At Dickson Realty, we’ve received many questions from our clients and friends about the status and health of the Reno-Sparks real estate market as a result of COVID-19. People want to know about prices, how unemployment is affecting demand, and if we are headed for another real estate bubble.

As trusted advisors and experts in the real estate industry, we want to address these questions by highlighting key statistics and facts about the state of the market, both locally and beyond. This data tells the story of what happened before and during COVID-19.

While we don’t have a crystal ball to say where the market will be post-COVID-19, we do have historical and current data that can help us make an educated guess.

I presented this information during a live video chat, which you can watch below. To download the slides, please click here.

WATCH: Virtual Salon-Update on the Real Estate Market from Dickson Realty on Vimeo.

How is the Reno-Sparks real estate market doing during COVID-19?

After the outbreak of the pandemic, housing demand in Reno-Sparks fell as some buyers lost their jobs, part of their income, or simply didn’t want shop for a home in the middle of a viral outbreak. However, while housing demand dropped substantially, housing supply also dropped dramatically as potential home sellers pulled out of the market for many of the same reasons buyers did. As a result, our relative supply and demand have stayed steady during this crisis, and the median price has also remained relatively consistent. We went into the pandemic with low inventory and will come out of the pandemic with low inventory again, and strong demand. As a result, we’re currently in a solid seller’s market in most price ranges, which will help us recover from this downturn. We believe home prices will remain steady, depending on what Q3 and Q4 bring. Ultimately, it’s still a great time to sell and buy as the market is proving its resilience.

What could the recovery look like for the U.S. housing market?

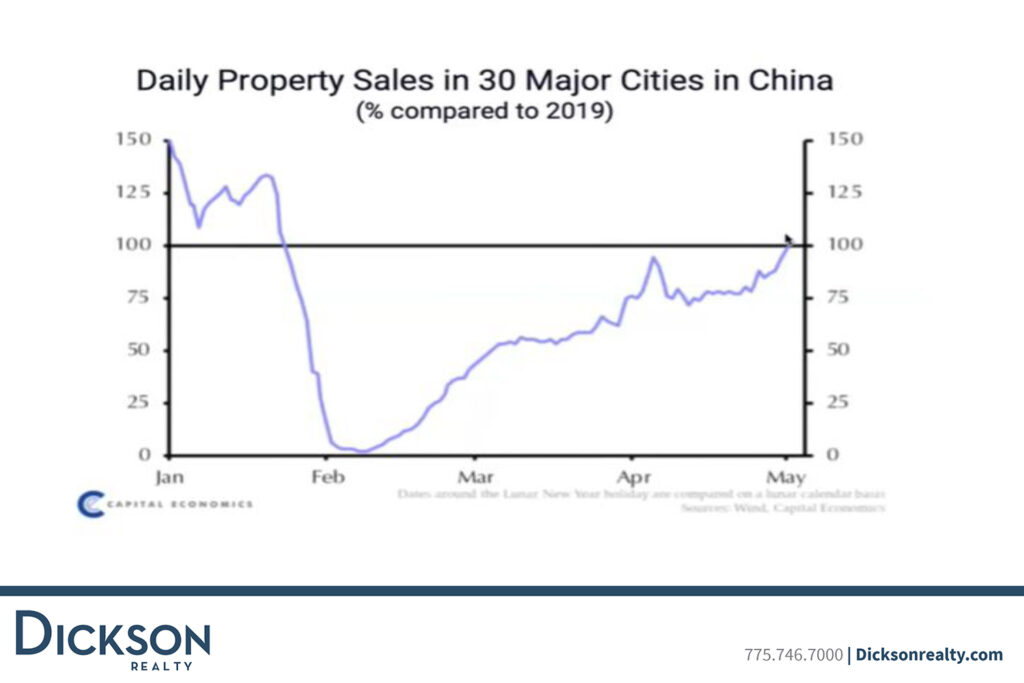

Property sales in 30 major cities in China give us some insight into what might happen in the United States. China is about two months ahead of us in dealing with the pandemic. In these 30 major cities, home sales dropped sharply during the peak of the pandemic and then started to rebound once restrictions relaxed. We think the U.S. market will respond similarly once restrictions lift, and we are beginning to see some evidence of that in some U.S. markets.

