This is the second in a series of blog posts I am writing about investment property and being a landlord. In my last post, I summarized what topics and questions this series will cover. If you have additional questions or topics that you would like discussed, I would love to hear from you.

So, what makes a good rental? The short answer is one that will be rented, of course!

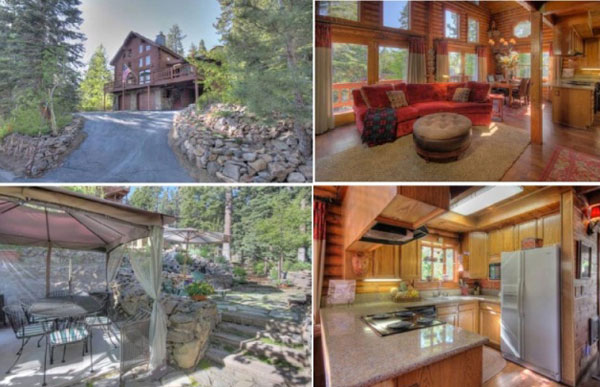

The longer answer; a property that is functional for the area it is located in, and one that makes financial sense for you. It does not make good, financial sense to invest in a ski in / ski out property near a resort if you’re hoping to rent it out over the summer. Just as having a lake house you use all summer with hopes of renting it out during the winter months, would not bring you the most bang for your buck either.

When considering a good rental, a better approach would be to think of it as a true “investment property”, which is defined by the Branch Banking and Trust Company as A property that is not occupied by the owner. Let that definition be your guide when choosing a suitable investment property. It is not necessarily the least expensive property, or a house you love, that will make the best investment when all things are taken into consideration. You may appreciate living in solitude, with a private yard and neighbors that are far away. Your potential renter may prefer condo living, since he does not care for home and yard maintenance and prefers to be close to plenty of people.

It all comes down to numbers – as well as smarts – so until next time, bring out your financial statements to see if we can make it work for your specific situation.