also shows a 9% decrease from March 2020. As of late April, there are 184 homes available for sale in the Reno-Sparks area and less than 47 homes available in the median sales price range.

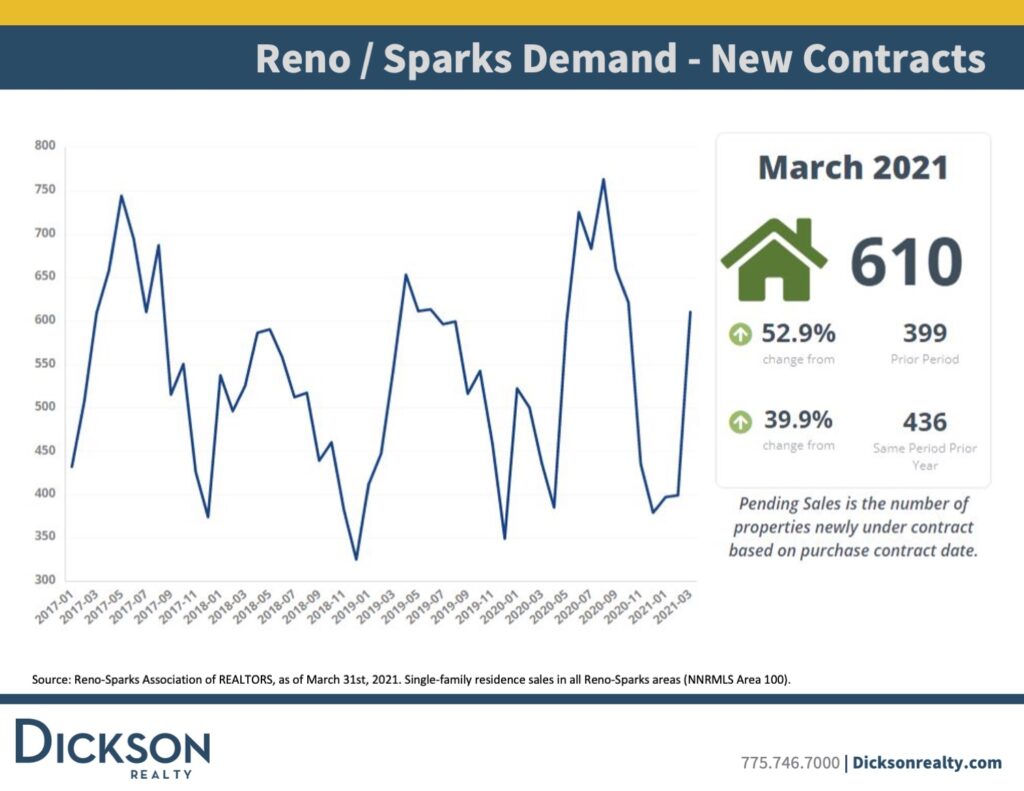

Demand Remains High For Housing

To measure demand, we track the number of new homes that go into contract in a given month. In March 2021, there were 610 new contracts in the Northern Nevada housing market, which is 50% more than in February. This number also shows an increase of about 40% year-over-year. With more people and businesses moving to the Reno-Sparks area, demand will continue outpacing supply until new housing opportunities come online.

