Every quarter, the Dickson Commercial Group releases a report about Reno/Sparks multifamily real estate activity. Using several key data sources, the report covers multifamily sales, apartment rental data, and construction activity. It offers a unique and comprehensive overview of the Reno/Sparks market for multifamily owners and investors.

Reno/Sparks Multifamily Sales in Q2 2019

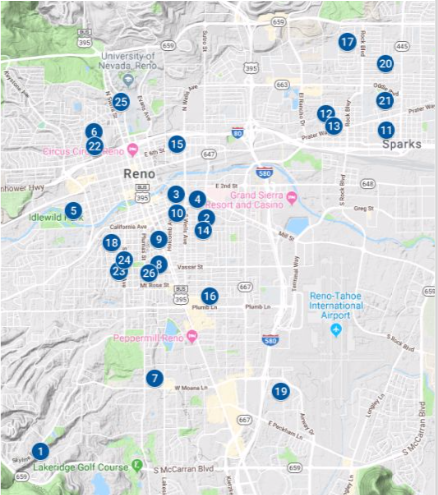

The second quarter of 2019 saw several large Reno/Sparks multifamily sales, for a total of 323 units sold. Of those, more than 60% came from the sale of Skyline Canyon Apartments at 3300 Skyline Blvd. The other three sales totaled 119 units in East Reno, on properties on Kirman Avenue, Mill Street, And Locust Street.

The second quarter of 2019 saw several large Reno/Sparks multifamily sales, for a total of 323 units sold. Of those, more than 60% came from the sale of Skyline Canyon Apartments at 3300 Skyline Blvd. The other three sales totaled 119 units in East Reno, on properties on Kirman Avenue, Mill Street, And Locust Street.

In Midtown and Downtown Reno areas, activity focused on smaller units. In total, 25 units traded hands in six multifamily sales during the second quarter. Of the six sales, four traded at an average price of more than $200,000 per unit.

“Specifically, in midtown and downtown, we see fewer transactions and higher sale prices,” said Chris Moton, a multi-family specialist with Dickson Commercial Group.

However, the relatively fewer multifamily transactions has little to do with investor interest, said Trevor Richardson, also a multi-family specialist with Dickson Commercial Group.

“We have more investors than we know what to do with,” Richardson said. “Money and capital investor activity is not a problem. We don’t have enough sellers, and we don’t have enough realistic sellers.”

Many sellers of multifamily properties are asking for prices that exceed the potential capitalization rate for a buyer, Richardson and Moton said.

“Multifamily in Reno is extremely desirable because our market is so stable,” Richardson said. “There’s not enough inventory in the overall market. Sellers know they have a very popular product and ask a super-premium price for it. However, they can ask for prices that we really can’t make sense of to sell to anybody else.”

When a property is priced appropriate, it sells quickly, Moton said.

“When a good deal comes along, those go really quickly,” he said. “So, you have to be ready to underwrite quickly and to be able to put in letter of intent offers quickly.”

Investors should also know that Reno is not an undervalued market anymore, Richardson said.

“People think we’re an undervalued market, and during the recession, we were,” he said. “We were one of the ground zeros. We were way undervalued. Now we’re overvalued.”

Ultimately, individuals hoping to buy Reno/Sparks multifamily real estate should consider what factors are important to them beyond returns.

“Our investors buy because they really like Reno and they want to be close to their property,” Richardson said. “They’re OK paying a higher price and getting less of a return in exchange for that.”

Reno/Sparks Multifamily Q2 2019 Rental Trends

Dickson Commercial Group’s Q2 Reno/Sparks multifamily report also illustrates rental rate trends for both Reno and Sparks apartment complexes with a minimum of 80 units. These complexes are comprised of only market-rate apartments, excluding student, senior, and affordable housing projects. The data is provided by Johnson Perkins Griffin Apartment Survey.

Dickson Commercial Group’s Q2 Reno/Sparks multifamily report also illustrates rental rate trends for both Reno and Sparks apartment complexes with a minimum of 80 units. These complexes are comprised of only market-rate apartments, excluding student, senior, and affordable housing projects. The data is provided by Johnson Perkins Griffin Apartment Survey.

In the second quarter of 2019, apartment demand in Reno/Sparks remained very strong with limited inventory available. Average rental rates increased by $28 per month to $1,344. Overall vacancy decreased to 2.67%, which was slightly higher than Q2 of 2018. Rents are expected to continue their upward push as more jobs come to the market.

However, DCG expects a slower rate of rent increase than in previous years.

Increasing rents also contribute to the low inventory regarding Reno/Sparks multifamily sales, Richardson said.

“If you own an apartment building, you’re making more money than you’ve ever made in Reno because the rents are the highest that they’ve ever been right now,” Richardson said. “Because of that, you don’t really want to sell. Moreover, even if you do sell, you’re going to want another building, and it’s challenging to buy because nobody else is selling.”

Reno/Sparks Multifamily Construction Overview

The final piece of the Reno/Sparks multifamily real estate market that the report examines is construction. In Q2, 2019, total multifamily units planned or under construction increased slightly to 10,280 units. In total, 4,457 multifamily units were under construction, and 5,823 were in the planning phase. Park Lane-Reno Urban Development, which is currently in the planning phase, could bring 1,800 new multifamily units near Midtown Reno. The Ryland Apartments development, planned for the north side of Ryland Street between Park Street and High Street, could bring almost 120 new units to Midtown.

The final piece of the Reno/Sparks multifamily real estate market that the report examines is construction. In Q2, 2019, total multifamily units planned or under construction increased slightly to 10,280 units. In total, 4,457 multifamily units were under construction, and 5,823 were in the planning phase. Park Lane-Reno Urban Development, which is currently in the planning phase, could bring 1,800 new multifamily units near Midtown Reno. The Ryland Apartments development, planned for the north side of Ryland Street between Park Street and High Street, could bring almost 120 new units to Midtown.

Both these new projects could change the Reno/Sparks multifamily landscape.

“Those projects are going to be done in phases,” Richardson said. “It’s kind of hard to determine exactly how much and when those are going to be available. However, when they are, it’s certainly going to affect areas.”

Is It Time To Sell Your Multifamily Property?

Based on the volume of multifamily sales, area’s rental trends, and new construction coming online, more conservative investors may want to consider selling their multifamily properties. Listing a property for a reasonable price is a safe bet, Richardson said.

“It’s a perfect time to sell,” he said. “We have lots of investors that are looking for properties.”

For a full report of all Reno/Sparks multifamily sales, download the Q2 report here.