The economy in Reno and Sparks has grown significantly over the last decade, and it’s had a significant impact on the people, businesses, jobs, and communities in the greater Northern Nevada region. And while this growth has benefited the economy with robust, evolving industries and greater personal wealth, it has also raised critical questions about city infrastructure, workforce turnover, and housing affordability.

These are all questions Dickson Realty addressed during its annual Economic Summit, where Brian Bonnenfant, the Project Manager for the Center for Regional Studies at the University of Nevada, served as one of the keynote speakers. With his in-depth knowledge, Bonnenfant shared insight about Northern Nevada’s economic development efforts, the housing industry, and what to expect in the future.

“We grew faster than we realized,” Bonnenfant said. “We need more housing supply and more people, but our cost of living could prevent people and businesses from moving here.”

With rising interest rates and global factors coming into play, there isn’t a quick-and-easy solution to ease Northern Nevada’s growing pains. Bonnenfant talked about focusing on the housing gap, or the “missing middle,” and how to expand decades of economic growth across the region. To learn more from Brian’s presentation, keep reading.

6 Things You Need To Know About The Economy In Reno/Sparks And How It Affects The Housing Market

If you’re thinking about moving to Northern Nevada, or you already live here and want to have an informed dinner conversation, we’re sharing what you need to know about the economy in Reno/Sparks and where it’s headed.

1. Industry Matters For The Homes You Can Buy

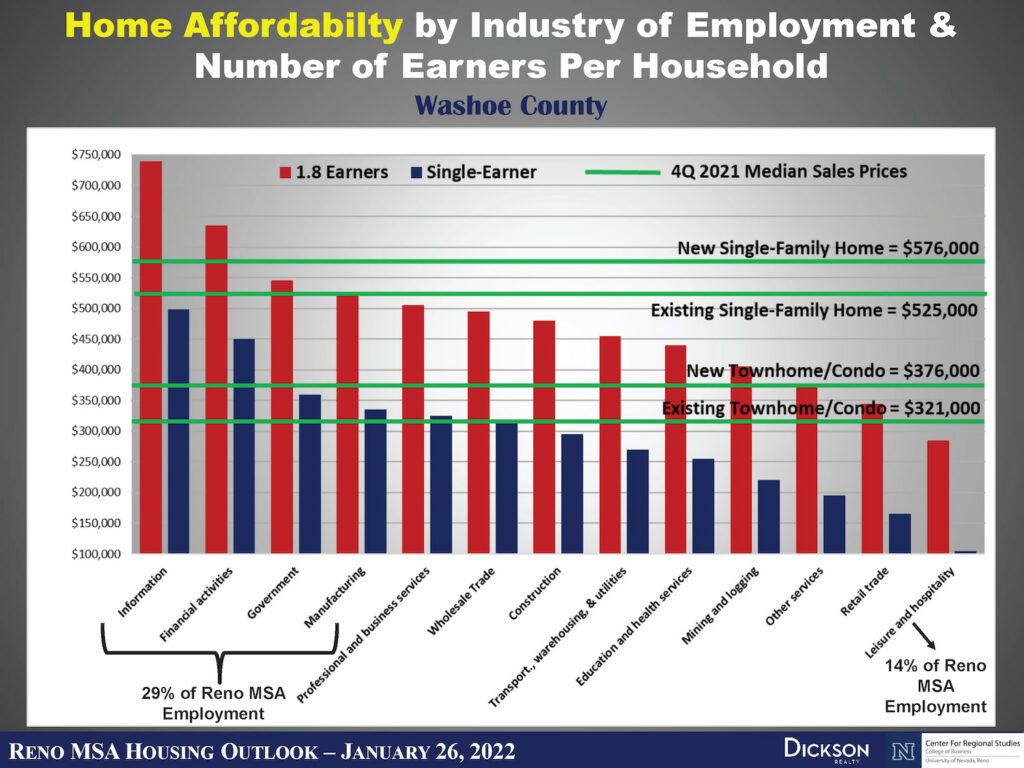

As the economy in Reno and Sparks continues to attract new jobs and businesses to the Northern Nevada region, housing prices have increased as well, and home affordability has become top-of-mind for many of the cities’ residents.

Bonnenfant explained that the higher housing prices have most significantly impacted lower-income single earners, especially those in leisure and hospitality.

“Many people in these industries can no longer afford attached or detached units for sale, and they are forced to rent,” Bonnenfant explained.

