Before we head into the new year, let’s get back to basics and focus on the supply and demand of real estate in Reno, Nevada, and the broader Northern Nevada area, including Sparks.

Here are the highlights: demand is up year over year, and supply is slowing down to match the season. As we head into 2022, we can expect that demand will continue to stay strong and that supply will increase with temperatures and new developments.

Demand Increases Year Over Year For Real Estate In Reno, Nevada, And Sparks

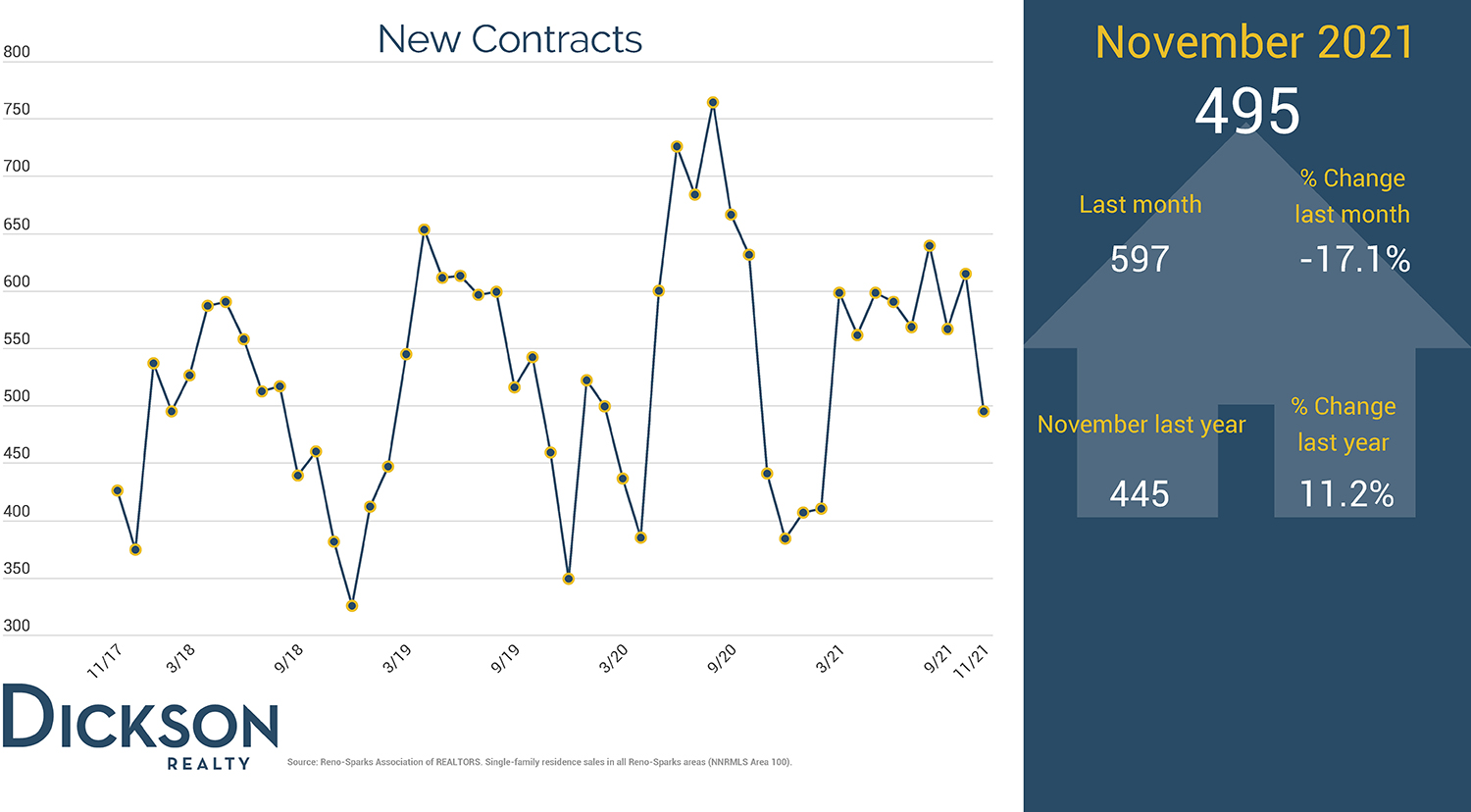

The number of new contracts highlights the demand in our market. In November, 495 homes went into contract, a more than 11% increase from the previous year. We did see the typical seasonal decrease in new contracts from October to November 2021, but this is expected as seasonality impacts buyers’ interest and time in buying and moving into a new home.