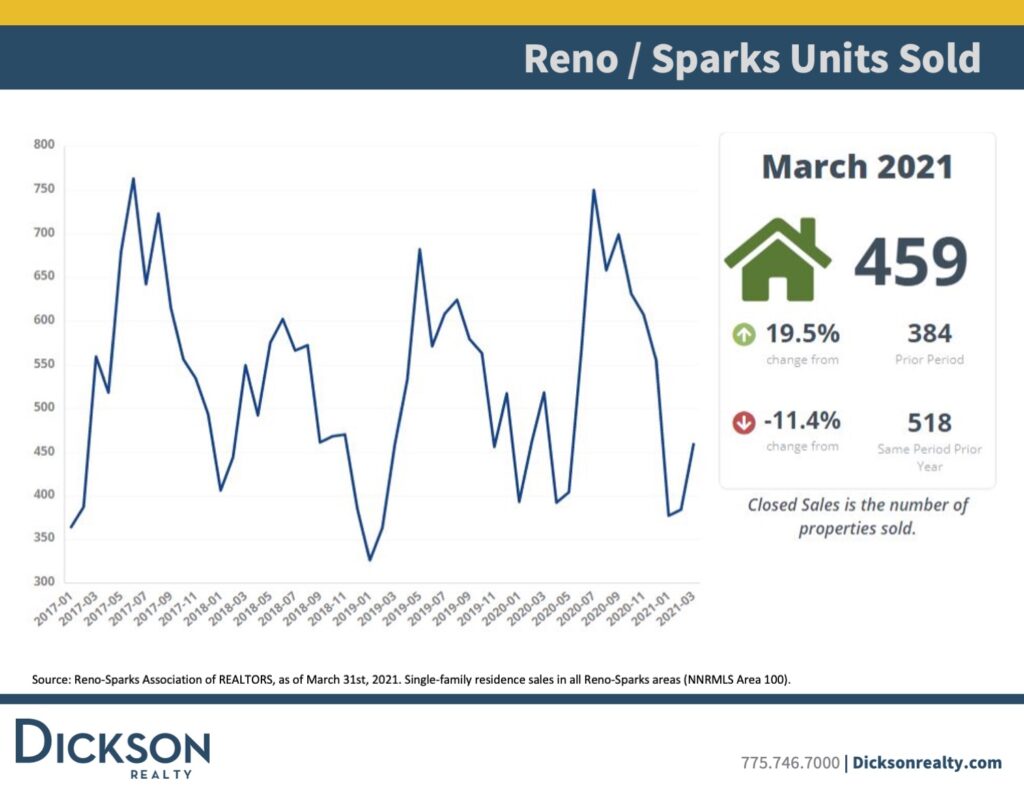

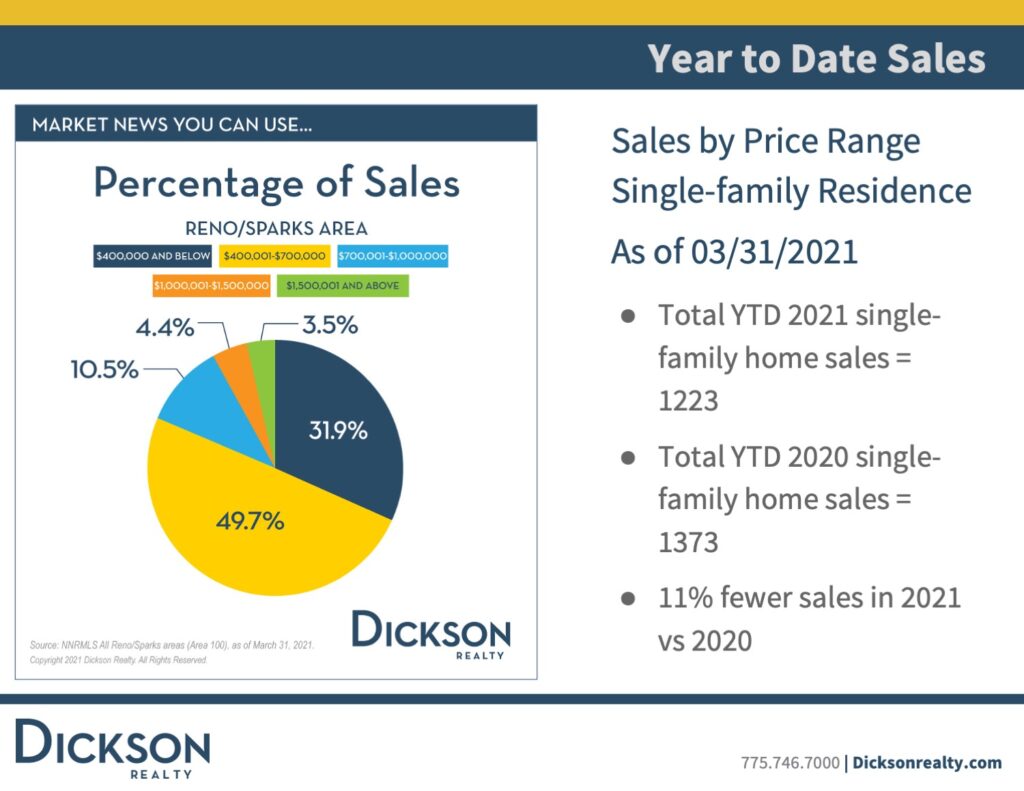

Housing Units Sold Reflect Low Inventory Numbers

In March 2021, there were 459 homes sold, which is a 20% increase from February. This number also shows an 11% decrease year-over-year, and the number of units will continue to reflect Northern Nevada’s low housing inventory numbers.