In Q4 2021, the median sales price for a new single-family home reached $576,000. This record high for the region has created an affordability issue for a large percentage of Reno’s workforce, pushing 14% entirely out of the market.

2. Higher Income In Areas Of Job Growth

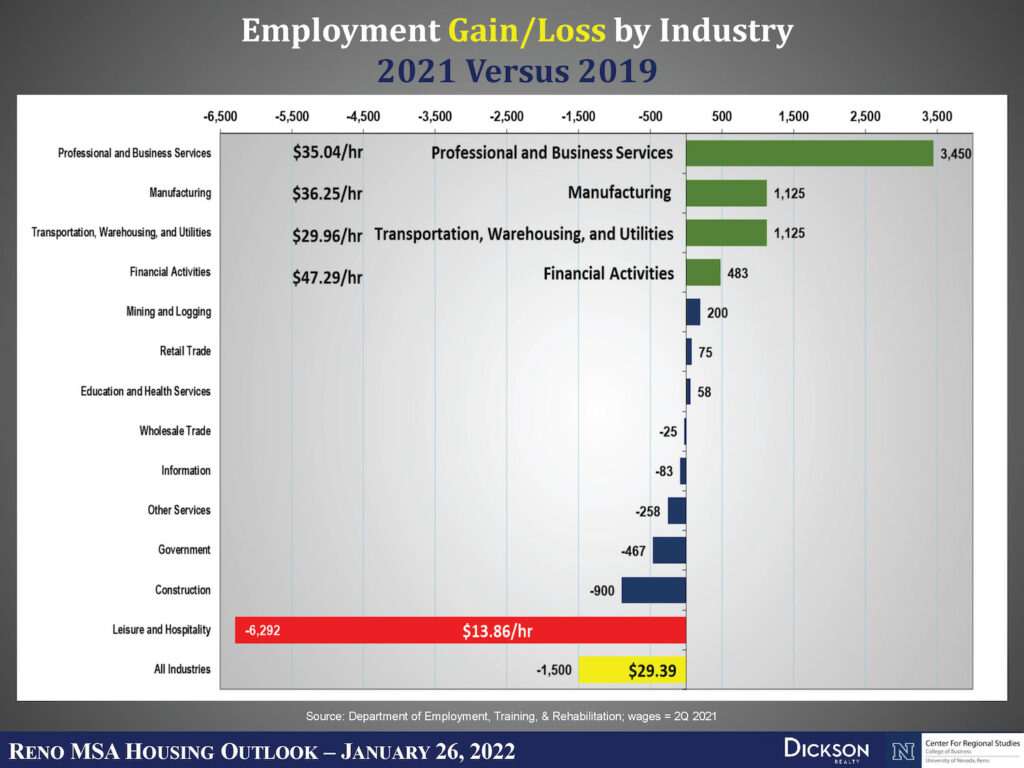

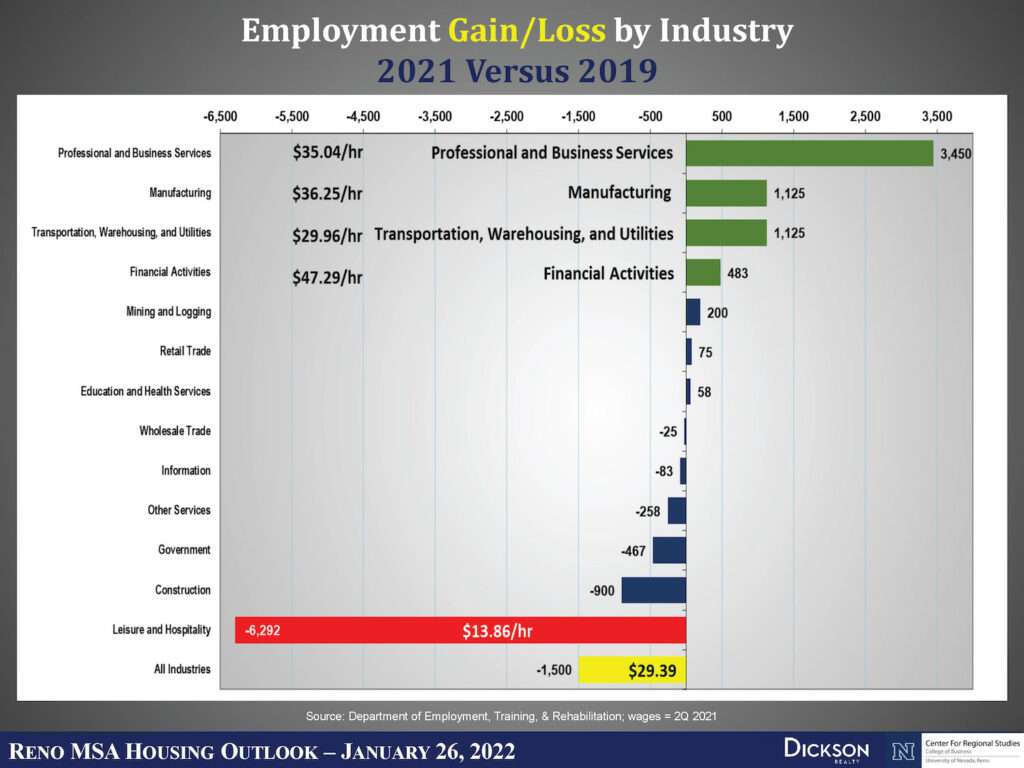

Although housing prices have increased substantially, there has also been significant job and income growth in the last three years.

More than 6,500 jobs have been created in the professional and business services, manufacturing, transportation, warehouse, utilities, and financial industries.

