What do rising interest rates mean for the prices and availability of Incline Village homes?

Higher mortgage rates can make buyers less able to afford a home, but they can also slow down demand and give supply a chance to catch up, which makes home prices more stable. In some ways, the numbers for September 2022 from this luxury, resort-style community on Lake Tahoe’s north shore start to show this possibility.

The median price of a single-family home in Incline Village was lower in September 2022 than in August 2022 or September 2021. But although the median price of condos sold in September 2022 was also lower than in August 2022, it was higher than in September 2021. In September 2022, more homes were sold than in August 2022 and September 2021. This was true for both single-family homes and condos.

Before we dig more into what these local numbers mean for buyers and sellers, let’s take a holistic look at the national market. We’ll see how that translates into trends for Incline Village and how things are shaping ahead of Lake Tahoe’s first significant snowfall.

Fed Rate Increases Decrease Buying Power, but Homeowners Remain Financially Strong

The most prominent national news centers on rising interest rates as the Federal Reserve battles rampant inflation. In late September, the central bank raised benchmark interest rates three-quarters of a point, now up to a range of 3% to 3.25%, the highest since 2008.

The Fed also announced a more aggressive approach into next year, with the rate poised to reach 4.5% by February 2023, compared to earlier projections of 3.5% to 3.75%. Mortgage rates continue to rise, with the average 30-year fixed rate climbing to 7% by the end of September.

While these increases have led to a stock market shift and subsequent concerns from Wall Street investors, homeowners remain financially stronger than ever.

According to Odeta Kushi, Deputy Chief Economist at First American Title Co., U.S. households own $41 trillion in owner-occupied real estate—more than $12 trillion in debt, with the remaining roughly $29 trillion in equity.

As a result, the national loan-to-value ratio in the second quarter of 2022 was 29.5%, the lowest since 1983. What’s more, homeowners had an average of $320,000 in inflation-adjusted equity in their homes in Q2, Kushi reports, which is an all-time high.

What Do the National Numbers Mean for sales of Incline Village Homes?

Even though interest rates are rising, people still need to buy and sell homes as their lives change. This could be moving to a bigger house to accommodate a growing family, a smaller house to make retirement easier, or a new city to take advantage of a new opportunity. These are the most common reasons people buy and sell homes, which is not likely to change. Discretionary buying and selling could cool in the coming months, which make up anywhere from 10% to 20% of all transactions.

Now, let’s take a closer look at Incline Village home sales in September 2022 compared to the previous month and year.

Demand for Incline Village Homes

Single-Family Homes and Condos Sold

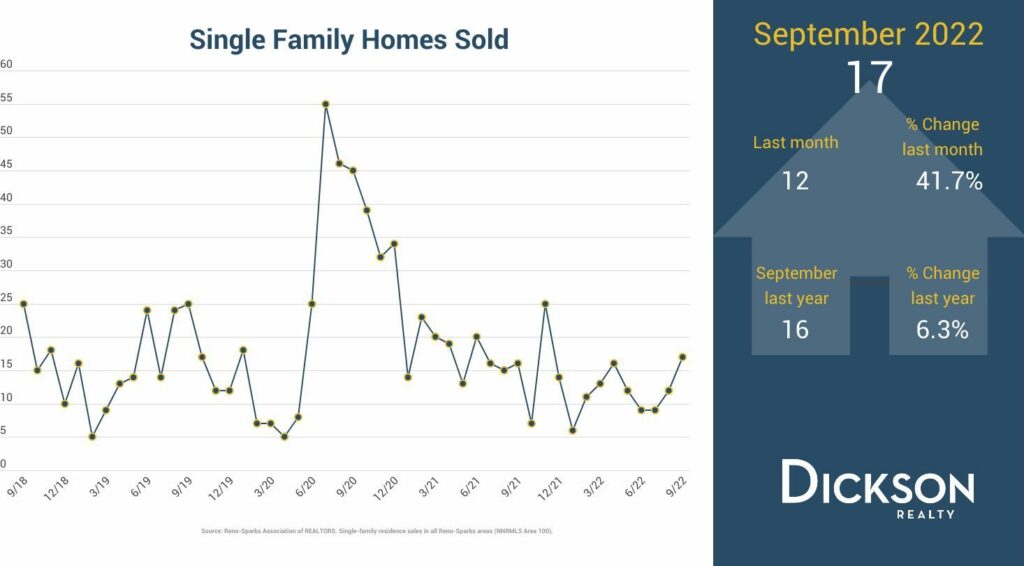

In September 2022, 17 single-family Incline Village homes were sold, representing a 41.7% increase from August and up 6.3% from the same time last year. In September 2022, 16 condominiums were sold in Incline Village, up 77.8% from August’s nine sales and 166.7% from 2021, when only six were sold. The fact that so many units sold indicates a healthy market.

