What’s happening with demand for homes, median prices and market times in our area? We are beginning to see some normalization in the numbers. Here’s the latest information on the Reno/Sparks real estate market, from the experts at Dickson Realty.

Click here to enlarge the graph

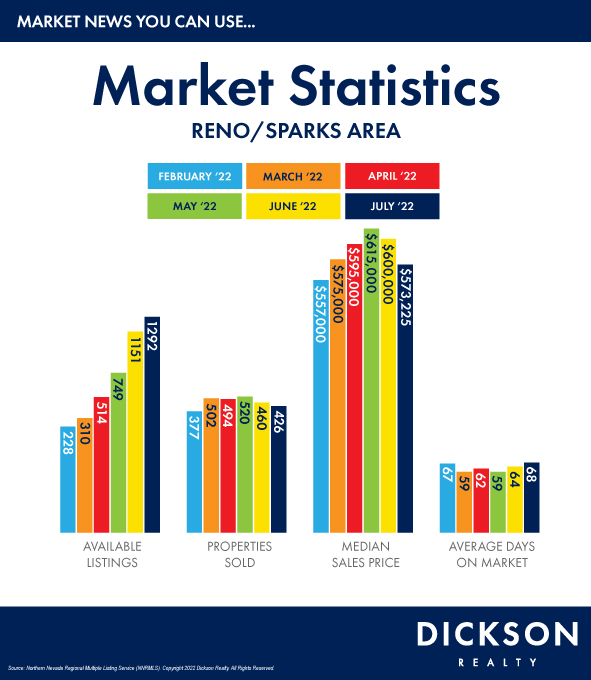

There were 1,292 homes active on the market and available for purchase (not in contract or escrow) at the end of July – a 12.3% increase from last month and a 211% increase in active/standing inventory from this time last year. More listings are coming to market as the summer selling season comes into full swing, and homes are taking longer to get into contract. This is not necessarily a bad thing and is a welcomed relief for home buyers in our region, many of whom have been unable to purchase because of the intense competition.

Reno/Sparks area REALTORS sold 426 single-family homes in July, which was a 7.4% decrease from June and a 33.9% decrease from the exceptional number of sales in July 2021. These sales numbers are still very high compared to the amount of homes on the market and is further evidence of continued demand in our region.

The median sales price for single-family homes in Reno/Sparks decreased by 4.5%, or $26,775 in the last month, coming in at $573,225 for July. Year-over-year, median price has increased by 9.2%, which is still a very strong number. Additionally, sellers received 99.2% of asking price on average for homes sold in the month of July 2022. The normalization in market activity and more price reductions on standing inventory should contribute to slowing the pace of price increases in the near term.

Average Days on Market for July increased by 6.3% over the last month to 68 days. It also increased by about 8% compared to this time last year. Another marker of a fast market is Days to Contract; here we see an average of 25 days from initial listing until a home goes into contract. We anticipate getting back to more normalized market conditions in the near term, and with that, these numbers will increase.

With mortgage rate uncertainty, it is more important than ever to be pre-qualified with a lender before looking at homes to buy and to have an expert REALTOR assist you with navigating the negotiations when making a home purchase.

If you have any questions about this report or would like to speak with a lender about getting pre-qualified, please feel free to call or text. It would be a pleasure to assist you.