As the hottest job market since the dot-com era, many tech professions also pay more because companies search for workers with specialized skills. For example, financial workers in Northern Nevada currently earn an average wage of $47.29/hour.

This trend in employment has caused the median wage for all industries to rise. In 2021, the average reached $29.39/hour in Reno and Sparks, and the median household income also increased by 5.8% in the last decade.

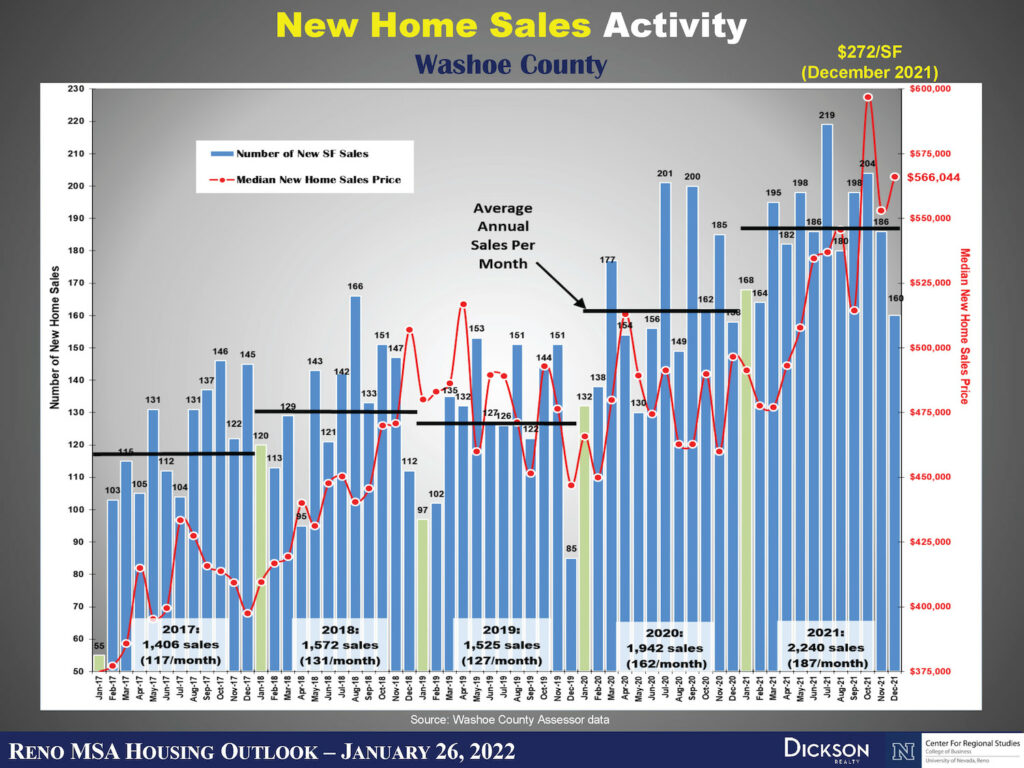

Bonnenfant explained that higher wages have positively impacted new construction home sales. There were 2,240 new construction homes sold in 2021, averaging 187 monthly.