Luxury Homes Gain Market Share

The region’s median housing price falls between $400,000 to $700,000, and this price range represents about 50% of sales in the market. However, higher-priced homes are becoming a more significant percentage of sales. In March 2021, single-family homes priced $1 million and above accounted for 8% of sales. Typically, this number represents 3% to 4% of homes sold.

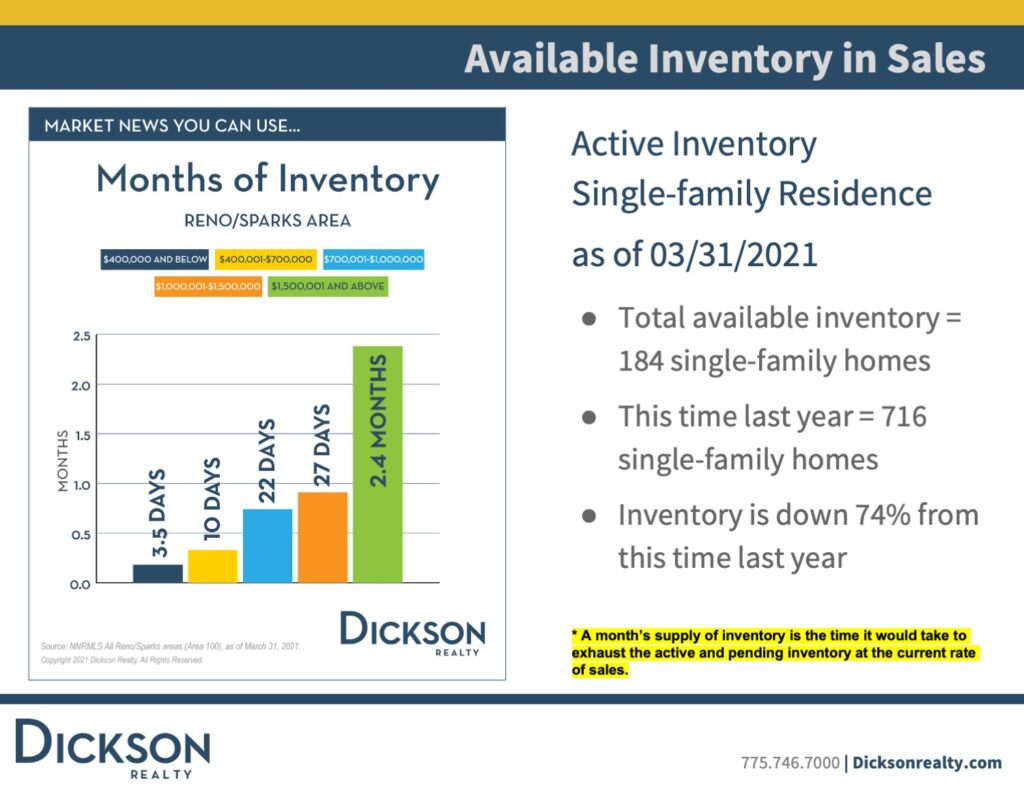

Available Inventory Still Low Compared to 2020 In Northern Nevada’s Housing Market

When we consider inventory levels in our housing market, we measure it by how much time it would take to exhaust the active and pending inventory at the current rate of sales. Typically, a five to six-month inventory is considered a healthy and balanced market.

We would generally measure inventory in months, but in March 2021, we had to measure in days for homes priced at less than $1.5 million. In March, there were 184 available single-family homes for sale, representing a 74% decrease year-over-year.

