by Nancy Fennell

This is the question that continues to come up as residents read about rising home prices. To them, it feels like 2006. However, I have listened to several presentations recently that would suggest otherwise. Those presentations coupled with sales statistics present another story; one not without challenges but certainly a picture that suggests we are not seeing a repeat of the housing crisis which began in 2006 just yet. We are in a slow recovery, but certainly a recovery.

The first several presentations I heard were from Mike Kazmierski, CEO of EDAWN (Economic Development Authority of Western Nevada). His team has done an outstanding job assisting more than 100 companies relocate to our area over the past four years. His future predictions of what is to come are even stronger. As he states, “This is just the beginning.”

Two differences from 2006 are job and population growth. I last wrote about the EPIC Report which took a “middle-of-the-road” projection of employment and population growth over the next five years (2015-2019). EDAWN took the middle scenario projecting an addition of 52,400 jobs through 2019 and a population growth of 64,700.

Mr. Kazmierski also explains why companies are coming to our area. The first reason is our strategic location. We have great access to rail and road support with 11 western states reachable with one-day ground support. The second reason is the lower cost of doing business in Nevada – labor, taxes and real estate costs are lower than surrounding states. Finally, we have a business friendly government. As we head into elections, we need to keep these attractions in mind. Lots of people credit Tesla with what is happening in our area. They were certainly a public relations boom, and as Mr. Kazmierski points out, “they gave us credibility,” but 100 companies have relocated in the past four years, not to mention the retention and expansion of many other companies already here.

There are three areas of concern according to Mr. Kazmierski, which are workforce development, affordable housing and infrastructure. He believes that up to now, relocating companies have been happy with the existing workforce in the area but for the future, we need to fund our community colleges better to turn out the workforce with the right skill set that will be required by relocating companies.”

Another presentation I have heard is by Brian Bonnenfant, Project Manager of the Center for Regional Studies at the University of Nevada, Reno. Brian has put together detailed housing reports for Washoe County for the past decade which examine new construction inventory, sales and future approved projects along with existing home inventory and sales by sub-region.

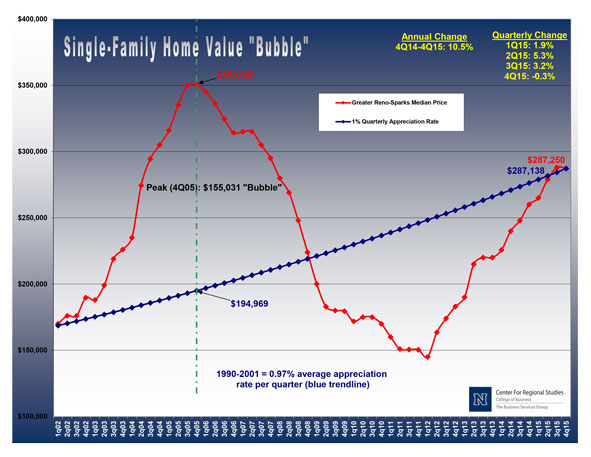

I recently heard his findings about single-family sales by region, which he compared with per capita income and average wages. One of the most interesting charts he prepared showed median home prices from the first quarter of 2002 to the fourth quarter of 2015. Basically, if home prices had only increased 1 percent per year for that entire period, median home prices in our area are exactly where they need to be.

Perhaps as interesting is his comparison of median home values and median family income. In the fourth quarter of 2015, Brian reports that 52.9 percent of homebuyers in the Reno MSA (Metropolitan Statistical Area) could afford a median value home, as opposed to 55.8 percent in the last quarter of 2014, a fact that will present a challenge that we are already feeling without the bulk of jobs coming into our area or the population growth figures.

According to Brian’s report, based on new and existing home sales, both pre-recession, recession and the future, we need to be building between 3,063 and 5,105 homes annually. New home permits that were pulled in 2015 were 1,995.

What does this mean for the housing market? We will continue to feel the pain especially in the spring due to the lack of affordable housing which represents 63.9 percent of our market. Wages are climbing but not keeping up with housing costs in this price range, so we will continue to see significant pressure and rising prices as demand exceeds supply. People will move into multi-family (apartments) or rental houses when they cannot find a house, another part of our market that has high demand and low inventory.

But as challenging as the $300,000-$600,000 price range is, homes that are priced above this are not experiencing the lack of demand and have a different metric of absorption depending on the price: $601,000-$900,000 represented 3.5 percent of all sales in 2015 with a 5 month absorption rate; $901,000-$1,500,000 represented 1.3 percent of all sales with 9.8 month supply and homes above $1,500,000 represented .4 percent and have 27.3 months supply.

All in all, we are experiencing a slow recovery but we need to have more affordable houses being built in order to grow effectively.

This post was originally published in the Northern Nevada Business Weekly.