How is this pandemic different than the 2008 recession?

Comparing the 2008 housing bubble and the COVID-19 pandemic crisis is like comparing apples-to-oranges. Here are five reasons why:

- Mortgage standards are much stricter now

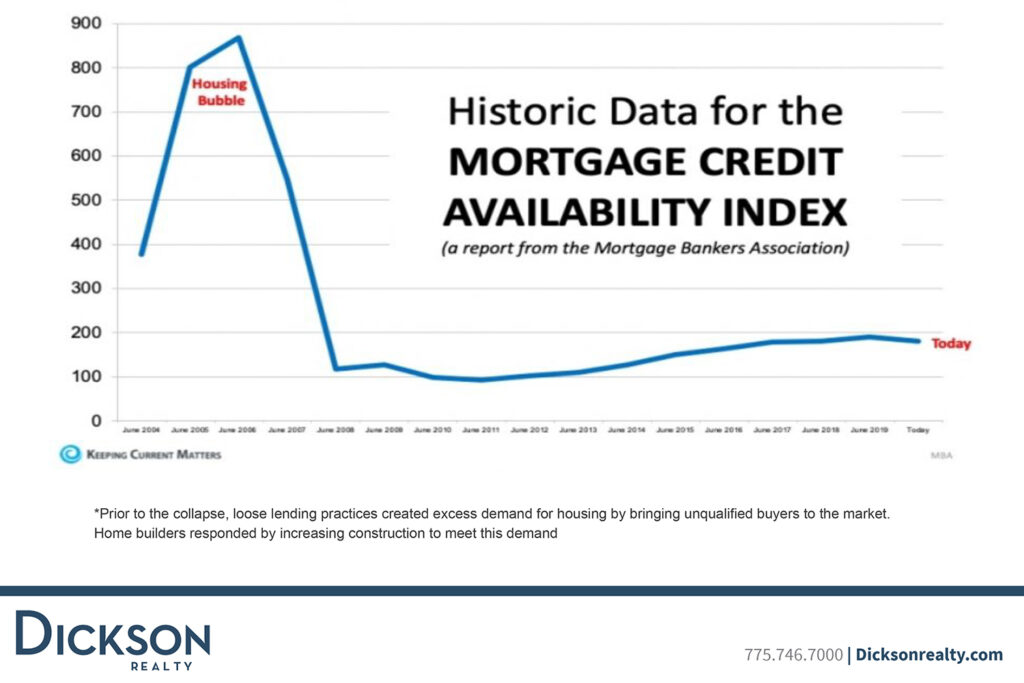

Before the 2008 collapse, loose lending practices created excess demand for housing by bringing unqualified buyers to the market. Today, mortgage requirements are much more demanding and stringent, which is a good thing. We know that people who have since qualified for a mortgage are very stable and financially sound, unlike the situation before 2008.

