If you are starting to fall behind mortgage payments (or just about in danger to do so), now is the best time to consider your options and decide which one would be suitable for you. Here are several choices to consider in dealing with this difficult decision:

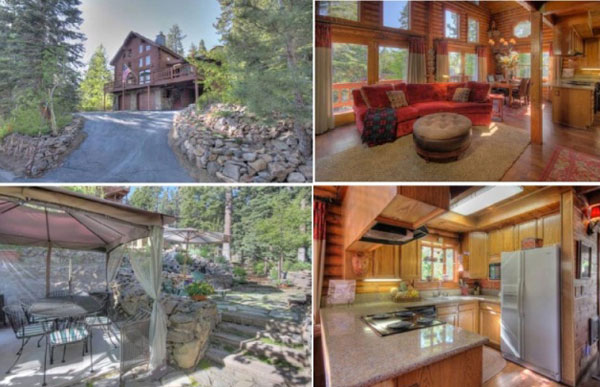

Short Sale – This is the sale of a real estate property for a sum less than the amount owed on the property. If the mortgage company agrees to this, you can sell your home and pay off all or portion of your mortgage balance with the proceeds. This process involves putting your house on the market. The owner must have financial hardship in order to qualify for this. A short sale allows the homeowner to avoid foreclosure, minimize financial damage and move on from a burdensome mortgage

Reinstatement – A reinstatement is the simplest solution for a foreclosure, as it does not need the mortgagor or lender’s approval. The homeowner simply pays the total amount past due, which includes missed payments, late fees and legal fees. Once the delinquent amount is fully paid, the mortgage is reinstated.

Forbearance or Repayment Plan – This involves negotiating with the mortgage company to allow you to pay the past due amount – added on to your current mortgage payments – over a specified period of time. This requires lender’s approval and the owner is required to submit financial documentation proving that he will be able to comply with the terms of the repayment plan.

Mortgage Modification – This is an agreement between you and the mortgage company to change the original terms of your mortgage – such as interest rate, principal balance, length of loan, etc. These changes require lender approval and typically result in a lower and more affordable payment. You may also be eligible for these government programs which were created to help struggling homeowners, the Home Affordable Modification Program (HAMP) and the program called Home Affordable Foreclosure Alternatives (HAFA).

Deed-for-Lease™ – This option allows you to temporarily rent your home for enough money to cover the monthly mortgage payment. You first need to transfer ownership of the home to the mortgage company through a Deed-in-Lieu of Foreclosure, in exchange for a release from your mortgage loan and payments. You can then rent your property back, at an affordable rate and remain in your home, this time as a tenant.

Deed-in-Lieu of Foreclosure – This is when you transfer the ownership of your property to the owner of your mortgage in exchange for a release from your loan and payments. This allows the homeowner to simply return the property to the lender rather than going through the foreclosure process. With this option, the homeowner will not be responsible for further payments and this can possibly lessen the damage to one’s credit score and future loan eligibility.

Refinance – A new loan that completely replaces your current mortgage. If you have already missed several mortgage payments, your credit score may make it difficult for you to apply for a new one that has cheaper payments. You should talk to your current lender first, before pursuing the refinance with other companies.

These options require much time to think about, as this will not only affect you but your whole family as well. In addition, you may also want to consult with an accountant and lawyer about this. If you need help or professional advice from a Certified Distressed Property Expert, feel free to contact Margie McIntyre at 775-850-3165 or email her at Margie@margiemcintyre.com.