Median Sales Price: Condos and Single-Family Homes

Meanwhile, the median home price in September 2022 was $1.95 million, a 41.8% decrease from August and a 5.5% dip from September 2021. While the month-over-month median change may seem drastic, it’s important to remember luxury Incline Village homes are defined as those with a median price of more than $2 million, which means one sale can significantly impact overall statistics.

It’s worth noting that the nearly 5% decrease in median sales price from 2021 to 2022 closely resembles the nearby Reno-Sparks market in terms of the percentage change. As a result, we’ve lost roughly a year’s worth of appreciation in the last four to six months. Buyers will have a better chance of finding a good deal if this trend continues and single-family home prices stabilize.

For the condo market, the median sales price in September 2022 was $935,000, down 22.1% from August 2022 but a considerable 46.1% from $640,000 in 2021.

New Contracts for Single Family Homes and Condos

New contracts demonstrate market demand by measuring how many offers came to fruition in a month. The number of new contracts for single-family homes has stabilized to pre-pandemic levels. In September 2022, 17 single-family homes went into contract in Incline Village, representing a 32% decrease from August 2022 and a 43.4% decrease from 2021.

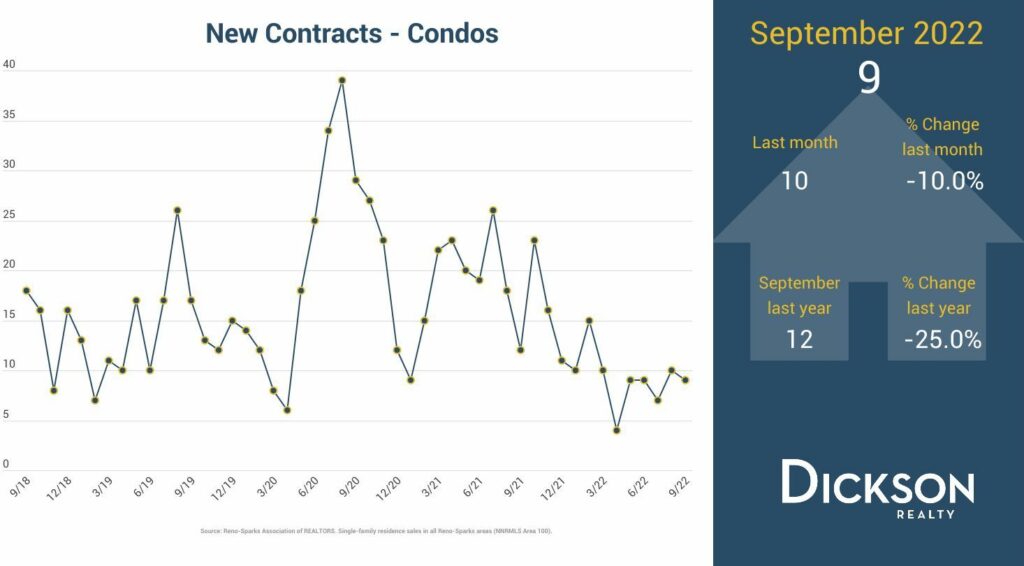

The nine condominiums that went into contract in September 2022 represent a 10% month-over-month decrease and a 25% decline year-over-year. Although the number of contracts has decreased since the market’s peak in 2020 and 2021, and even from the average pre-pandemic market, the market is still relatively healthy.

Over-Ask Analysis: Incline Village Homes

Another way to assess buyer demand is by dividing the average sales price of homes in the Incline Market by the final asking price. This over-ask analysis measures how many Incline Village homes sold for more than the asking price and by what percentage.

In September 2022, most single-family homes went into contract at 96.4% of the asking price, which was up from August 2022’s 92.9%, down from September 2021’s 98.6%, and almost six points lower than a historic high of 100.7% during the height of the pandemic.