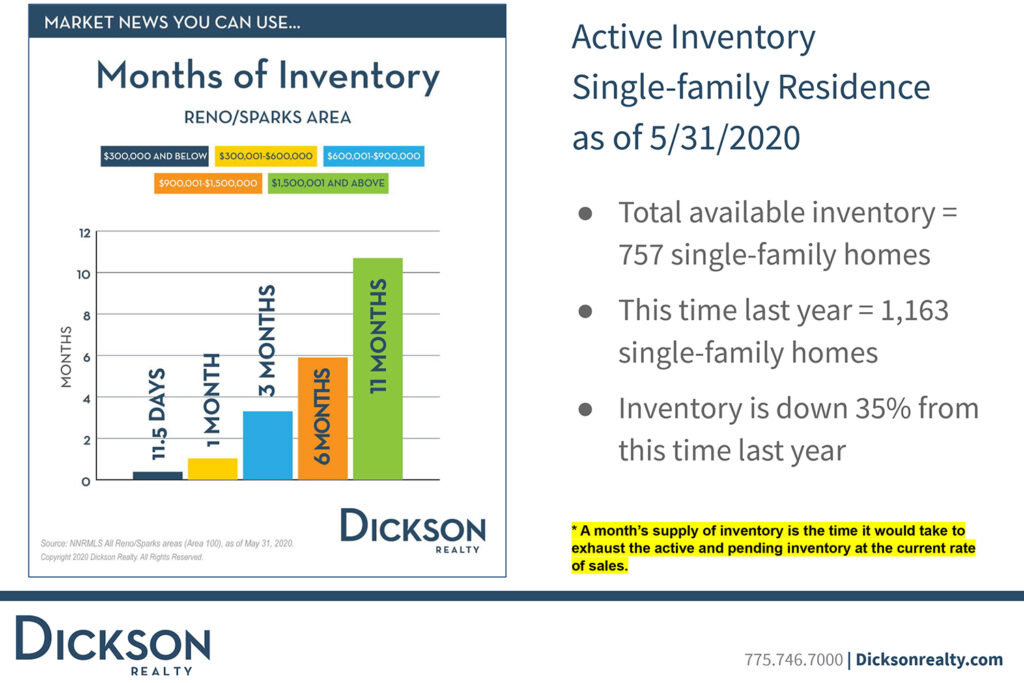

- Fewer homes for sale, more demand

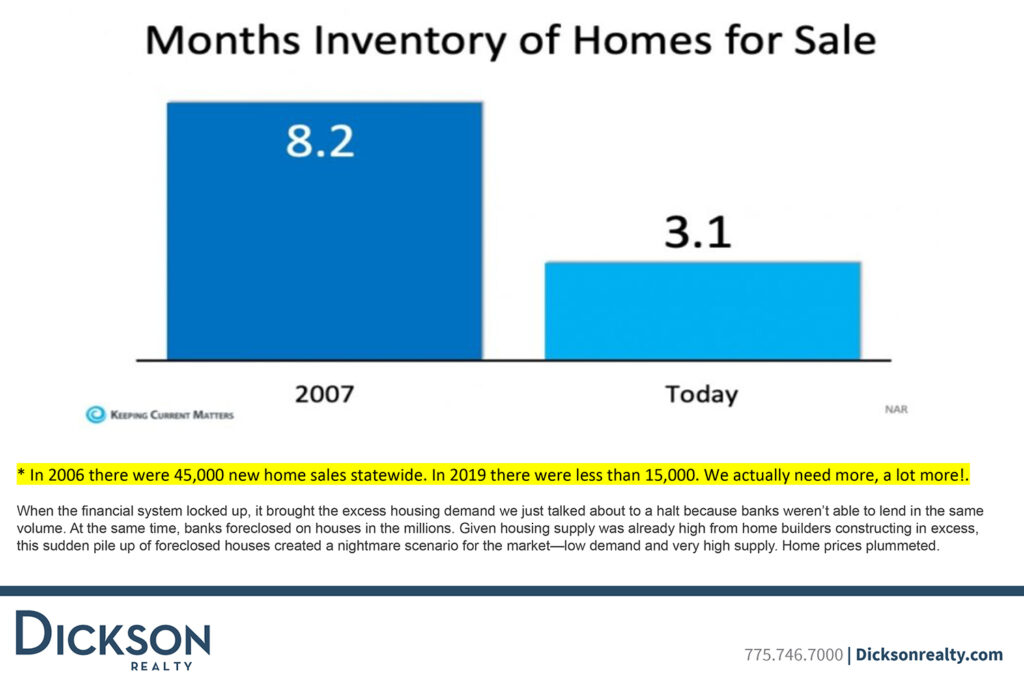

It will take multiple years to resolve the housing shortage created when building dramatically declined after the housing crisis of 2008 to 2012. For example, the average months of inventory of homes for sale in 2007 were 8.2 months compared to today, which is 3.1 months. In 2006, Nevada had 45,000 new home sales statewide. In 2019, we had less than 15,000. In the years leading up to the recession, we had too much building. But now, we need a lot more. This creates a scenario where demand outpaces supply.

