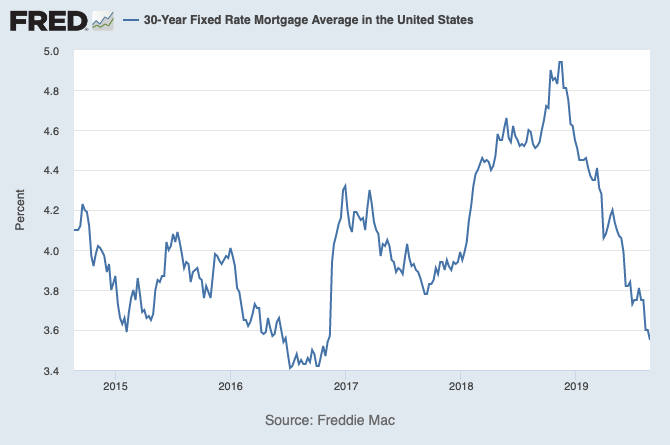

With interest rates at the lowest they’ve been in about three years, now might be the right time to refinance your mortgage. To dig more into the current interest rates and refinancing a home loan, I reached out to one of our trusted partners, Dereck Bowlen. Dereck is the Branch Manager for Synergy Home Mortgage in Caughlin Ranch. He’s been in the mortgage industry for more than 25 years and offered his perspective and advice.

Is now the time to think about refinancing your mortgage?

We are experiencing rates that we probably haven’t seen in about three years. But, interest rates are always faster to go up than they are to go down, and we could see a snapback at any time. So, it’s a great time to talk to a mortgage professional to see if it makes sense for your situation.

How can you tell if you’re a good candidate to refinance?

The old rule of thumb was that it had to be 2% or more of a reduction in the interest rate. But, that was also in the days when we had much smaller loan amounts and lower loan prices. Now, even a half a percent to one percent reduction might be advantageous. The main factors to consider are your loan size, the potential interest rates savings, the refinancing costs, and how long it will take you to recoup those costs.

What costs could you incur if you refinance your mortgage?

Refinancing fees really depend on each situation. You need to talk to a mortgage professional to understand what your cost would be.

Do you need to refinance your mortgage with the same company that issued it?

No, you can refinance your mortgage with a new company or the same company. I strongly recommend getting referrals and recommendations from real estate professionals, friends, family, and coworkers to find the right mortgage professional for you. I also encourage people to keep it local. Then, you can knock on someone’s door if something isn’t going right or you need to address something right away.

How soon can you refinance your mortgage after you buy your home?

We’re looking at people who closed on their home purchase just a year ago when rates were in the mid to high 4% or 5%. We’re refinancing a lot of those loans, and today’s rates are definitely benefiting the client’s financial situation.