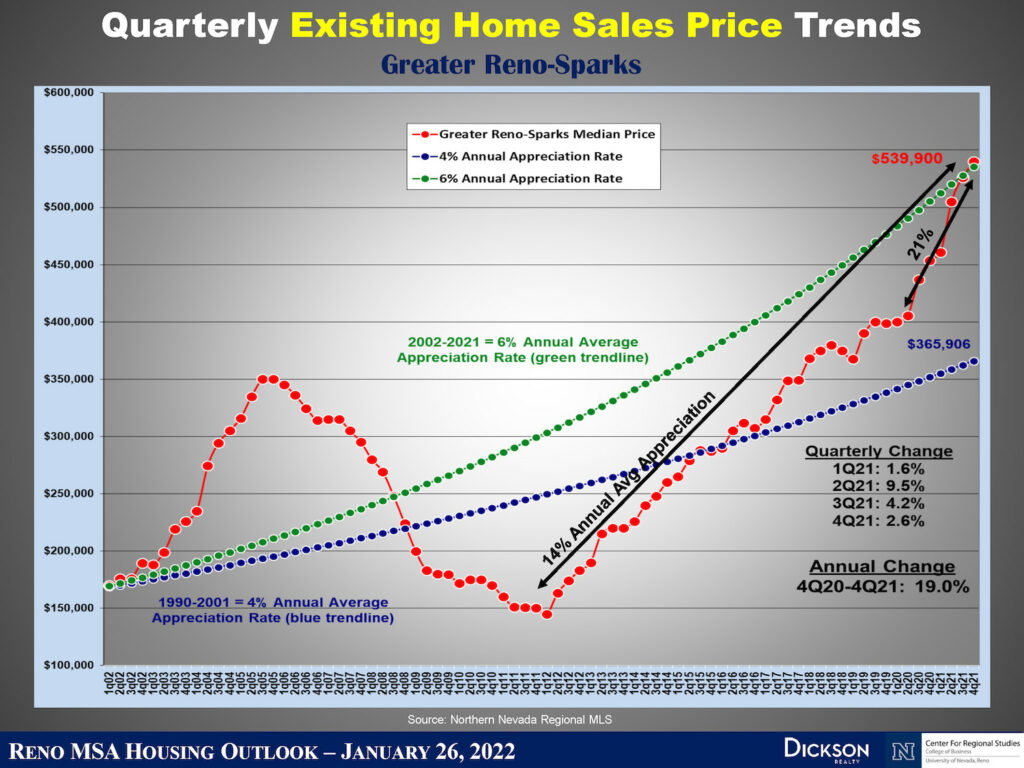

However, it has also increased living costs—the annual appreciation rate for existing homes in Reno and Sparks has risen by 6% per year since 2002 (14% annual average appreciation since 2011), and it’s expected to continue climbing in 2022.

With U.S. inflation reaching its largest annual advance since 1982, the Federal Reserve plans to raise interest rates three times in 2022. If this plan goes through, there may be fewer purchases of mortgage-backed securities, which could result in higher mortgage rates.

However, if job and wage growth in Northern Nevada remains consistent with the last five years, Bonnenfant projected home price appreciation to stay between 6% and 8%.

3. Wage Inequality Has Caused A Nationwide Labor Shortage

Although the economy is booming with business, manufacturing, tech, and financial services, the service industry has experienced an exponential loss. In November 2021, more than 1 million U.S. restaurant and hotel workers quit their jobs.

Since the pandemic began, service workers have dealt with back-and-forth closures, changing CDC guidelines, staff shortages, and angry customers, and it has caused a nationwide burnout. So, if you’ve been to a hotel or restaurant lately, this is why you have probably experienced limited services and longer wait times.

But this employment drop-off isn’t solely pandemic-related. This is more of an ongoing income inequality issue, which many are no longer tolerating.

With an average annual wage of $13.86/hour in Reno and Sparks, the leisure and hospitality industry has dropped by about 6,300 jobs since 2019.

Another industry has also taken a particularly hard hit over the last several years—the construction industry needs a “staggering” 2.2 million more workers to keep up with the booming demand for houses.

In 2020, the Bureau of Labor Statistics reported construction workers earning an average wage of $17.83/hour and $37,080 annually. This unequal distribution of wealth has brought many laborers to search for better wages, benefits, and working conditions.