- Homeowners are equity rich

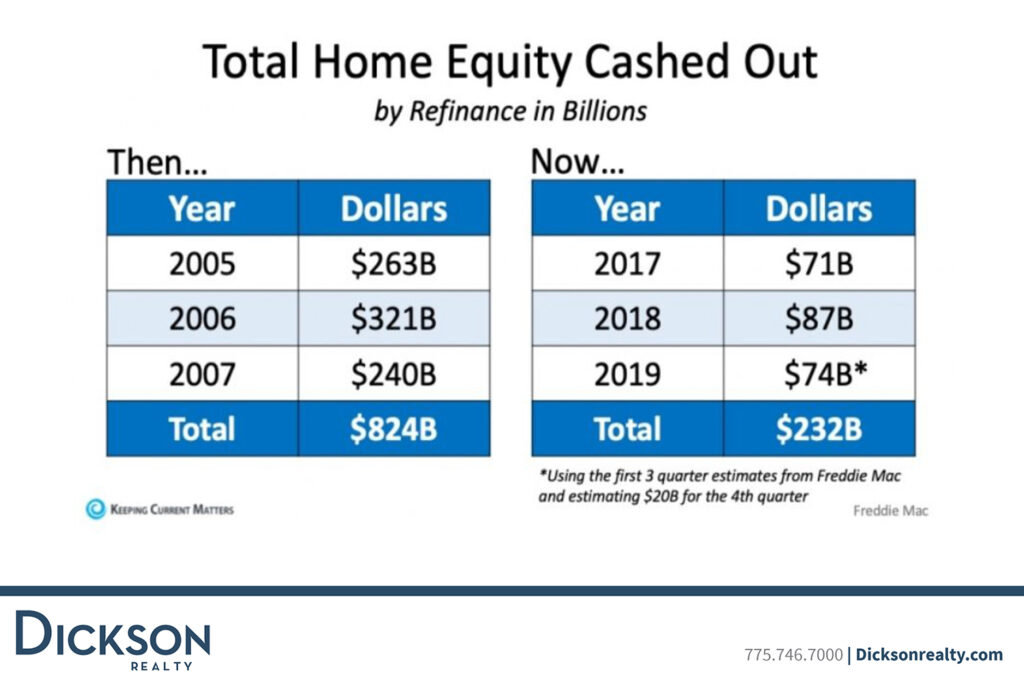

From 2005 to 2007, homeowners nationally refinanced about $824 billion. Between 2017 to 2019, they only refinanced about one-third of that amount. Current homeowners have a lot more equity, which should help them withstand a dramatic market decline. If for some reason a homeowner couldn’t pay their mortgage, they would likely now have the equity and ability to sell the home and leverage that equity. There would be no reason to foreclose and give all that equity away to a bank. This, along with the high credit standards to buy a home, is why we don’t expect a foreclosure crisis in our local market.