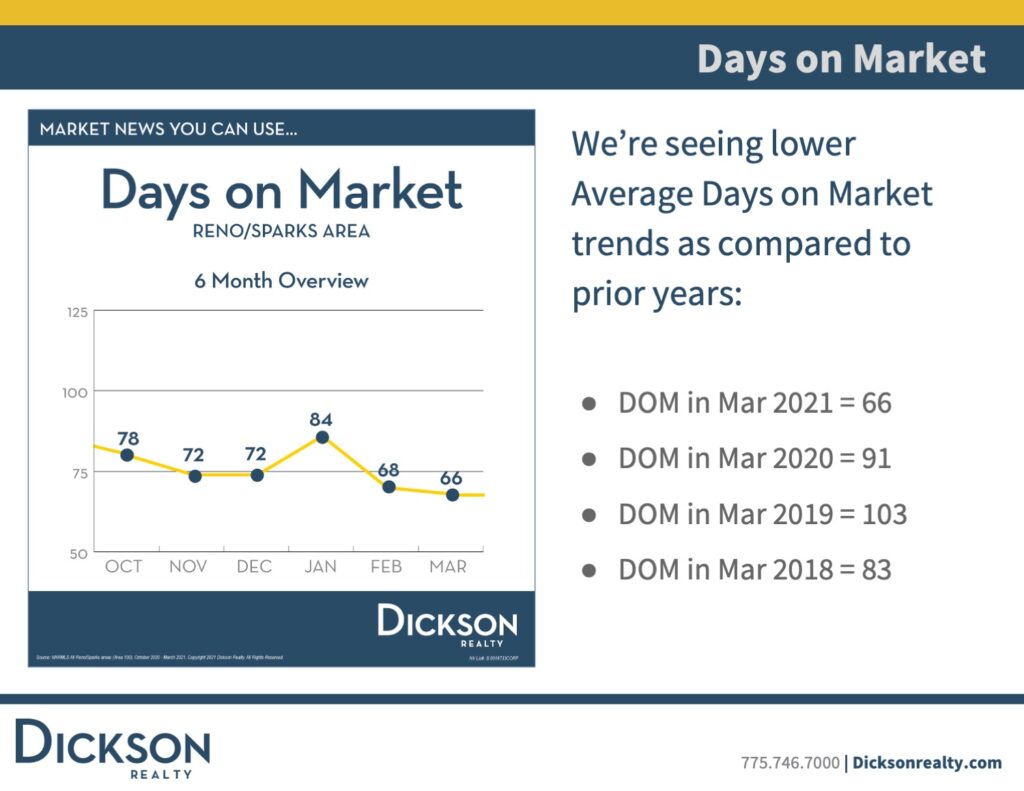

Sellers Continue To Be Well Positioned In Northern Nevada’s Housing Market

Many homes in the median market range are getting into contract and selling within 30 to 45 days. This is an excellent tool for homeowners to know how long it will take to sell a home. In March 2021, most homes sold within 68 days, which is down from 91 days year-over-year. This is also a result of demand outpacing our housing supply, which gives sellers the upper hand.

Consumer Confidence Fuels National Economic Growth

In March 2021, the economy accelerated further into recovery after a challenging year of financial and personal hardship. National economists say there could be sustained job growth in industries, regions, and workers affected most by the 2020 pandemic recession.

This month, U.S. employers added 916,000 jobs to the market, representing the biggest gain in job growth since August 2020. However, although the national unemployment rate is now at 6%, there are still 8.4 million fewer jobs than February 2020.

Consumer spending accounts for more than two-thirds of economic demand and is an essential element of recovery. With vaccinations becoming more readily available and state restrictions lifting on business activity, Americans are now spending more time at gyms, salons, and spas in recent weeks than they have in the last year.

This confluence of spending and consumer confidence is propelling economic growth and will hopefully continue to influence unemployment rates positively.