While the Northern Nevada area is down 900 construction jobs, Bonnenfant also explained that the cost of building materials has increased by more than 45% in the last year, contributing to the labor shortage and the region’s higher housing prices.

“If the economy in Reno and Sparks attracts more construction workers to town, we need to pay them more, which will cause housing prices to rise,” Bonnenfant said.

4. Buyer Migration And Demographics Have Shifted

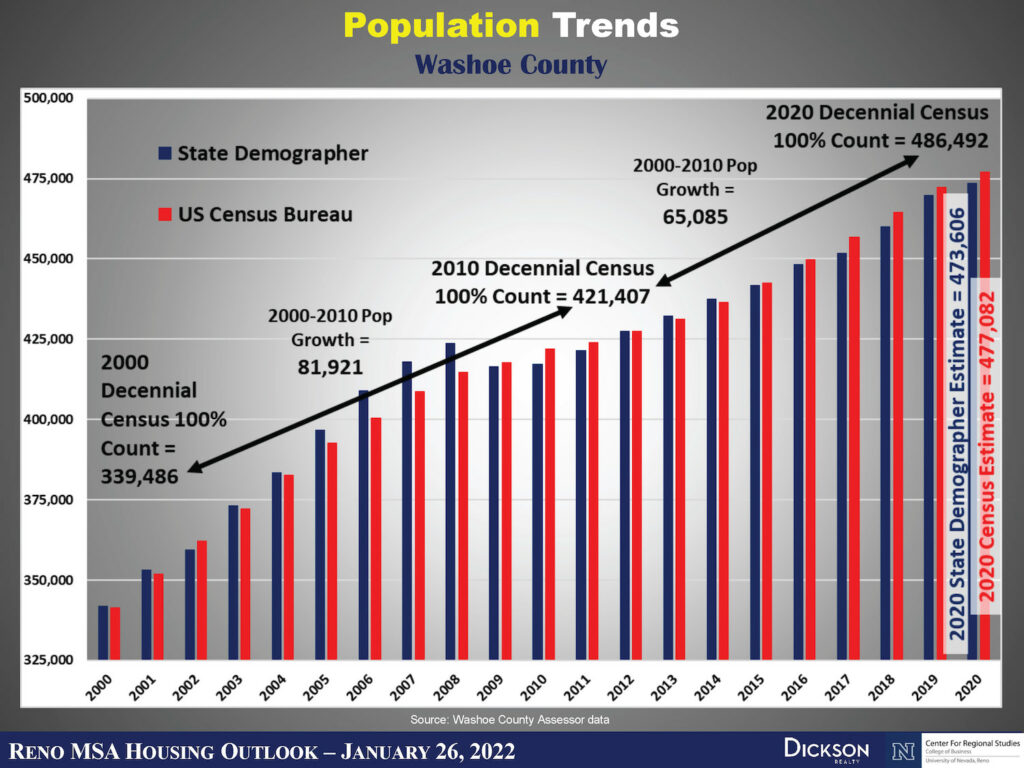

In the last two decades, Washoe County’s population has grown by more than 147,000. Much of this growth has been from people moving from California to Nevada for the state’s tax benefits and a better quality of life. With a 360-degree view of mountains, a bustling community, and the shores of Lake Tahoe close by, who could blame them?

The U.S. Census Bureau found the highest pre-pandemic migration numbers to Washoe County from Clark County, Lyon County, Los Angeles County, San Diego County, and Sacramento County.

And although we’re still waiting on U.S. Census Bureau data for 2021, Bonnenfant pointed out that the population growth rate has slowed down since 2010. With this in mind, the pandemic brought more people and businesses to Northern Nevada than expected.

In 2020, the U.S. Census Bureau estimated that 477,082 people resided in Reno. However, the state demographer’s numbers vary by more than 9,400.

This urban to suburban migration boom caused many people to flee from larger cities to smaller ones while searching for more space and remote working opportunities, which is why Reno and Sparks offered the perfect solution.

It’s no news that the Coronavirus outbreak changed the way Americans work—about 71% of people are currently working from home.

With this global shift to remote and e-commerce work, we’re also experiencing a significant change in buyer demographics as millennials enter the housing market and baby boomers reach retirement age.

Millennials now account for over half of all home-purchase loan applications, and economists expect them to bolster demand for years.

5. Filling The Gap With Multi-Family Housing

With all these factors coming into play, Bonnenfant suggested building a bridge between Northern Nevada’s depleted housing supply and increased housing prices.