Another change that will likely increase demand and the number of homes that go into contract is the new, higher limit for loans backed by the Federal Housing Administration. Beginning in 2022, buyers can borrow up to $647,200 with a conforming loan in most parts of the United States—a $95,000 increase from 2021 limits. This will increase many people’s buying power and allow them to enter the housing market at higher price points, increasing demand.

Fewer Homes Sold In Northern Nevada

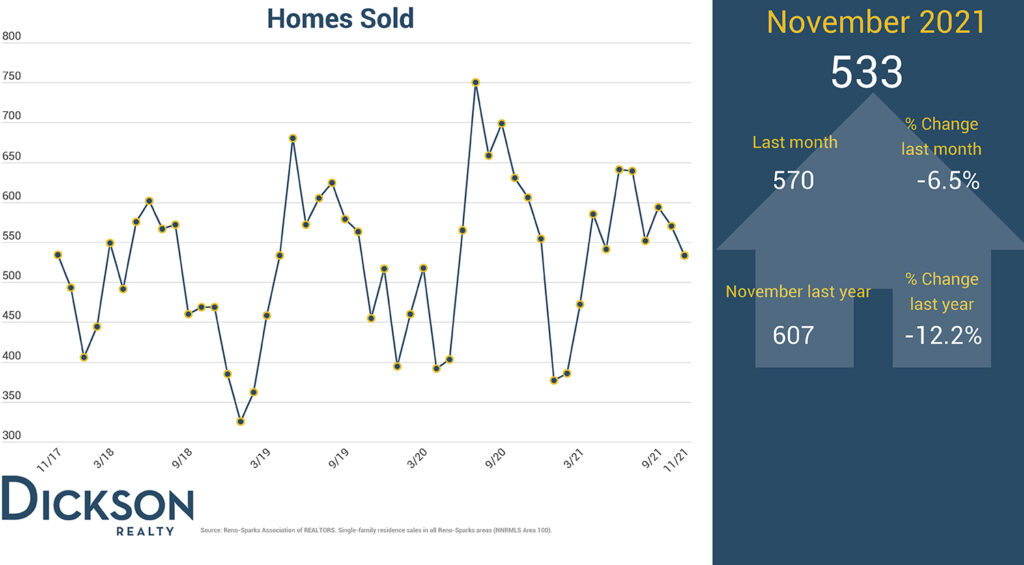

Another measure of demand is the number of homes sold on the market. In November 2021, 533 homes were sold, representing a 6.5% decrease month-over-month and a 12.2% decrease from the previous year. Although this number may seem low for the Northern Nevada region, it’s important to note that homes sales are higher than in 2019 and 2018.