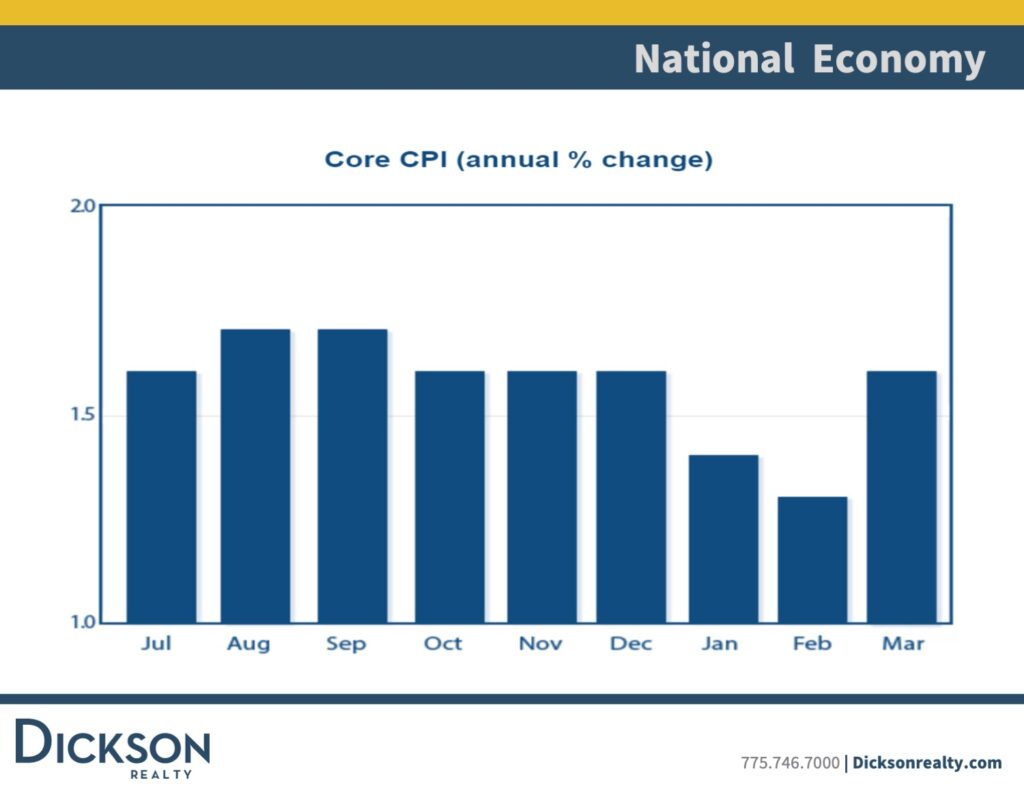

National Inflation Rates Show Slight Increase

While the Consumer Price Index (CPI) is a widely followed monthly inflation report, investors generally prefer to look at the core rate, which excludes food and energy prices that are often volatile. Excluding these two national commodities gives investors a more accurate representation of the cost of living for a typical consumer because there are fewer misleading inflation swings.

It is crucial to keep a close eye on incoming inflation data as it heavily influences mortgage rates. If inflation starts to rise significantly, then mortgage rates will increase. Homeowners and buyers should consider this when deciding whether to take advantage of the housing market as mortgage rates are currently at record lows.

Many investors and federal reserve officials are divided about future inflation trends. Some are concerned that it may increase as the year progresses, and others believe the perceived risks are overblown. It may be a temporary effect caused by the uneven reopening of the economy, and inflation will stabilize as companies adjust.

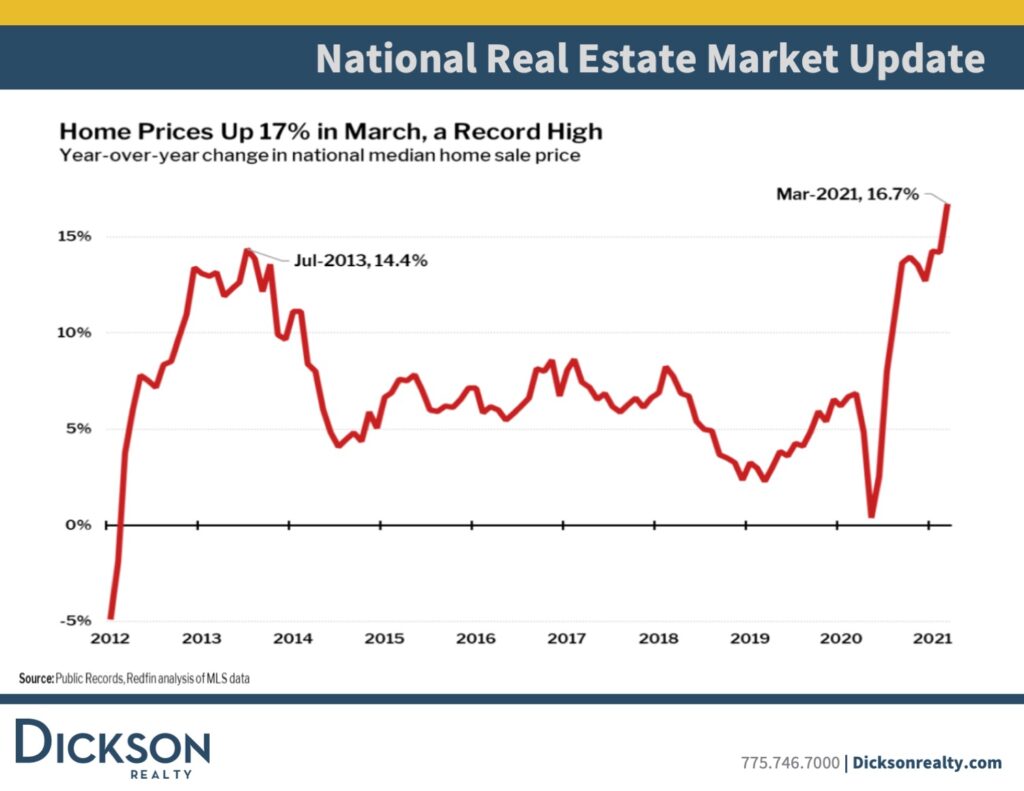

National Median Home Price Reaches Record High

The national median home sale price reached $353,000, representing a 17% increase year-over-year and a new high-record for the housing market. With homebuyers offering over-asking prices and low inventory levels across the country, these prices will likely continue to rise in the coming year.