Many believe the missing middle can help close this gap by building more efficient housing density with multi-family housing developments.

This approach can provide low-income and single earners with much-needed housing while simultaneously driving down market costs.

The U.S. Census Bureau defines multi-family housing as residential buildings containing units built on top of another and those built side-by-side that do not have a ground-to-roof wall. Some examples include duplexes, condos, and townhomes.

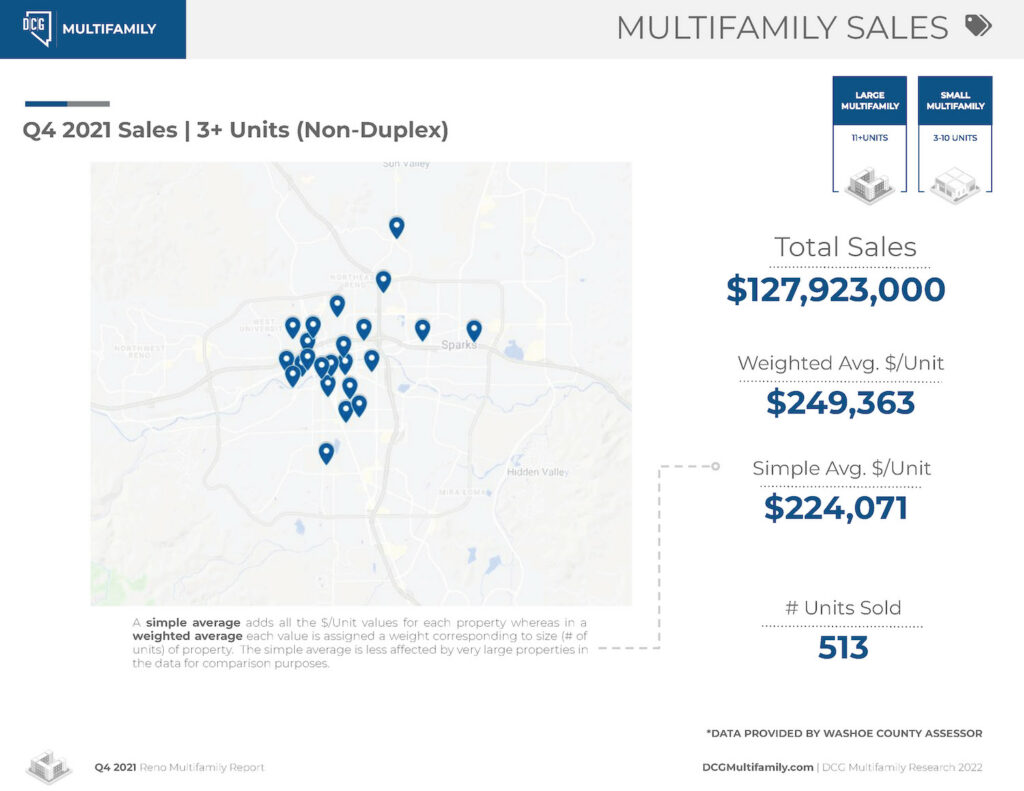

