Beau Keenan, president of Dickson Realty takes a look back at 2020’s Sparks and Reno housing market trends to see what happened and why. He also looks toward 2021 with forecasts and national trends to see what’s in stock for us in the upcoming year.

Watch his video update here, or continue reading below for details.

Overall Economic Outlooks for 2020 and 2021

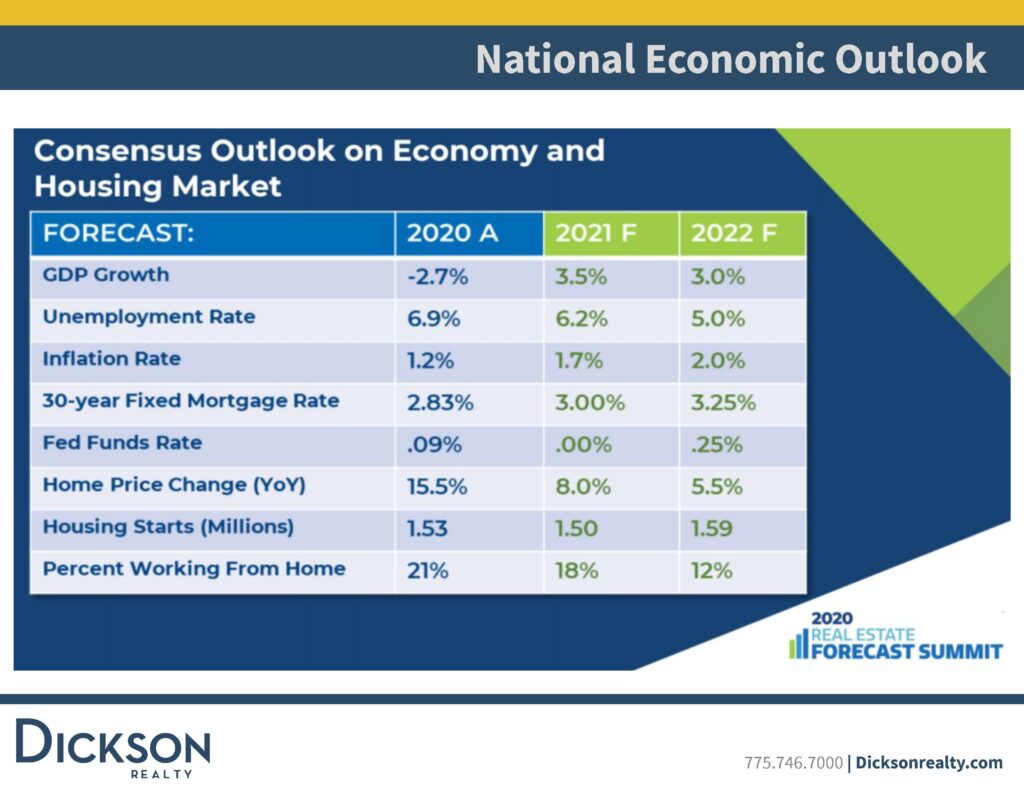

In December, Nevada’s unemployment rate fell to 9.2%, a far cry from the state’s 28% rate in April, the worst ever in state history and the country’s highest for 2020. But we have come a long way in recovery, and with the efforts to reopen businesses and resume activities, our GDP grew 52.2% in the third quarter, the most significant increase in the country. In 2020, our GDP in the United States went down by 2.7%. But even with COVID-19, we still see a 2021 forecast of 3.5% growth, and some economists are projected up to 6% growth.

Washoe County’s unemployment rate decreased from 20.4% down to 5.4% from April to December, while the Las Vegas Metropolitan Area, which relies more heavily on gambling and tourism than the north, saw its jobless rate decrease from 34% to 11.5%. National unemployment climbed to its peak between March and April, reaching about 16% but fell sharply from October to December, giving a 2020 average of 6.9%. It is projected to decrease to 6.2% in 2021.

Sellers Continue to Hold the Upper Hand in the Sparks and Reno Housing Market

Washoe County is definitely a seller’s market, and demand continues to outpace inventory even in winter months, which traditionally see slower home sales. Median sale prices remain at record highs, with December’s Reno-Sparks median at $449,600. Although similar to November, the median sales price is up 14% from December of 2019. Our median sold price-per-square-foot is up 16.4% year-over-year.