Homes Took Longer To Go Into Contract

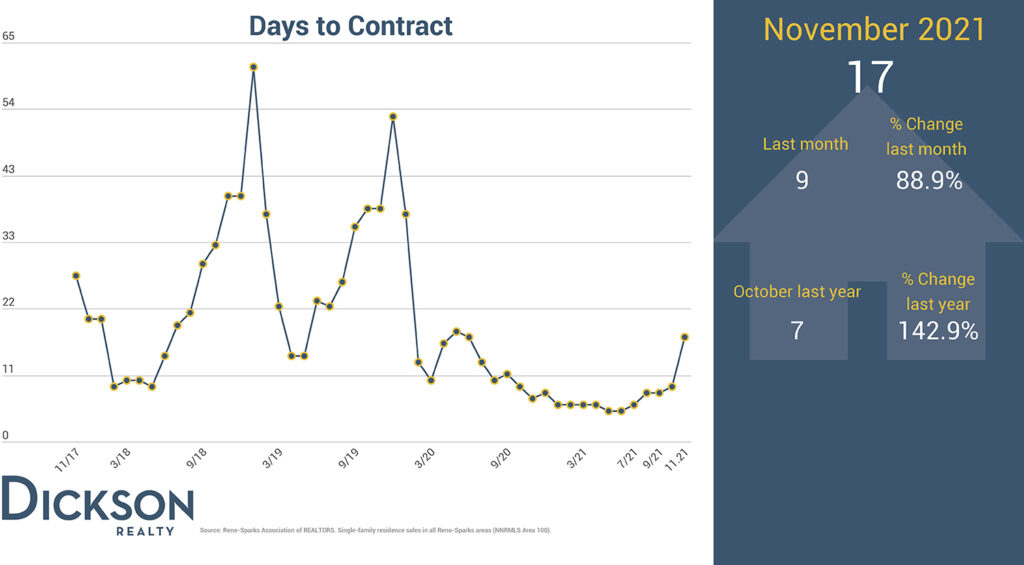

The number of days it takes for a home to go into a contract also reflects the demand for real estate in Reno, Nevada, and Sparks. In November 2021, it took 17 days on average for a home to go into contact. Although this represents an 88.9% increase month-over-month and a 142.9% increase year-over-year, it is still an extremely fast-paced market when comparing to prior years.

Asking Prices Dropped Below 100 Percent

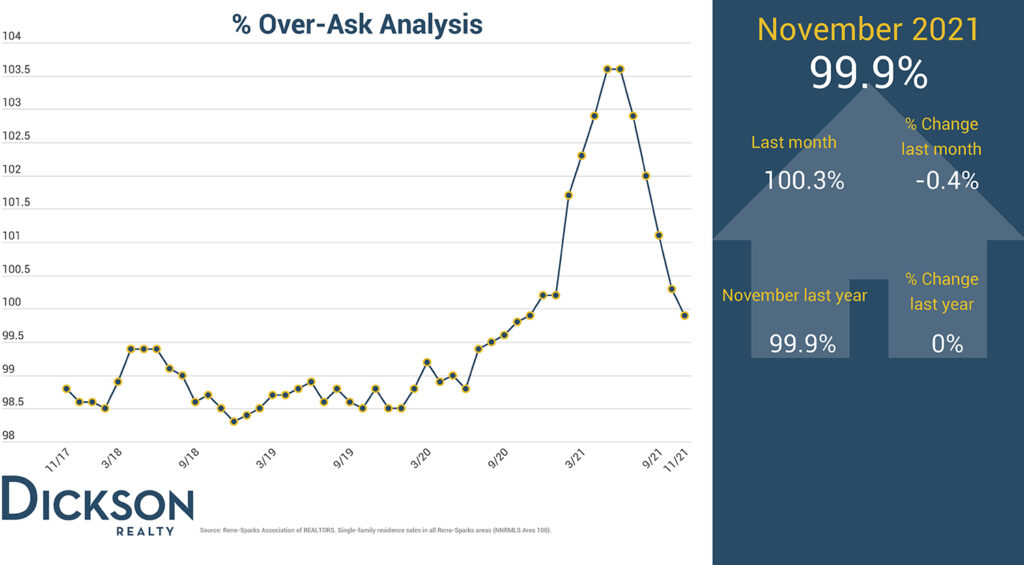

Since the beginning of the year, we have experienced a trend of buyers paying more than the list price for real estate in Reno, Nevada, and Sparks. This is due to high buyer demand and record-low inventory levels that were intensified by the pandemic, which affected housing markets across the country. To understand this trend, we calculate the average listing price divided by the final sales price to measure how many homes sold for more than the listing price and by what percentage.

In November 2021, the ratio of sold price to asking price for homes in Reno and Sparks was 99.9%, representing a record-low for this year. This should provide buyers with some relief as over-ask percentages drop below 100% and housing prices start to stabilize. For sellers, this is a sign to list your house at a price the market will bear and take advantage of the market’s conditions.