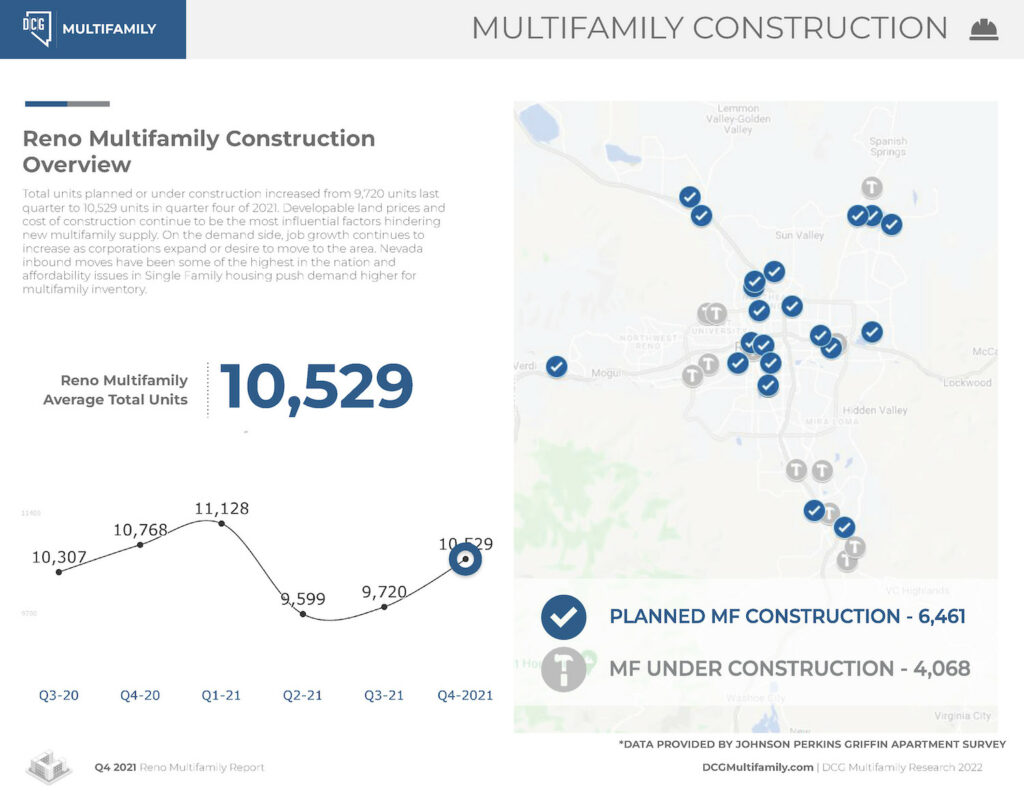

Dickson Commercial Group (DCG) provides monthly and quarterly updates on existing and new projects to understand Northern Nevada’s multi-family housing market.

In Q4 2021, DCG reported more than 500 multi-family homes that were not duplexes sold, with a total sales volume of about $127.9 million.

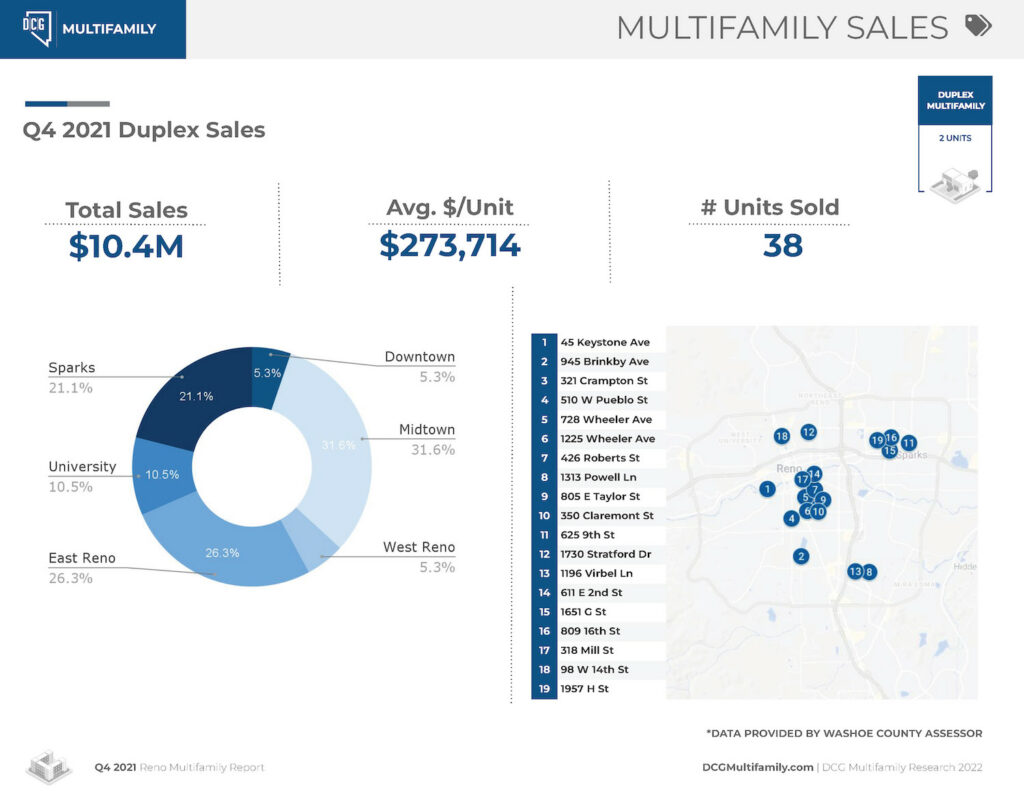

During the same quarter, 38 duplex units sold for more than $10 million. This sales report includes all multi-family sales, large and small complexes.

