Surprisingly, yes! Below are the sales in a few areas of Reno just for review. Let’s take a look:

Area 122-Somersett area had 20 sales in the last 30 days. The price range was $140,000-$540,000 and of the 20 sold, 13 were non-distressed, 7 of them are short sales.

Area 161-Caughlin Ranch area had 12 sales in the last 30 days ranging from $172,000-$537,500. 7 were non-distressed and 5 were short sales.

Area 163-Lakeridge area had 17 sales which included 4 short sales and 1 bank owned property. There were 12 non-distressed sales.

We can see that homes are selling and prices are steadily rising, but is now a good time to consider selling your home or should you wait?

The first thing to consider before selling your home is the real reason for selling, i.e. are you considering an out-of-town move, is it a job change, a change of pay? I would never tell a buyer or seller that the prices will continue to rise. That was what was happening in 2004, 2005, and 2006 which got a lot of homeowner’s in trouble financially. You can never predict the market because there are a lot of outside factors that can influence the prices. We saw a substantial decline in our market following 9/11 which was a totally unpredictable event.

“My house will be worth more in the spring, supposedly the best time to sell, so I’ll wait.”

We have a lack of inventory now and there is no guarantee that will be the case in the spring. A lot of sellers wait until the spring because they believe their home will sell for more money than in the winter. But if more supply comes into the market, the competition could drive down prices so there is no guarantee that spring is the best time to sell.

Do interest rates affect the sale of your home and when you should sell?

Generally when interest rates are lower people are more likely to buy homes. It will cost them less to borrow money than when interest rates are higher. A higher interest rate translates to a higher cost for the borrower. This results in fewer homes being sold. Fewer people will be able to afford mortgages. In the early 80’s when the prime lending rate was near 20%, there were very few homes sold. In my opinion it was a worse market than the market we experienced in 2008-2011.

There are a lot of foreclosed homes in your neighborhood. How does that affect you?

It only affects you if you are selling. If there are non-distressed properties selling as well, you would hope that that the prices would be stable. The biggest concern of selling when you are competing with foreclosures is getting an appraisal. The appraiser can only use the comparable sales that are available. They try to use non-distressed comparables for non-distressed sales, but that is not always possible. Appraisers also try to not use sales that are over three months old so the market can change fairly quickly.

How do traditional sales compare in price and selling-process to other types of sales, such as short sales and bank owned/REO’s?

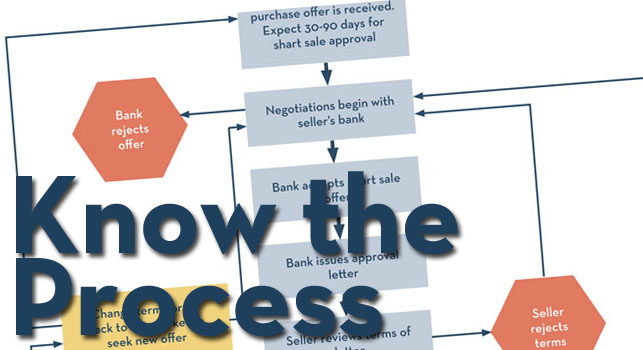

There is a misconception in the market that short sales and foreclosures are ALWAYS cheaper than a traditional sale. This is not always the case. We have had a lot of short sales and bank owned properties that seem a lot cheaper than a non-distressed sale. The condition of a distressed property is rarely as good as a traditional sale. Most homeowners that are “under water” on their home stop keeping up the maintenance they normally would do if they were planning on staying in the home. The process for a short sale is probably the hardest of any real estate transaction for a buyer and seller. Frequently the timeline is unclear which causes a lot of anxiety especially for the buyer. There is always a chance that the bank will not approve the short sale which will put the buyer back in the market of finding another house. There is also a chance the bank will counter the price they have offered, and the seller has accepted.

I have found with my clients that the unknown of when they will be able to actually close and move causes a lot of stress on families. In addition to these obstacles with a short sale, you are buying the property in “as is” condition, meaning neither the bank nor the seller will make any repairs. A buyer may have waited on short sale approval on a property for four months only to find out during inspections that there are many repairs to be done that they cannot afford. A REO or bank owned property is usually easier to close than a short sale. The bank agrees in the contract to a timeline, but a REO is also sold “as is” with no repairs. A buyer can have any or all inspections completed once their offer is accepted by the bank. However, any issues or defects that are found during inspections are the buyer’s responsibility. Buyers that I have represented on a purchase of a short sale or an REO have commented that they take all the risk.

Why is now a good time to sell?

I feel that our prices have appreciated since the second quarter of 2012. There is definitely a lack of inventory now in our market so the market time should be shorter. We are seeing a lot of properties with multiple offers. And of course, it is always better to sell when it is a “seller’s market.”