Supply Shows Typical Seasonal Changes

Active Inventory Levels Increase Year Over Year

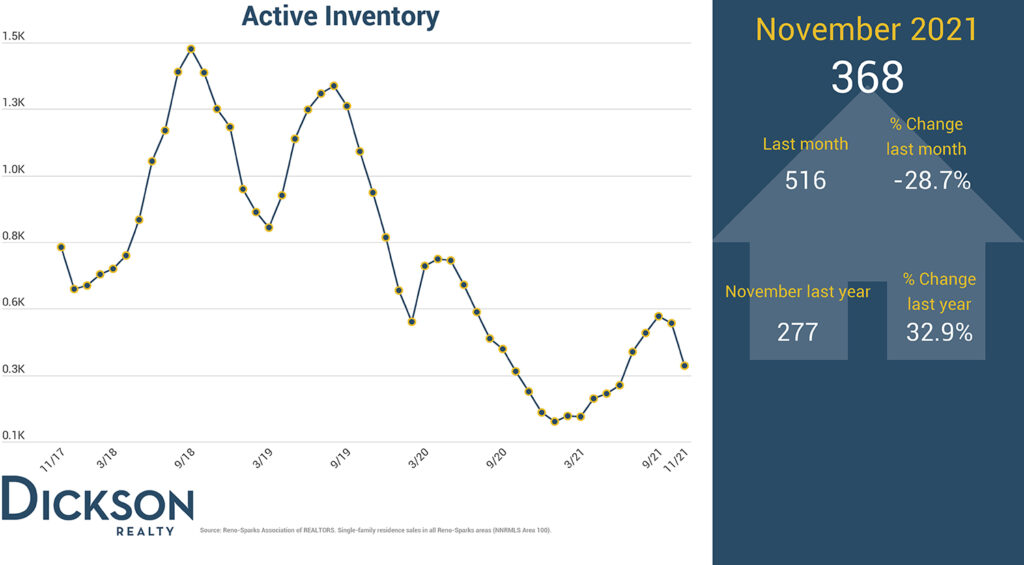

After considering the demand of our housing market, it’s time to flip the proverbial coin and consider the supply. Inventory represents the active supply of homes on the market. Any time a seller lists a property, it’s considered inventory. As the number of homes on the market is constantly changing, active inventory is a more dynamic metric to measure this activity. Active Inventory is a snapshot of how many homes were on the market on a given day of the month, typically measured on the last day of each month.

While our area is still experiencing low active inventory levels, there were 368 homes actively listed in November 2021—an almost 33% increase from 2020. A well-balanced market will have about 800 to 1,000 available homes for sale, so over the next 12 months, we would like to see the amount of active inventory increase to balance supply and demand.

November’s active inventory decreased from October, but seasonality is key. The real estate market typically slows down during the winter months as the holidays approach, and this is perfectly normal.

Fewer New Listings Come To Market In November 2021

We can also measure inventory by examining the number of new listings that came to the market in the past month. In November 2021, sellers listed 370 homes, a decrease of almost 7% from October 2021 and nearly 40% from November 2020. However—and this may sound repetitive—it’s essential to consider seasonality. For example, we typically see a dramatic drop in the number of new listings in the fall and winter. In fact, in December 2020, there were fewer than 300 new listings, compared to more than 550 in September of that same year. As the temperatures warm up, we also see an increase in new listings and active inventory.