Qualitative Ratings Show ‘Hot’ Market ZIP Code Indicators

To get a more accurate idea of current housing market conditions, Black Knight, Inc., a premier real estate data and analytics provider, completes a monthly report using statistical area and ZIP code data from across the country. Its ratings include trends in sold and active listings, inventory levels, sold and active days on the market, sold-to-list price ratios, and more. This graph shows numerical metrics using qualitative ratings ranging from hot to distressed.

In March 2021, 28% of single-family ZIP codes ranked in the ‘hot’ category. Typically, less than 10% of these markets will rank as ‘hot’ or ‘distressed,’ and about two-thirds will be in the three middle categories. This shows that single-family homes are ‘hot’ commodities and ZIP codes across the country are being affected, including the Northern Nevada housing market.

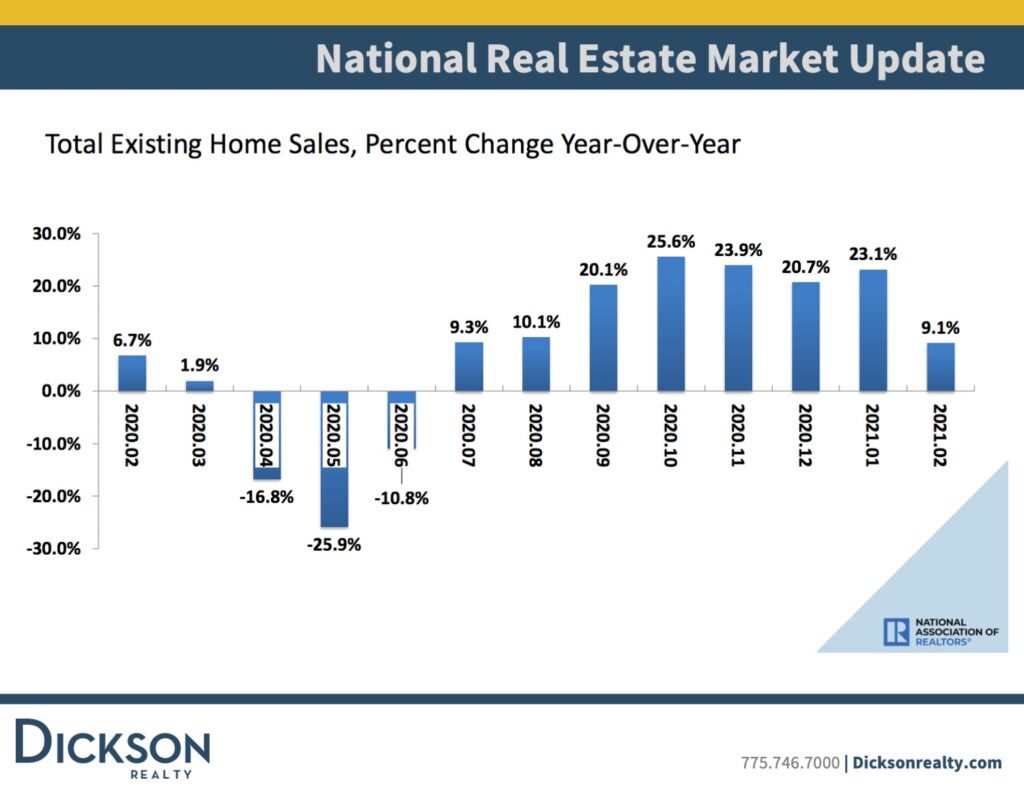

Existing Homes Sell Faster

While we are seeing fewer homes for sale nationally and in Northern Nevada’s housing market, buyers are quickly absorbing that inventory. As a result, it may feel like there are no homes for sale on the market—even if that’s not the case. For example, National Association of Realtors projected that there would be about 6.5 million existing-home sales this year, a significant increase from 5.64 million year-over-year and 5.34 million in 2019. This is another case of demand outpacing supply, and creating specific market conditions as a result.