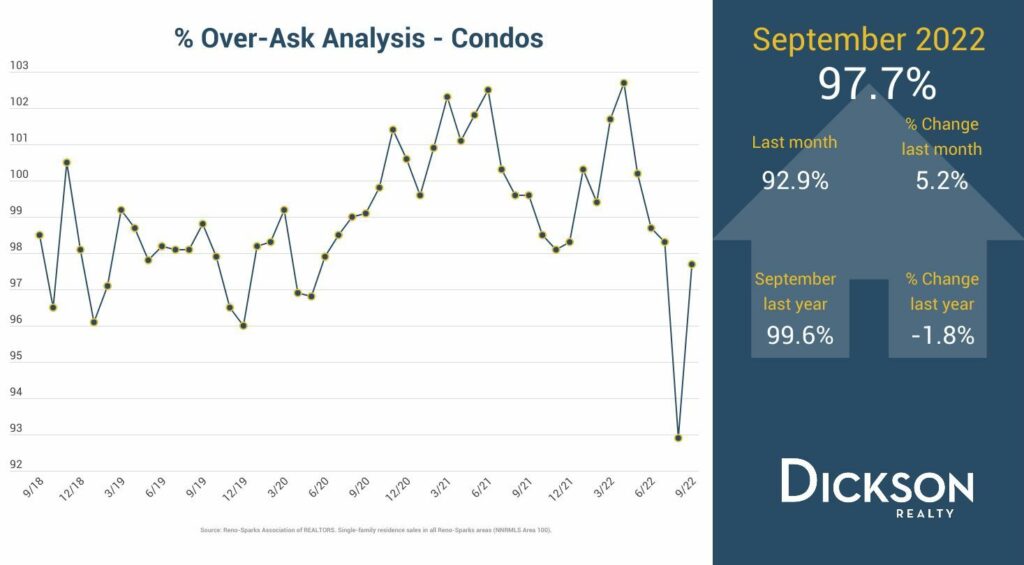

For condos, the over-ask analysis stood at 97.7% in September 2022, up 5.2% month-over-month and down 1.8% year-over-year.

Supply of Incline Village Homes

New Listings: Single-Family Homes and Condos

There were 12 new single-family home listings in September 2022, down 40% from the 20 new listings in August 2022 and 36.8% from the 19 listed in 2021.

New condo listings in September 2022 increased 33.3% to 12 compared to nine in August 2021, though they saw a 29.4% year-over-year decrease compared to 17 new listings in September 2021.

New condo listings in September 2022 increased 33.3% to 12 compared to nine in August 2021, though they saw a 29.4% year-over-year decrease compared to 17 new listings in September 2021.

Active Inventory of Incline Village Homes

Active inventory is a dynamic metric that gives buyers a better idea of how many Incline Village homes are for sale in a given month. It is a raw count of the number of properties actively marketed and listed.

In Incline Village, there were 49 single-family homes considered active inventory in September 2022, down 5.8% from August 2022 and 8.9% from 2021.

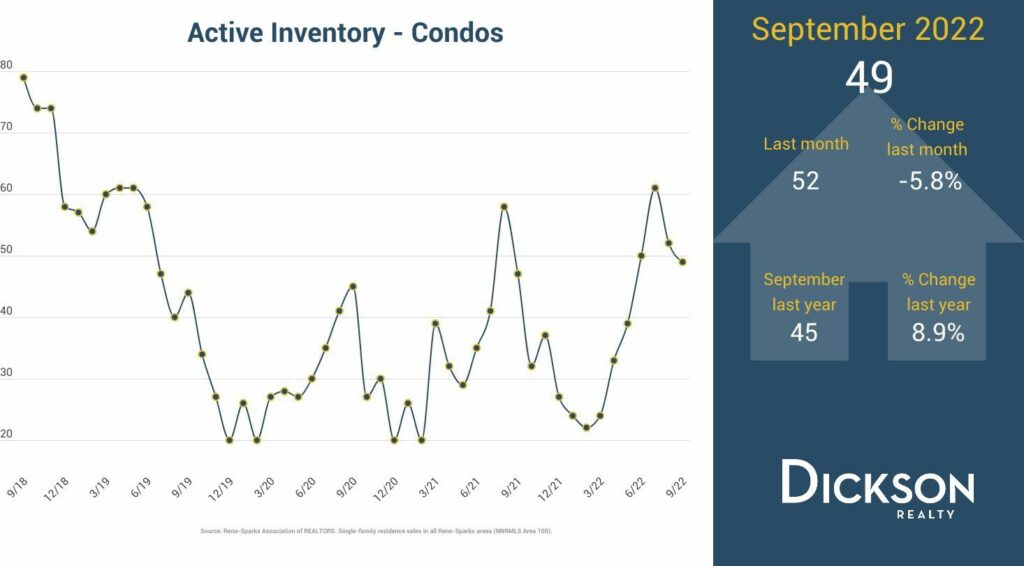

Like single-family homes, active inventory for condos was up 8.9% year-over-year in September, indicating that while inventory has been climbing, it’s not getting out of control to where it’s overshadowing demand.

Advice for Buying and Selling Incline Village Homes

Lake Tahoe is a popular destination for winter ski trips and holidays, influencing many to consider buying a primary or second home in the market. This trend can cause an increase in demand in the snowy months, especially in Incline Village. So, If you’re looking to buy or sell an Incline Village home, consider these recommendations:

- Sellers: Incline Village can experience a second busy season with the first snowfall, unlike most markets which see a lull as the temperatures drop. Listing your home before Thanksgiving can set you up for a successful home sale in the winter. Inventory is stabilizing, but it has not yet returned to pre-pandemic levels, and many buyers are willing to pay a premium for turnkey properties in this picturesque mountain town. Maintaining open lines of communication with your real estate agent, particularly regarding pricing, is crucial in this market.

- Buyers: An increase in interest rates may reduce your purchasing power, but it may also cause prices to level off, making this a great time to buy a home in Incline Village. It’s a good idea to talk to a local lender who is familiar with the area about getting pre-approved for a loan and learning about your other financing options. However, if you wait too long for prices to drop significantly, you might miss out on the house of your dreams.