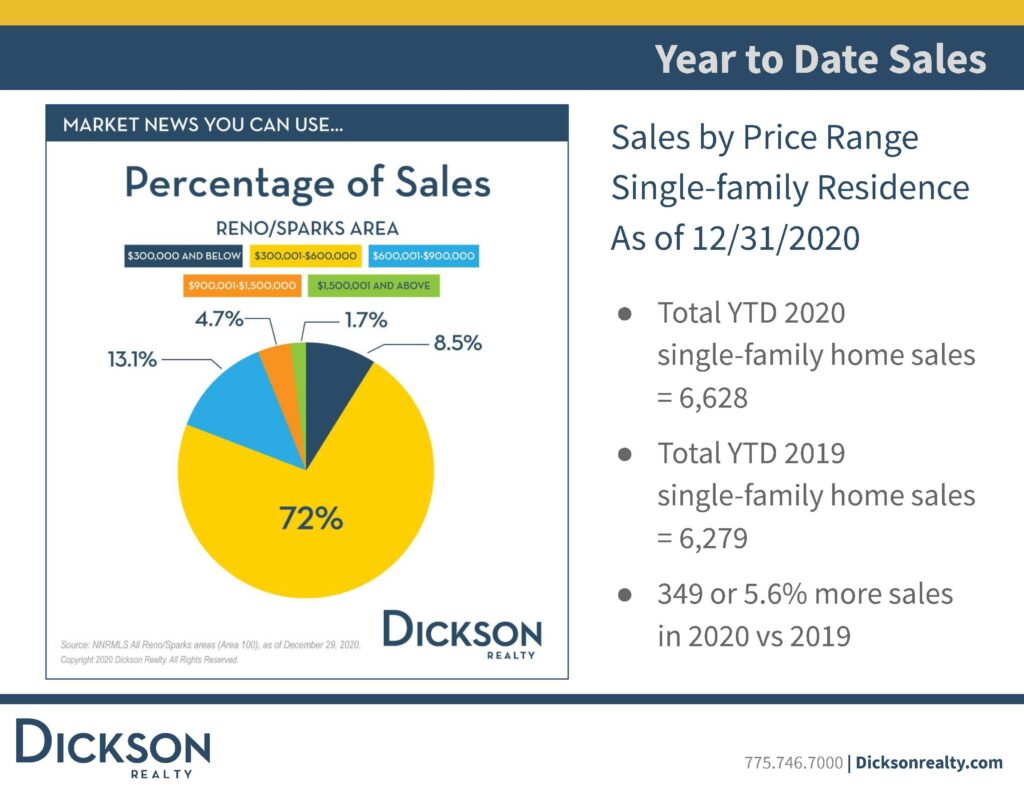

The meat of the market, which is the $300,000-$600,000 range, constitutes 72% of sales. Homes in the $600,000-$900,000 range make up 13% of sales, followed by the $300,000 and below range, representing 8.5% of sales. Although homes ranging from $900,000 to $1,500,000 and $1,500,000 and above constitute around 6.4% for total sales, that market is growing as more wealth comes to the area.