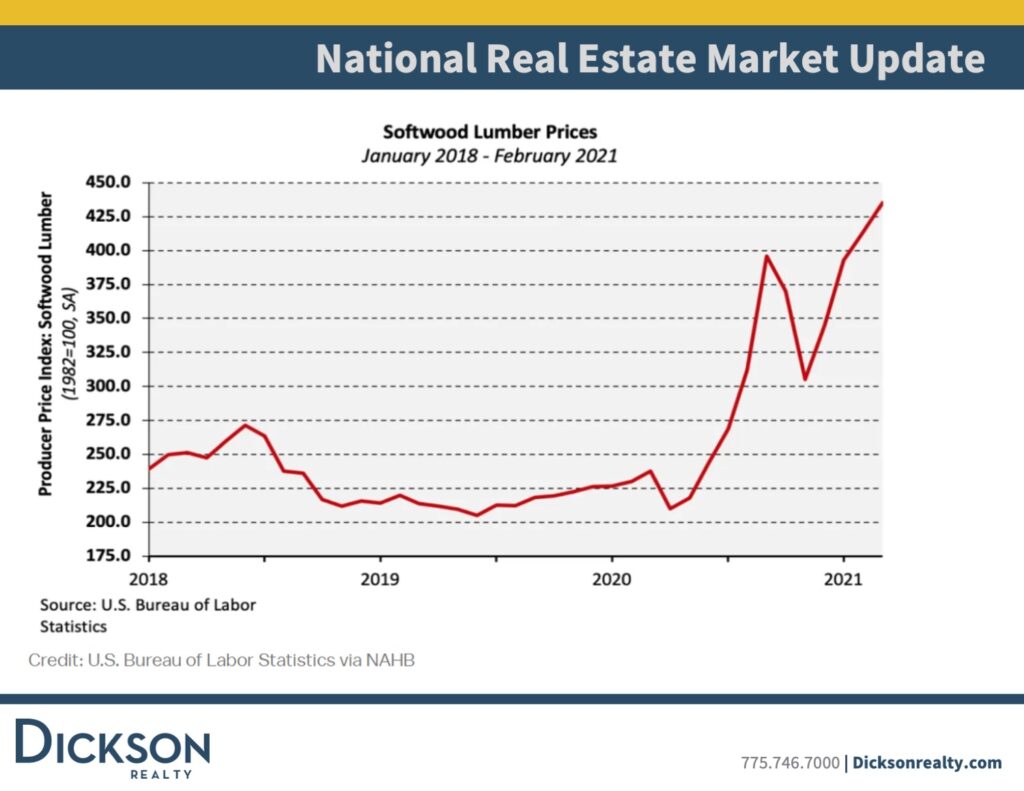

Increased Construction Costs Raise Concerns

The cost of building supplies has been steadily increasing for the last few years, but the global COVID-19 pandemic worsened the problem. Like many other industries, engineering and construction have had to reimagine how work gets done. Lumber companies believed there would be an eventual drop in demand during the pandemic, but that proved to be wrong.

Businesses are now struggling to meet the increasing demand for housing with higher construction costs for labor and materials. According to David Logan, a senior economist for the National Association of Home Builders (NAHB), the cost of lumber has almost tripled since last year. Higher material prices are causing building costs to increase, which translates to higher sales prices for consumers.

In February 2021, the NAHB estimated this trend added more than $24,000 to the cost of a newly built single-family home. Data from the U.S. Bureau of Labor Statistics further show that prices for plywood, lumber, veneer, pallets, and various other items have increased over the last year. The U.S. is also experiencing shortages in everything from steel products to toilets to appliances.

Investors Seek Long-Term Investments In Housing

Commercial real estate investment has plummeted in response to the COVID-19-related shutdowns of stores, restaurants, and hospitality industries. Investors are now searching for other opportunities and are buying 20% of all homes in the U.S.

Residential real estate is a relatively safe investment in the eyes of these deep-pocketed investors, who view the market as a hedge against inflation. In other words, they’re in it for the long term and can rent the homes they buy homes at great prices to justify their investment. This trend may not be readily apparent to consumers or real estate agents, but it’s making a substantial impact on housing inventories across the country, including Northern’s Nevada housing market.