While demand remains strong and home sales continue to drive the market, Bonnenfant explained that there’s an immediate need for more multi-family housing.

“There are more than 6,000 multi-family units currently under construction,” Bonnenfant said. “So, we have the supplies and solutions coming.”

In the fourth quarter of 2021, DCG reported that the total number of planned multi-family units increased from 9,720 units in Q3 to 10,529. Some of the larger projects under construction include the 5th & Vine Apartments in Downtown Reno, the Spectrum-Dandini development in North Reno, and Azure-Phase II in Sparks.

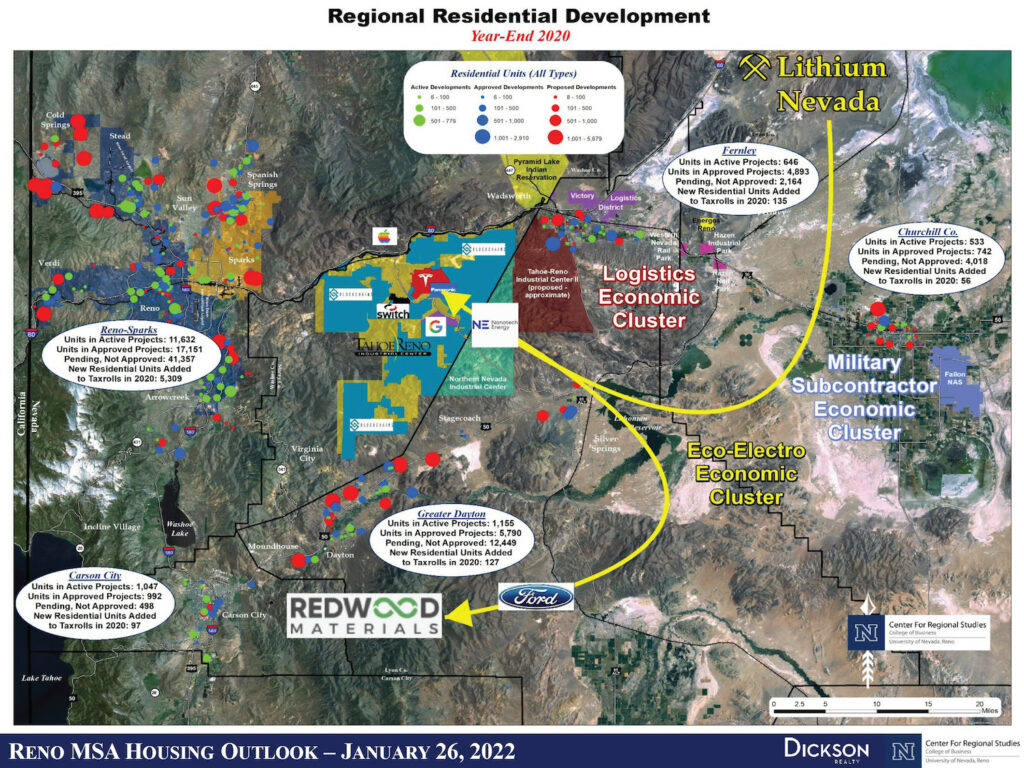

6. Economic Clusters To Expand The Northern Nevada Region

Although new housing efforts are underway, developable land and the cost of construction will continue to influence Northern Nevada’s new multi-family supply.

Job growth, which will further push demand higher for housing, is also expected to continue climbing as more businesses expand or desire to move to the area.

Bonnenfant concluded his presentation by discussing how the U.S. supply chain has been affected locally and nationally since the pandemic started.

Aligned with the Executive Order to revitalize American manufacturing and foster broad-based growth, the economy in Reno and Sparks has expanded its resources and services across the Northern Nevada region.

Bonnenfant shared information about three economic clusters for this purpose:

- Eco-Electro Economic Cluster

- Logistics Economic Cluster

- Military Subcontractor Cluster

These three clusters allow the Northern Nevada region to expand its longevity, Bonnenfant explained. With room to grow, there will be more demand for housing in Northern Nevada’s more rural towns such as Winnemucca, Fallon, and Fernley.

Several sustainability projects also include the Lithium Mine in Humboldt County, Nevada, Google’s Geothermal, and the chain of Redwood Materials’ recycled batteries from the Corwin Ford Dealership To Tesla in Reno/Sparks.