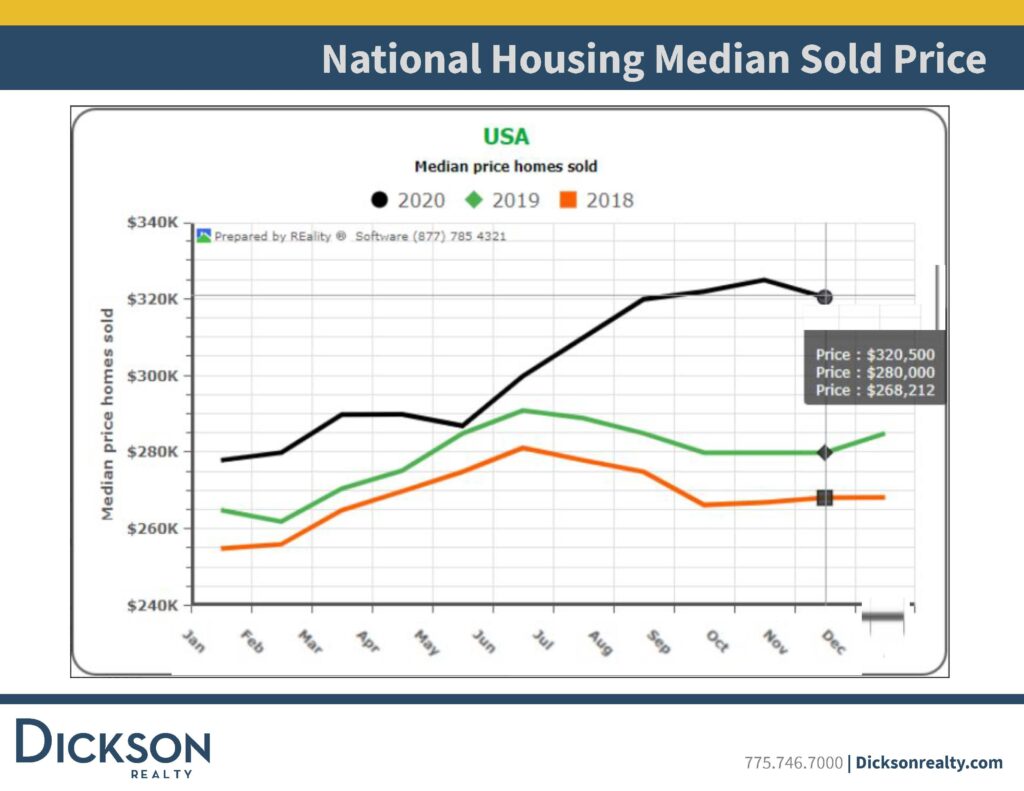

In December, the median national price rose to $320,500, up 13% from the $280,000 median from December of 2019. This national price increase marks 106 straight months of year-over-year gains. There is a significant concern growing regarding the divergence between median wages and median home prices, especially here in our own backyard. Although President Joe Biden has promised to invest $65 billion in building affordable homes, both for rent and for sale, it’s really a matter of how and when, considering his already packed agenda.

Home prices will continue to increase nationally by around 8% but not to the level you saw in 2020, which ended with a 15% rise. This is partly due to supply and demand, decreasing from 1.53 million homes available on the market in 2020 with a projected decrease to 1.50 in 2021. This also stems from COVID-19 restrictions and concerns impacting building project start dates. The summer and fall showed an increase in builds, but we won’t start catching up to pre-2020 levels until 2022.