More COVID-19 Vaccines Administered

In March 2021, northern and eastern regions of the country continued to see higher rates of COVID-19 cases, while Nevada maintained its efforts to keep cases down. Clark County’s two-week positivity rate decreased to 4.7%, and Washoe County reached 6.2%, a slight increase month-over-month. There have been 1.4 million vaccines administered in Nevada as of March, and about 560,000 people are fully vaccinated. Everyone 16 years and older can also receive the Pfizer vaccine, and the Johnson & Johnson and Moderna vaccines are available to residents 18 years and older.

About 70% of homeowners are now saying that they will feel comfortable moving to a new home after widespread COVID-19 vaccines have been distributed, according to a recent Zillow survey. This will also influence their decision to sell and should hopefully produce more housing opportunities for Northern Nevada’s housing market as statewide vaccinations continue.

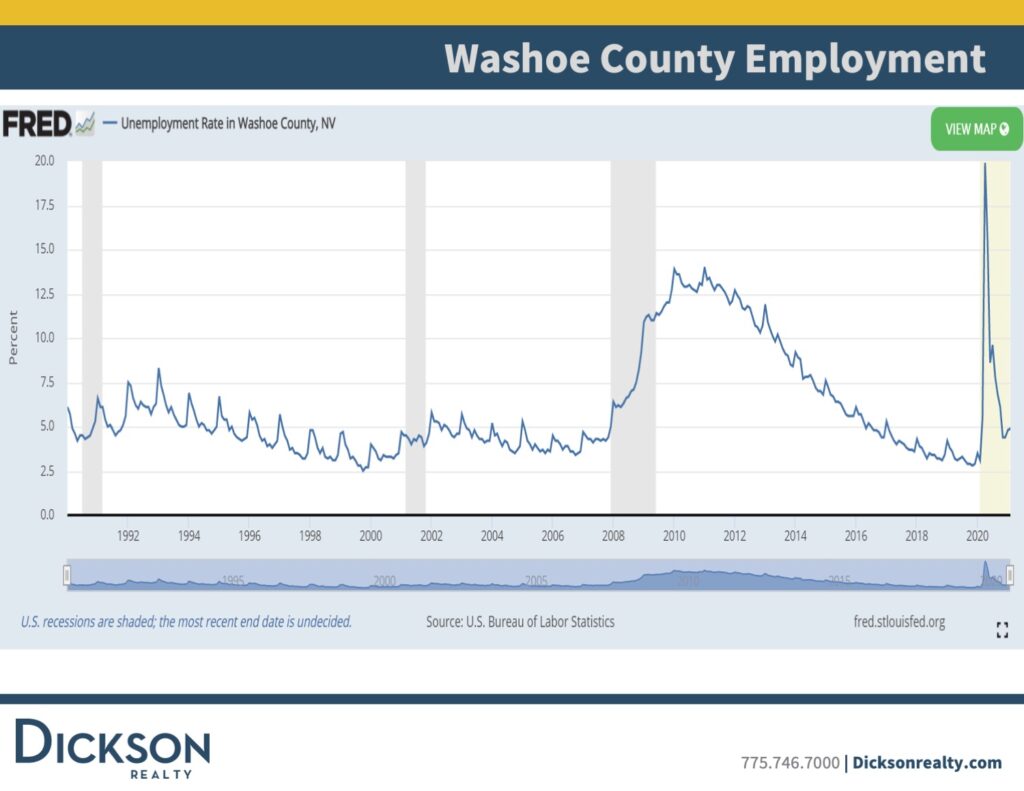

Washoe County Unemployment Rate Below National Average

In March 2021, Washoe County’s unemployment rate fell to 4.9%, which is a dramatic decrease from 28% year-over-year. Nevada’s unemployment rate has come a long way in recovery since reaching the country’s highest and the worst ever in state history in April 2020. With efforts to reopen businesses, resume activities, and administer vaccines, we’re hopeful that unemployment rates will continue to decline.

What To Expect In The Coming Months For Northern Nevada’s Housing Market

After a challenging year, the Northern Nevada housing market is showing improvements. New housing developments are on the horizon, statewide vaccines are available, and mortgage rates have reached new record lows. There is hope that the homebuying frenzy will eventually calm down, and there will be less competition amongst buyers.

However, national and state economists expect home prices to continue rising and housing demand to remain high. With this in mind, there will likely be more jobs that can accommodate higher living costs as the economy recovers from a year of downturn.