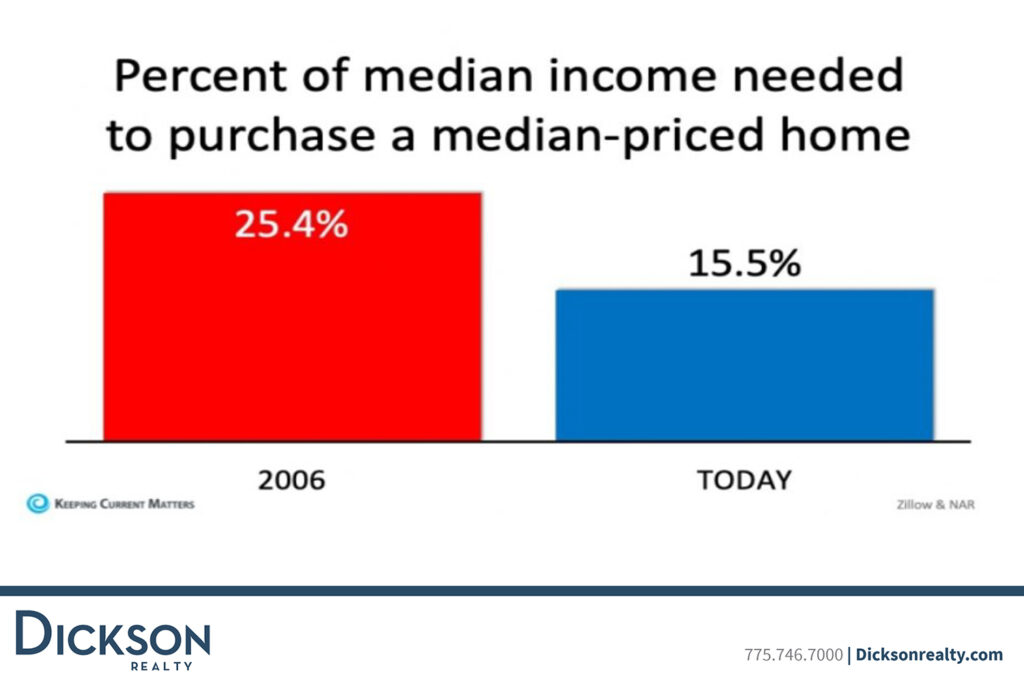

- Housing is actually more affordable compared to 2006.

This may come as a surprise, but while home prices have appreciated quite a bit here in Reno, the percent of median income needed to purchase a median-priced home has decreased from 2006. About 25% of the median income was required to buy a home in 2006. Today, that ratio is 15.5%.

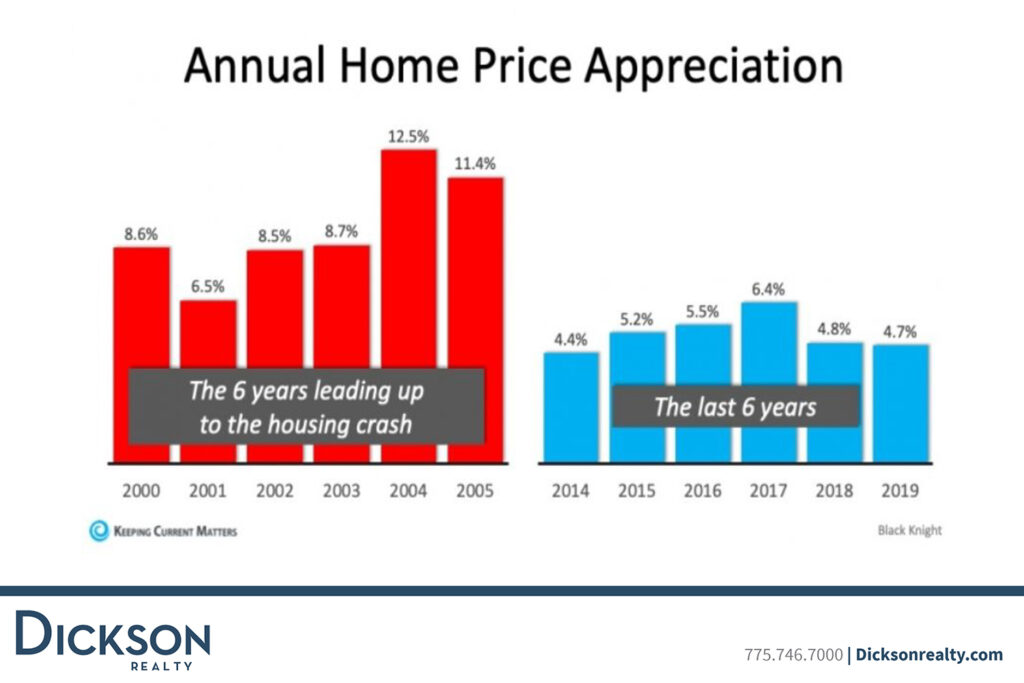

- Housing appreciation is more consistent

From 2000 to 2005, housing prices appreciated at about 10% every year. From 2014 to 2019, appreciation on an annual basis has been much closer to 4% or 5%, nationally. The more recent healthy appreciation rate also supports the argument that we are not in a housing bubble.