New Listings in Reno and Sparks Swooped Up as Soon as They Hit the Market

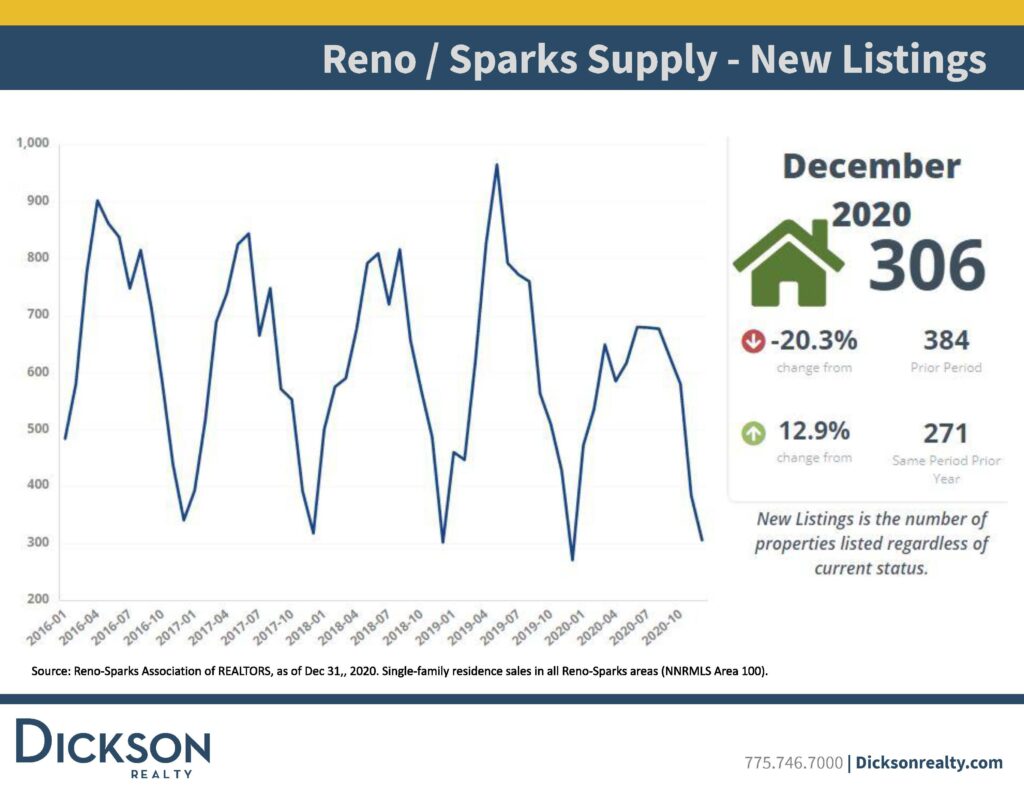

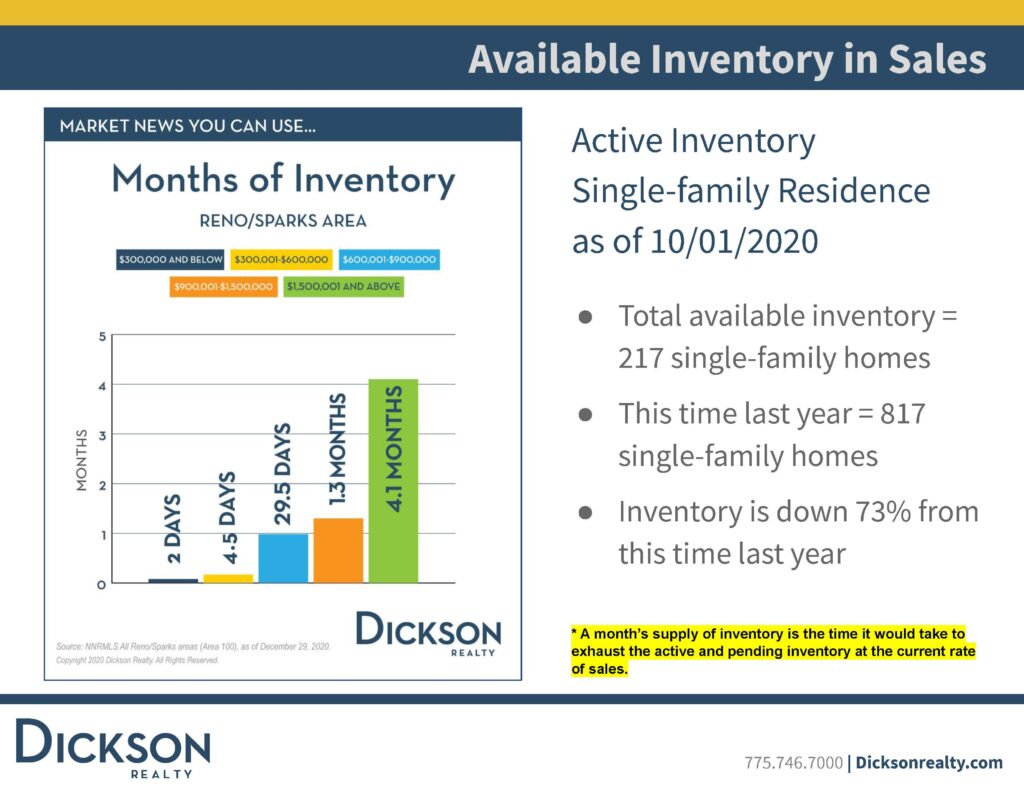

In December, 306 new listings hit the Reno-Sparks market, down 20% from the 384 homes listed for sale in November. Our year-over-year current available inventory is down a whopping 73%. With the short amount of new listings, we’re getting to the point where available inventory will be whatever comes on the market the very next day.