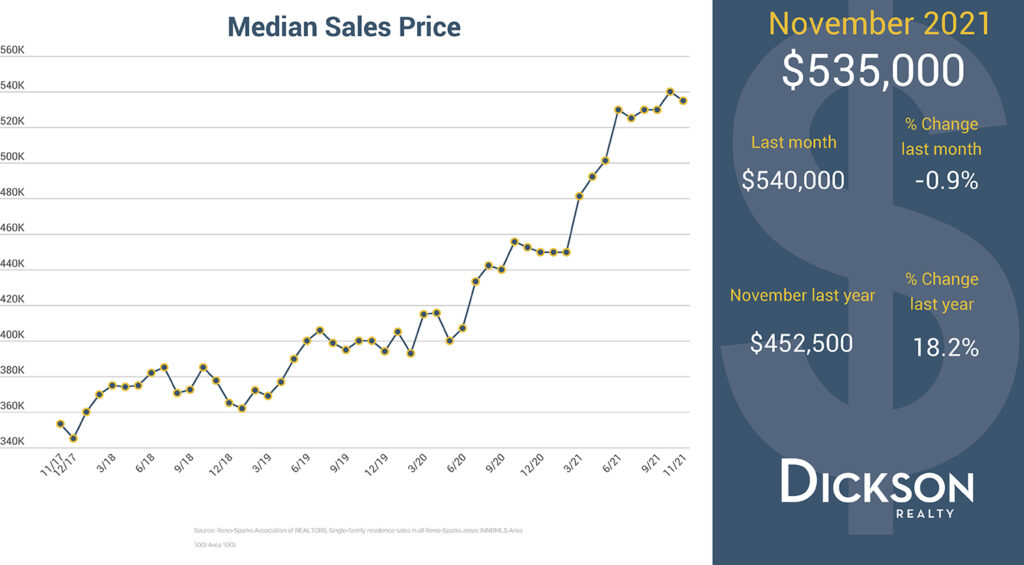

Northern Nevada Housing Prices Dropped Slightly

The median sales price for real estate in Reno, Nevada, and Sparks decreased slightly from $540,000 in October to $535,000 in November 2021. A better measure of price trends though is to look at the 18.2% increase year-over-year, which represents a significant rise in housing prices. However, the market is showing signs of stabilizing, and we’re expecting the rate of price increases to continue slowing down for the remainder of the year.

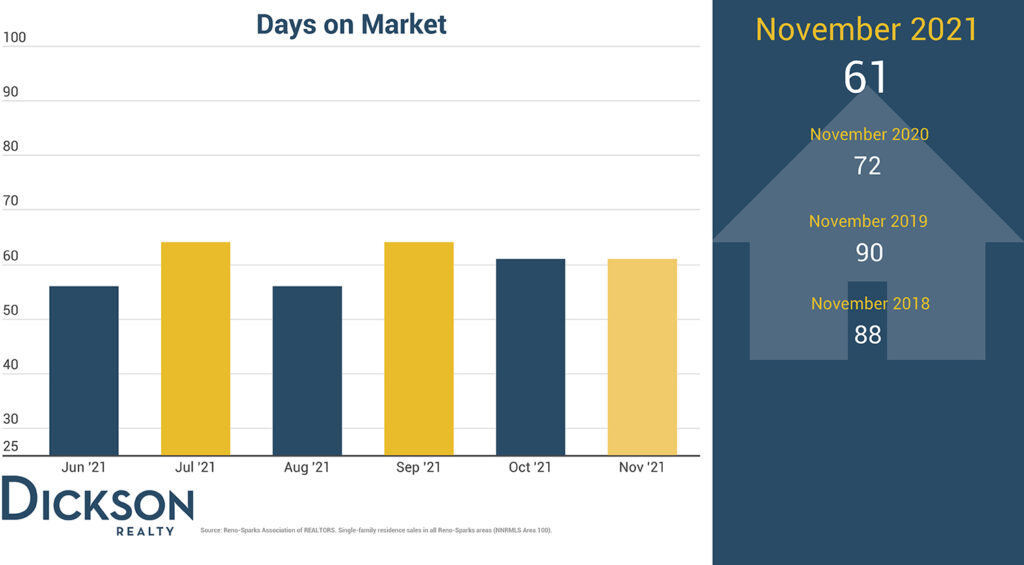

No Monthly Change For Days On Market

Days on market is an essential metric for sellers to understand typically how long it will take them to sell real estate in Reno, Nevada, and Sparks. In November 2021, homes stayed on the market for 61 days before selling, 11 days shorter than last year and 27 days down from November 2019. This number also represents a 0% change month-over-month, consistent with 2021 averages.

Advice For Buyers And Sellers

Buyers: The increase in FHA conforming loan limits paired with still-low mortgage limits means that your buying power is strong. The Federal Reserve plans to raise rates three times in 2022 to make borrowing more expensive for individuals and businesses, aiming to cool demand and soaring prices. It also expects more hikes in the following two years, lifting rates from near zero to 2.1% by the end of 2024. As mortgage rates increase, your buying power will decrease. So, now is the time to buy. Get preapproved for a loan before you hit the market and position yourself as a competitive buyer. It’s also vital to have an experienced REALTOR in your corner who knows how to navigate a market like ours.

Sellers: While there is still plenty of demand working in your favor, the decrease in the number of Over-Ask sales is a signal of what the market is willing to bear. As inventory levels continue to grow and buyers have more options, home prices are starting to stabilize. That’s why it’s essential to understand where the market is now and focus on the big picture. With the help of one of our neighborhood experts, we can help you find a new home while getting the most out of your current property.