What factors should we watch for that may affect the Reno-Sparks real estate market?

At Dickson Realty, we watch four key factors: employment, appreciation, supply and demand, and affordability. Here is where our market stands right now:

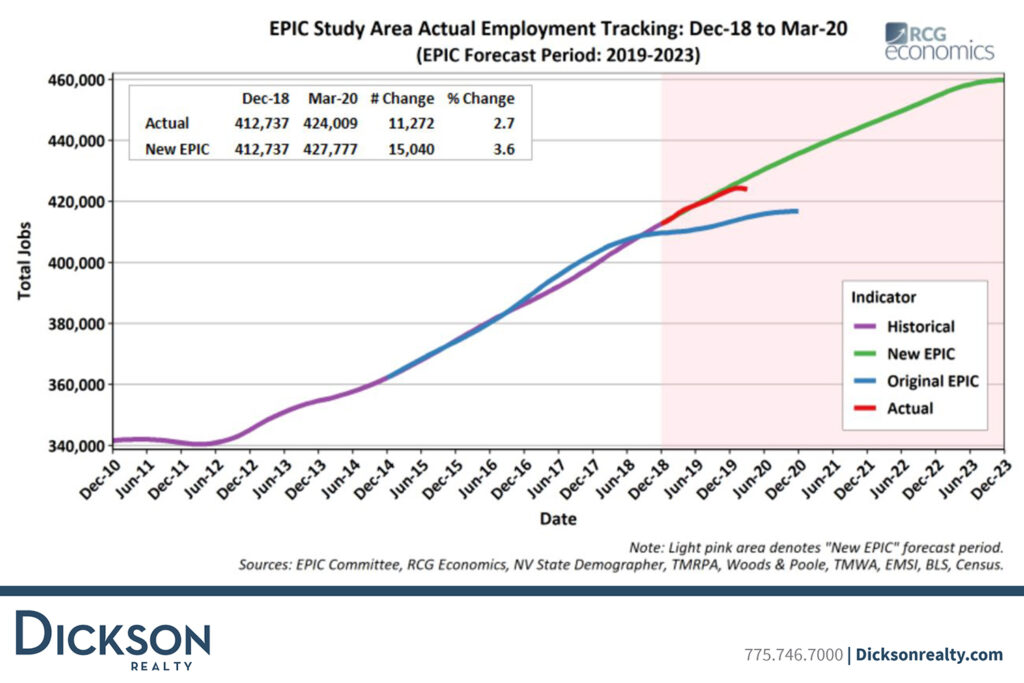

- Employment: Washoe County currently has a 19.6% unemployment rate. However, the Economic Development Authority of Western Nevada is projecting that more jobs will continue to come to the Reno-Sparks region as companies relocate or launch here. As a result, EDAWN predicts that there will be almost 460,000 jobs in the area by 2023.

- Appreciation Rate: Median housing prices have remained steady at around $400,000. This number could increase as demand continues to outpace supply.

- Supply and Demand: A month’s supply of inventory is the time it would take to exhaust the active and pending inventory at the current rate of sales. We currently have one month of supply in our median home price of $300,000-$600,000. If no additional new listings came into the market, with the demand we have right now, we’d be out of listings in one month in that price range. Historically, a balanced supply is six months of inventory. Below that is considered a “Sellers Market” and above that is considered a “Buyers Market.”

- Affordability: Reno-Sparks began this year as the 18th least affordable place among the nation’s top 100 cities. It’s important to know that this is something that affects our region. However, interest rates are helping with affordability and bolstering demand. Rates for a 30-year fixed mortgage hit the lowest point in nearly 50 years near the end of May and early June. This means that buyers could have up to $30,000 more in buying power than they did just a year ago. We don’t anticipate mortgage rates increasing too rapidly in the near term.

For all of these reasons, the Reno-Sparks real estate market is poised to make a strong recovery from the COVID-19 pandemic. If you have any other further questions, reach out to your real estate agent, or contact one of our neighborhood experts at Dickson Realty.

Beau Keenan is the president of Dickson Realty. Visit dicksonrealty.com to learn more.