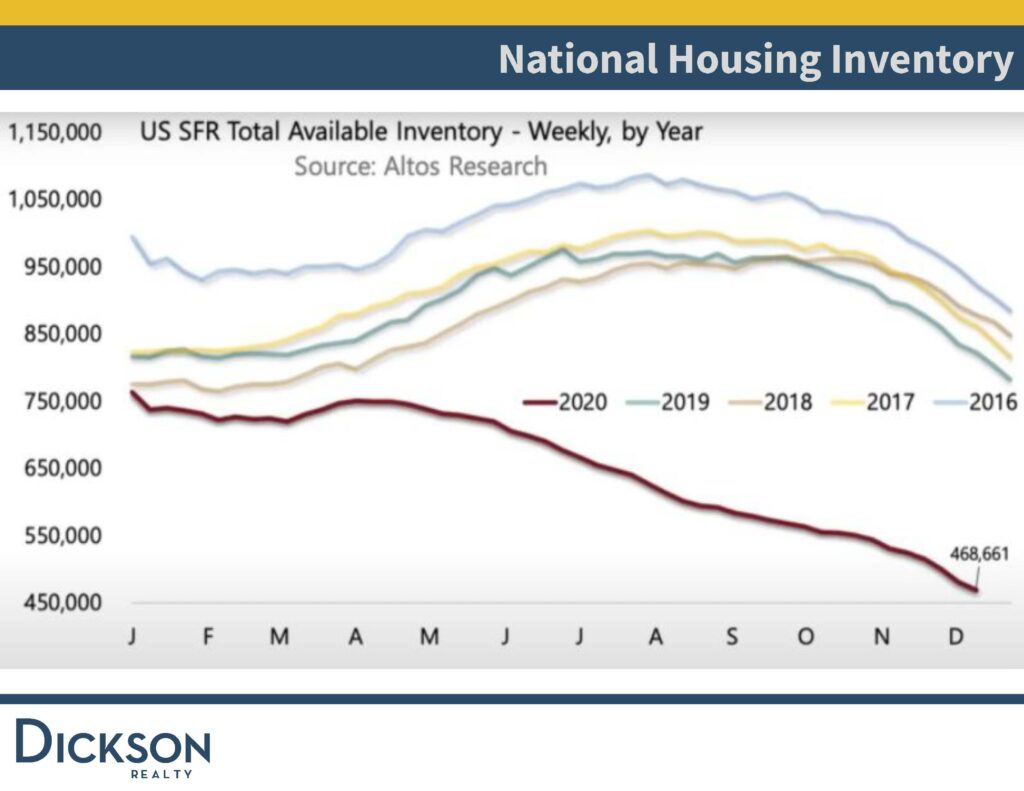

According to the National Housing Inventory, the national housing supply has plunged to just under 469,000 single family homes this month. Looking at everything available on the market (condos, townhomes, etc.), inventory dipped below 700,000 nationally for the first time and is down 40% compared to this same time last year.

Demand Far Outpaces Supply

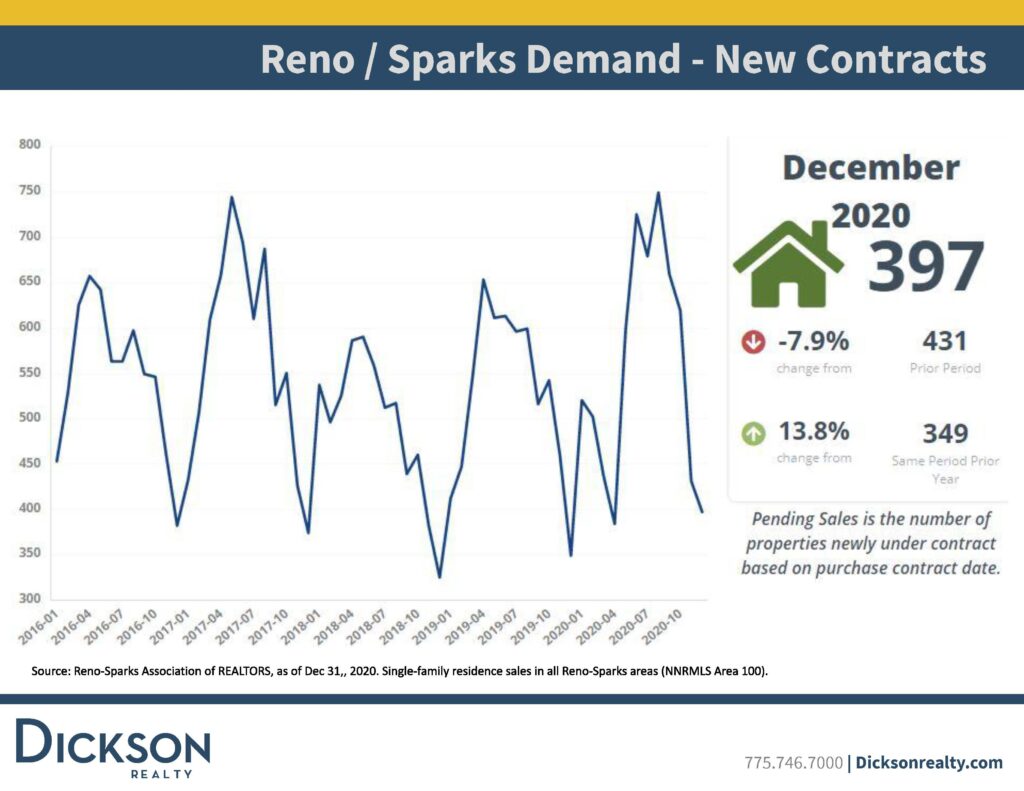

As far as local demand goes, 397 new contracts accepted an offer in December, down 8% for November but up almost 14% from the same time last year. Typically our Q4 slows down, but the end of 2020 showed full-steam-ahead momentum.

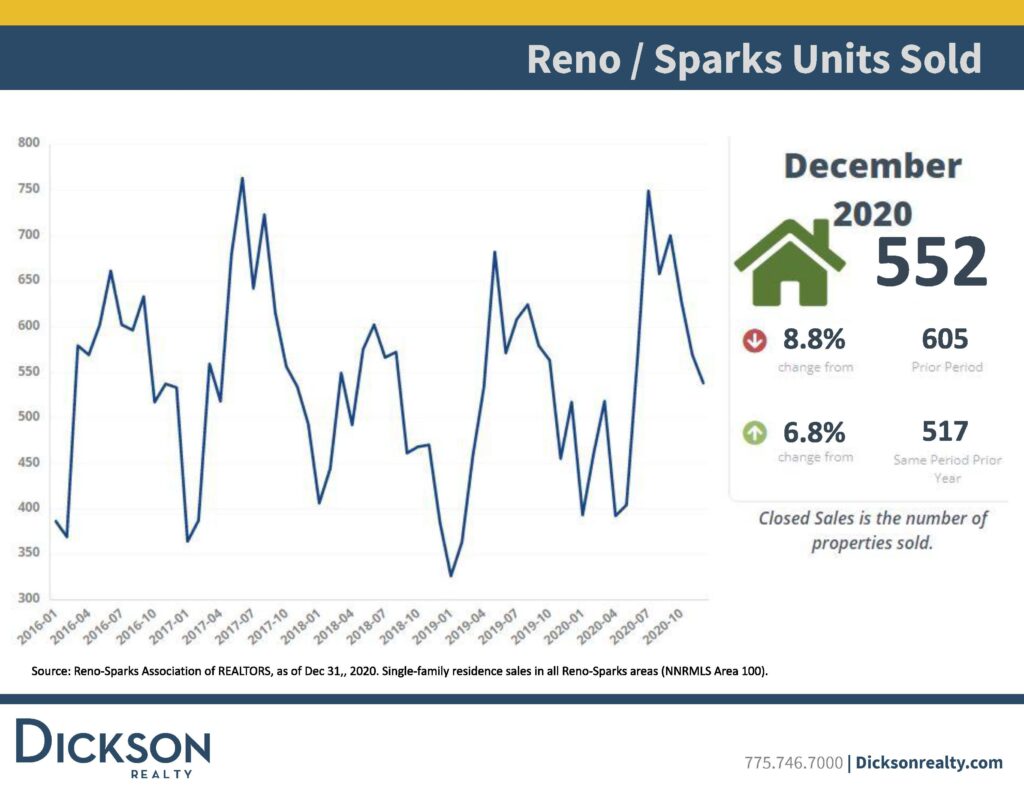

Although local home sales decreased by 8.8% from November to December, they increased 6.8% from homes sold in December of 2019. Year-to-date, home sales for all of 2020 were 6,628, which ended up being a 5.6% increase from 2019. As sales slowed from March to the beginning of May, this increase is significant, as the area not only caught up in sales but exceeded 2019 numbers.

In 2020, national single-family home sales rose at a seasonally-adjusted rate of 6.7 million in December, increasing 0.7% from the 5.99 million in November, but more noteworthy, rising 22.8% from December 2019. Danielle Hale, Chief Economist at Realtor.com, said she expects home sales to continue growing to about 7% in 2021, though at a slower pace than in 2020. Listing reductions did not go down as much as in the previous year, with reductions reaching 26% at the end of 2020 while they reduced 31% at the end of 2019. This again highlights the strong demand with two key factors:

- A lot of people were nervous about moving in 2020 and feared the ability to find a new home in the pandemic

- COVID-19 seriously slowed home building

Low Available Inventory in Sparks and Reno Housing Market

A month’s inventory supply shows how long it would take to exhaust the active and pending inventory at the current rate of sales. Usually, these show in one, two, or three-month increments. So, it’s astounding that the $300,000 and below range currently shows the inventory supply at two days, with the midrange showing at 4.5 days. Already historically lows, this inventory supply will likely shorten even more in January and February due to the lack of new property reflected from issues having to do with COVID-19.

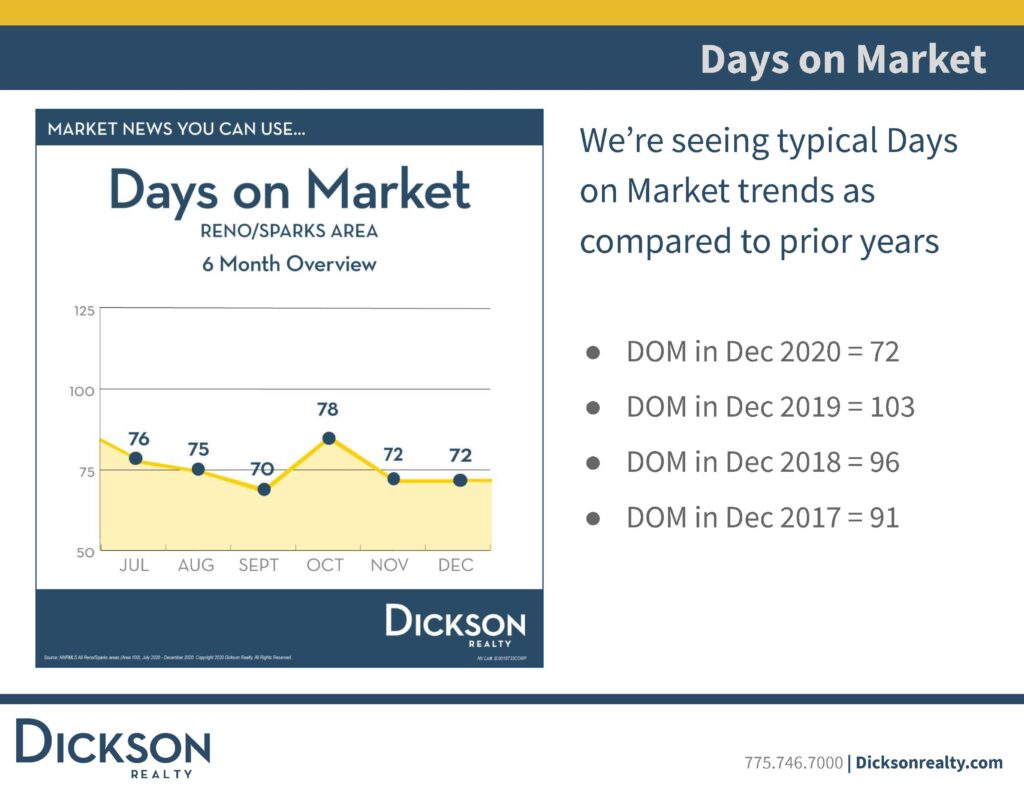

Shortened Days on the Market

Homes in Reno and Sparks are going quicker than ever and for a lot more. From listing to close, times averaged 72 days in December 2020, drastically lower than any year of the last several years, which averaged 103, 96, and 91 days.

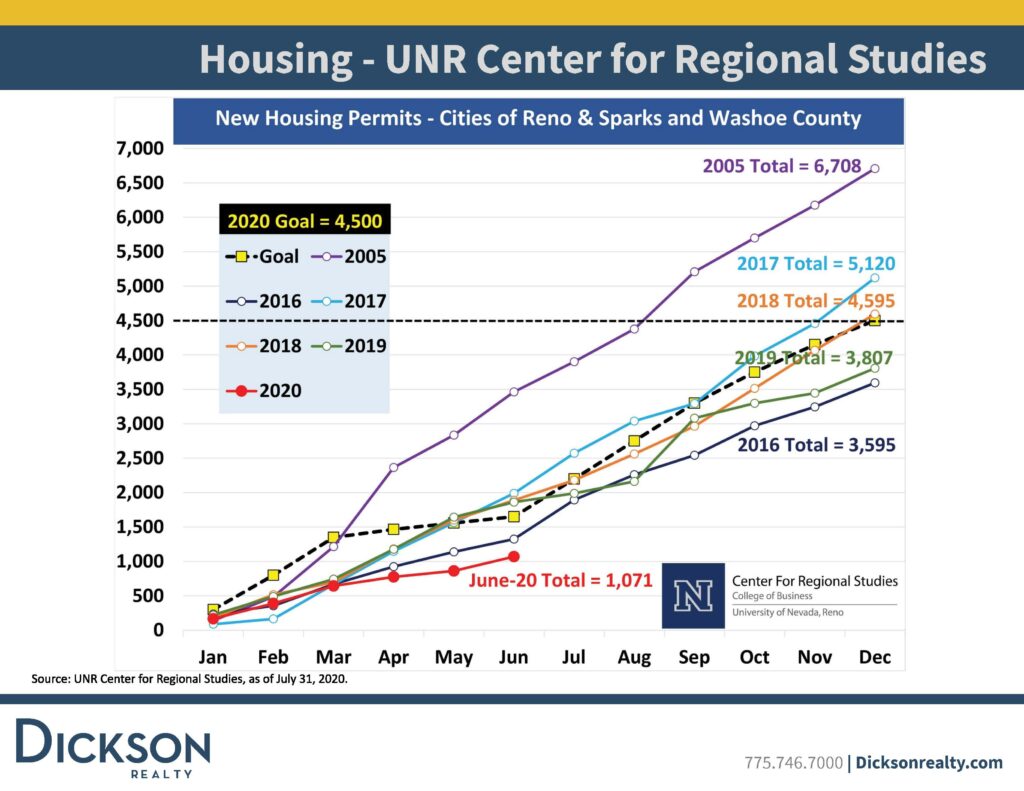

New Home Builds Necessary in Reno/Sparks and Across the Country

Based on new housing permits, the 2020 goals projected 4,500 new homes built in the area. Completed builds fell far below the goal due to COVID-19-associated issues. Locally, we need at least another 1,000 homes or 2,000 homes being built annually to meet demand.

According to the National Real Estate Outlook, national new construction is also crucial as our inventory continues to see a shortfall. Although we had phenomenal sale records in 2020, the national market is short anywhere from 2 million to 4 million homes right now considering current demand. This would essentially take 10 years of doubling our production to get us even close to the 2 million home shortage.

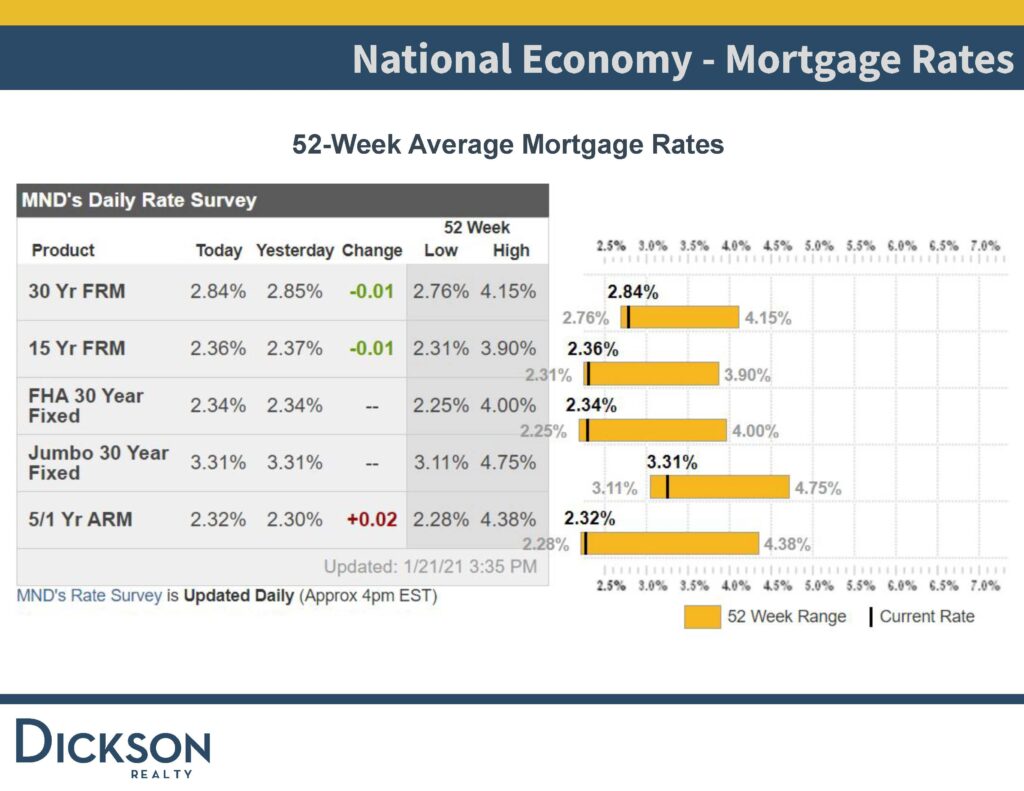

Mortgage Rates at Record Low

Mortgage rates are historically low right now. For 30-year mortgages, the high over the past 52 weeks was 4.15, and the low was 2.76, ending at 2.84% in December. This supercharges the real estate market and gives people the affordability to make higher offers, which drives up appreciation.

Fiscal Stimulus Effects

With the additional federal fiscal stimulus, greater control over the pandemic, and the current level of GDP on the rise, the US economy should fare well in 2021, and the recovery will continue to work itself out. The real estate industry will continue to lead the way with more sales than ever and continued appreciation. With demand rising, new home construction down by the 1,000 plus homes needed annually, and people still not selling also due to COVID concerns, there’s just no telling how high prices will go this year. As that continues to happen, expect the outlying areas like Fernley, Fallon, Dayton, Silver Springs, and others to start to grow significantly.